Topics

Latest

AI

Amazon

Image Credits:Doola(opens in a new window)

Apps

Biotech & Health

clime

Image Credits:Doola(opens in a new window)

Cloud Computing

Commerce

Crypto

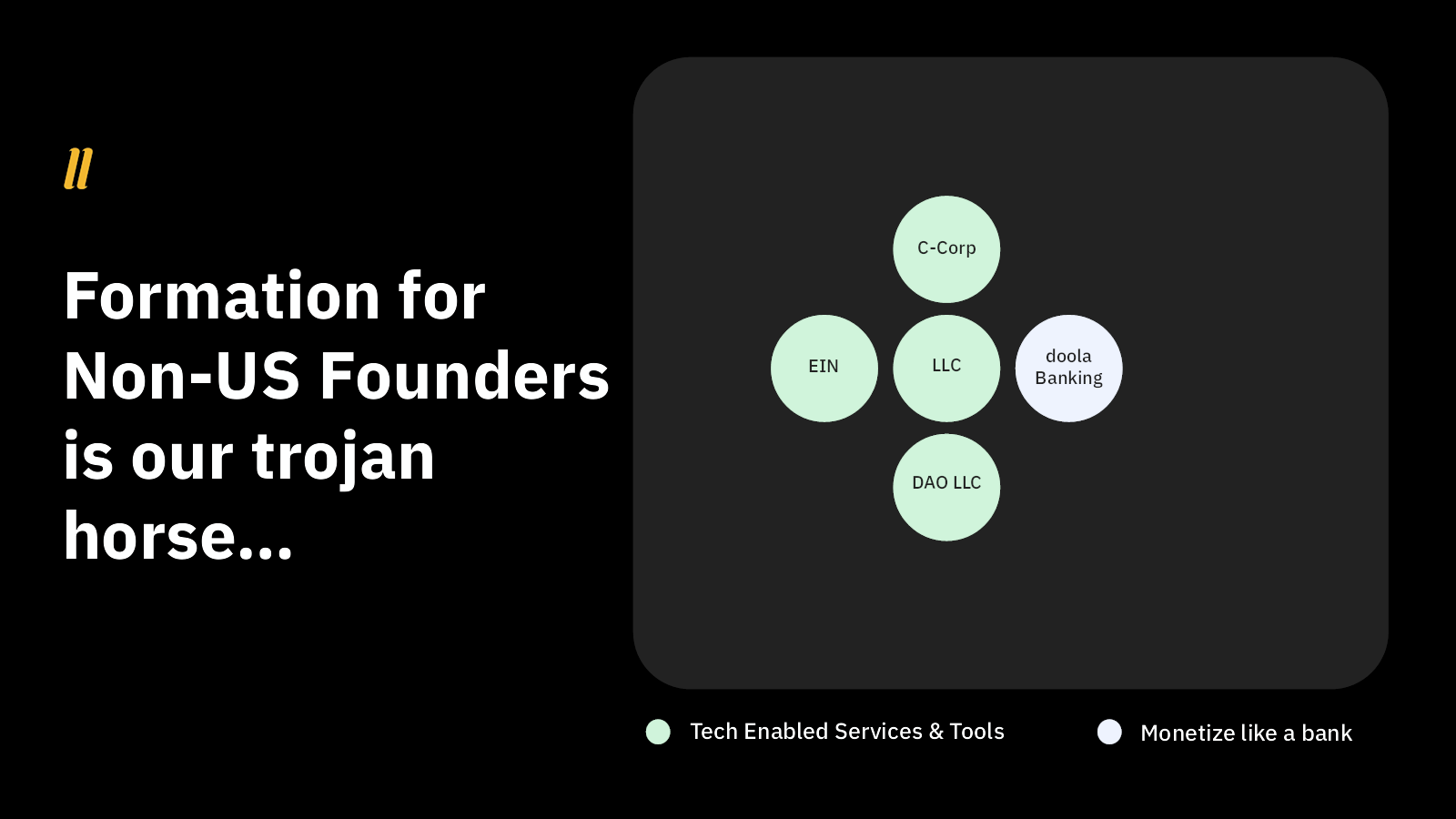

[Slide 6] The setup . . .Image Credits: Doola

endeavour

EVs

Fintech

[Slide 7] . . . and what a payoff!Image Credits: Doola

Fundraising

convenience

Gaming

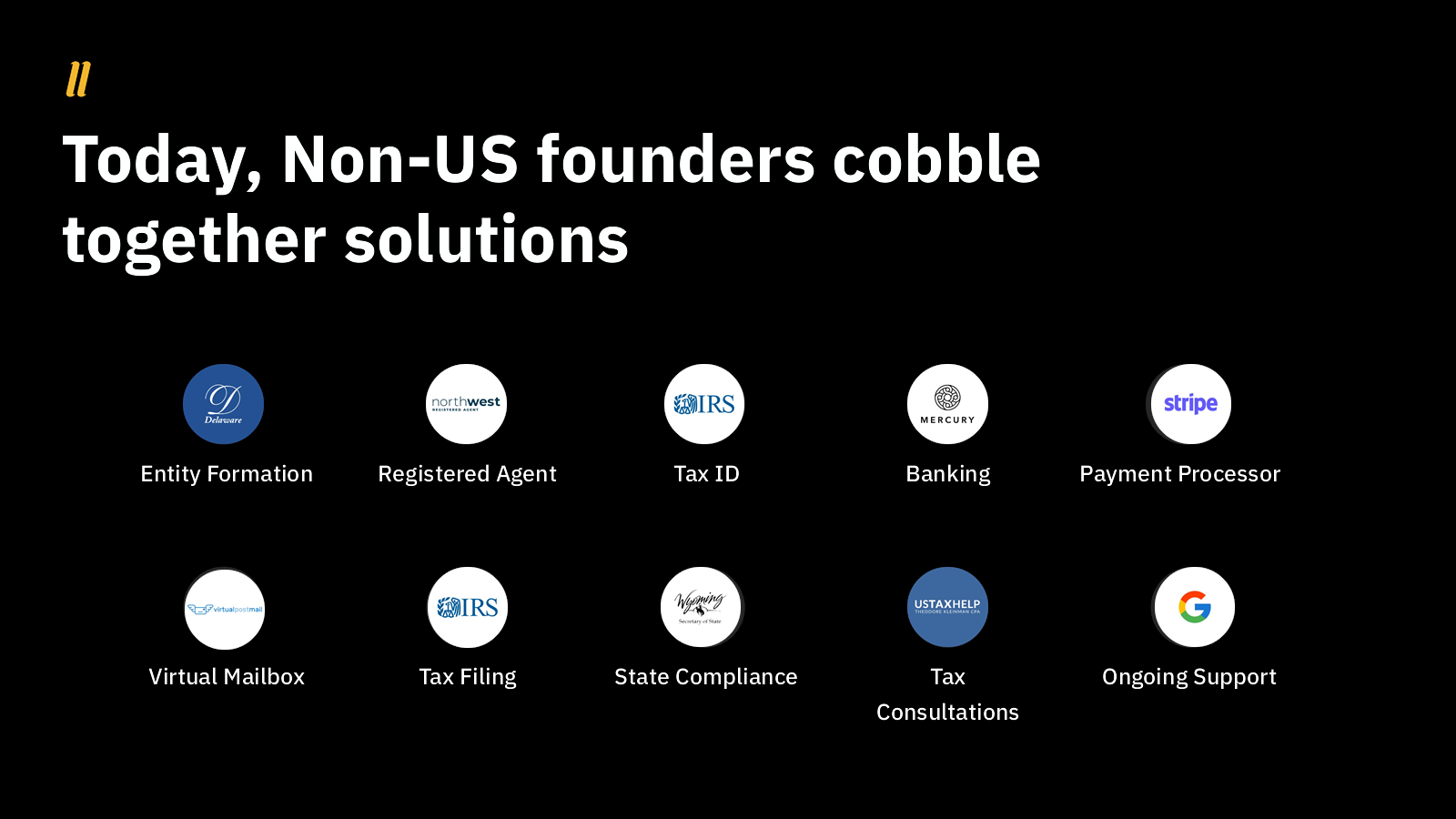

[Slide 3] Understated problem statement — it’s a bit of a gamble, but it works here.Image Credits:Doola

Government & Policy

Hardware

[Slide 10] It’s interesting, but is it a good idea?Image Credits: Doola

Layoffs

Media & Entertainment

[Slide 13] What?!Image Credits: Doola

Meta

Microsoft

Privacy

Robotics

Security

societal

Space

inauguration

TikTok

Department of Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

The earth is full of byplay that attempt to help streamline the appendage of setting up a troupe . Doolais one such startup , and it hasraised a cool $ 12 millionto day of the month since its inception in 2020 . The society justclosed a $ 1 million “ strategic investment funds round ” from HubSpot Ventures , less than a twelvemonth after its $ 8 million Series A , and today we get to take a proficient look at the pitch deck it used to raise that rhythm .

unremarkably , when a inauguration raises a small amount of money following a decent - sized round , there ’s something strange going on — it ’s a symptom of something notquitegoing to project . In Doola ’s case , however , HubSpot ’s involvement have sense : The marketing package party reach out a lot of customers , so Doola ’s toolset could be a good fit with HubSpot ’s business model .

We ’re look for more unique rake deck to tear down , so if you need to put forward your own , here ’s how you’re able to do that .

Slides in this deck

Doola apportion its 14 - slide deck of cards without any editing .

Three things to love

To be frank , I can tell from just see at the list above that there’sa lotof entropy neglect from the deck . In fact , my AI deck of cards - review tool estimatesthere ’s only a 15 % fortune of Doola successfully provoke capitalwith this deck alone . We ’ll get to that afterward , but permit ’s first focus on what Doola bring forth ripe , because it does do some thingsincrediblywell :

Great use of a combination slide

I know using two swoop that make for together to tell a compelling taradiddle . Doola uses slides 6 and 7 to great effect :

This is quite the effective way to ramp up toward explaining the business model indirectly . It also position the degree for explain the clientele model and monetization plan over sentence .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

A subtle and elegant problem statement

This is a gross model of a company that knows its interview . The sloping trough place out a bunch of trouble , but Doola love it is talking to investors , and so it resists the temptation to excuse each problem . investor arepainfullyaware of many of these issues and how they show up for startup .

Simplifying thing is always a gamble , but in this case , I believe Doola won the bet . Yes , these are complex , frustrating and expensive problems , which makes them by all odds worth work !

Interesting bottom-up approach to size up the market

Most inauguration have a decent amount of success with the top - down approach for estimating their market ’s size ( using the TAM / SAM / SOM model ) . But it ’s interesting to see Doola take a different tack to get at a likely market size of $ 4.5 billion per year . As I ’ve write before , slap-up founder often have to plow to a bottom - up approach to grocery sizing , because there ’s nothing else like what they are work up out there .

I ’m not certain if that ’s the correct approach path here give that this space does have a few competitors , but I do enjoy the clarity of this slide .

As I cite before , there ’s a vast amount of information missing from this pitch deck . So much , in fact , that it is essentially useless as a traditional pitching deck . I suspect that Doola was already talking to HubSpot Ventures as part of its original bout and that something encouraged HubSpot to write a baulk anyway — maybe the investor had already made up their judgment before they saw this deck .

In the rest of this teardown , we ’ll look at three thing Doola could have improved or done differently , along with its full sales talk deck !

Three things that could be improved

The hooey that works in this deck does an amazing job , but . . .

Where’s the rest of the deck?

As a founder , you ’re not going to get off with using a pack of cards like this unless something unusual is underway . There ’s so much missing here that this C. W. Post will be 900 page long if I explain it all , so let ’s condense it to bullets :

That is wild , given how good the slide in the deck are .

Here ’s a handy checklist of the 16 slideway you take :

This team slide is useless

I have no musical theme what ’s going on here . Why would an investor require to know the U.S. population compared to the rest of the mankind ? Why would they want to know that you have employee in Russia , Israel and Japan ? Perhaps the beginner are create a point when they talk over this slide , but on its own , this playground slide has me baffled .

The squad glide is often take the most of import playground slide in a startup ’s slant deck . If your startup has extraordinary founder - market convulsion , this coast should be one of the first in your presentation . The fact that this is the next-to-last playground slide and does n’t say anythingaboutthe squad is a immense ruddy flag .

I wish Doola had alternatively focused on its key team members . It ’s not necessary to include everyone , but at least name the citizenry whose roles are primal to the startup ’s success . Detail their background and talk about their relevant experience , science and any unique qualifications that make them ideally suited for their roles . Illustrate how the founders ’ acquirement , experience and vision align with the market ’s demand and opportunities the startup is addressing . explicate why this team is not just restricted , butuniquelyqualified to execute on the specific opportunity your startup is pursuing . This can include their diligence expertise , previous entrepreneurial successes , or specialized knowledge relevant to your startup ’s field .

The team swoop is your chance to showcase the human capital behind your startup , which is often as important to investor as the idea or product itself.

Where’s your traction?

I want to highlight the absence seizure of a traction slide specifically .

It ’s absolutely crucial to talk about your companionship ’s adhesive friction so far in a auction pitch pack of cards . That ’s true for all pitches ( even if you do n’t have tax income yet ) , but specially for a inauguration like Doola that is this far into its journey . When investors see that your product or service has realize some stage of acceptance in the market , it validates the demand for what you ’re offering .

This is specially significant for other - degree startups , where the intersection - market fit might still be in question . Traction evince that not only is there need for your merchandise , but also that you are capable of capturing and growing this demand .

Traction is also a primal index of possible success — it suggests that your business example is make for and can be scaled . Metrics such as user outgrowth rate , revenue growth , partnership plug , or any other key functioning indicant relevant to your business concern can clearly instance this potential difference .

Moreover , traction spotlight the effectivity of your squad . It ’s one matter to have a great idea or a splendid product , but in effect work it to market and generating interest or sales is quite a different proposition . certify traction show that your team has grow a viable product or service and that it possess the competency to carry through your business programme efficaciously . This is key , because investors are not simply investing in your idea ; they ’re also betting on your team ’s ability to action it .

This lack of traction metrics conflate with the fact that the companionship is raising what looks like an reference round makes for a ruby sword lily of larger-than-life symmetry . If I were considering place in this company , the founders could look to be thoroughly grilled about the company ’s business model , product , customer learning and adhesive friction metric .

The full pitch deck

If you need your own tar pack of cards teardown featured on TC+,here ’s more entropy . Also , check outall our Pitch Deck Teardowns and other lurch advice , all collected in one handy place for you !