Topics

Latest

AI

Amazon

Image Credits:Metafuels(opens in a new window)

Apps

Biotech & Health

Climate

Image Credits:Metafuels(opens in a new window)

Cloud Computing

Commerce

Crypto

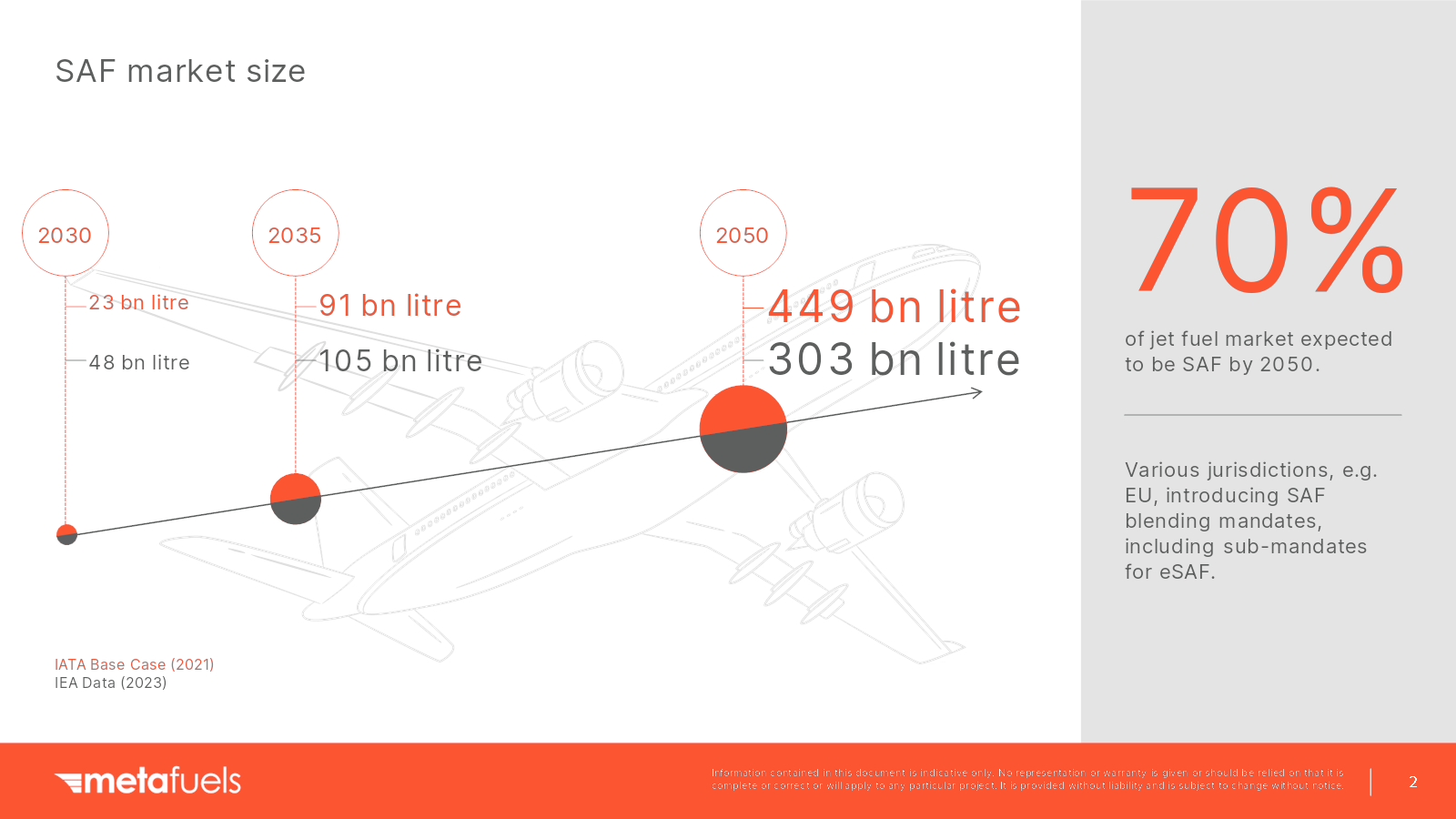

[Slide 2] Gunning for 70% of the plane fuel market is hella bold. I like it.Image Credits:Metafuels

Enterprise

EVs

Fintech

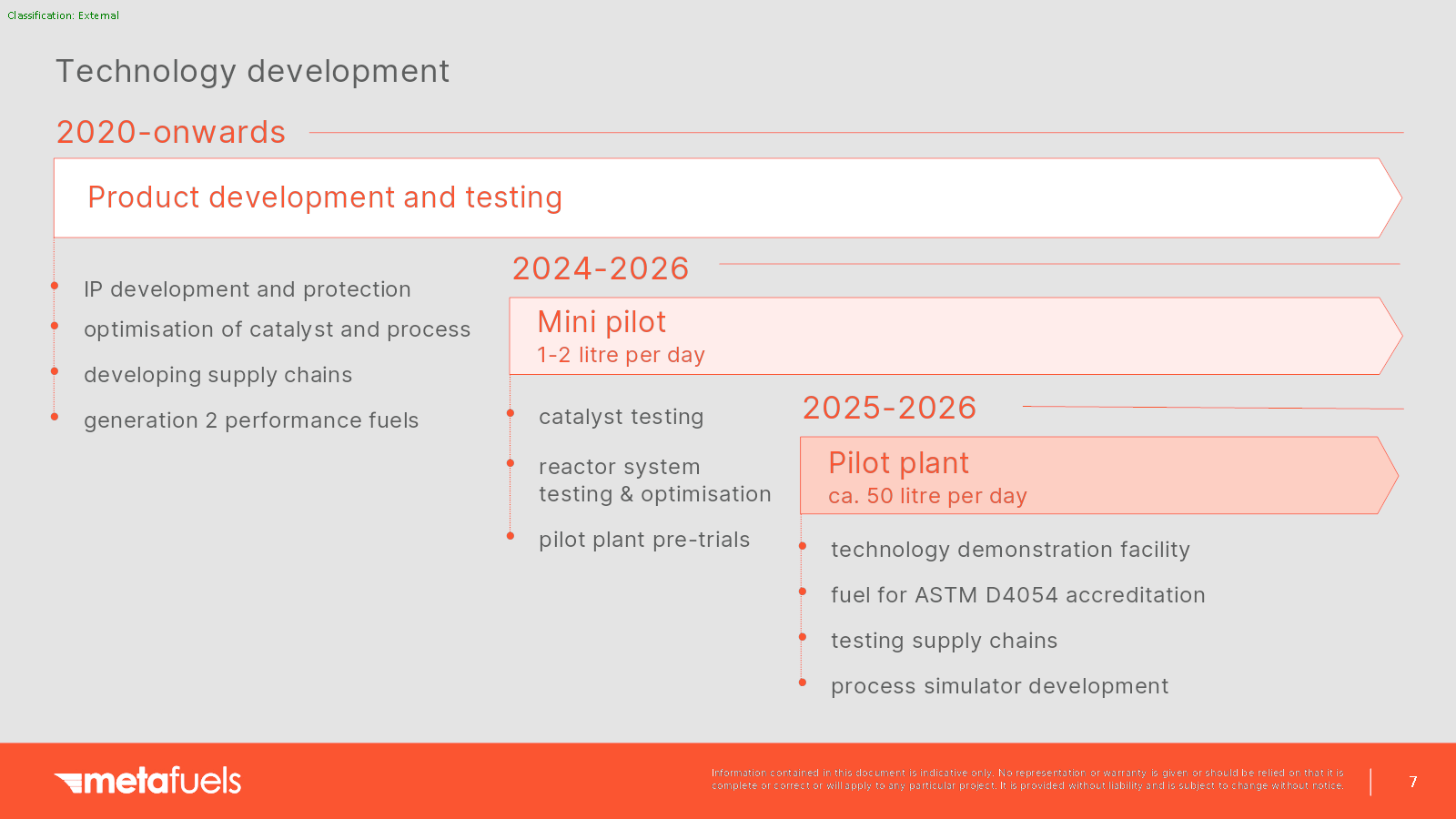

[Slide 4] Ugh, yes, talk nerdy to me, baby.Image Credits:Metafuels

fund raise

Gadgets

Gaming

[Slide 7] I love the clarity of Metafuels’ plan.Image Credits:Metafuels

Government & Policy

Hardware

[Slide 12] You’re going to change the world, and this is the best team slide you can come up with?Image Credits:Metafuels

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

Startups

TikTok

transit

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

TV

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

About 2 % of the world ’s CO₂ emission come from pressurized , honey oil - powered sausages careening through the air . originally this hebdomad , I covered one startup , Metafuels , that thinks it has a solutionfor reducing aircraft emissions .

I was able to blab the company ’s founders into give me the pitch deck for their $ 8 million seed bout so we could do a cryptic dive into the fabric it used to advance the financial backing .

We ’re looking for more unequalled delivery decks to tear down , so if you need to submit your own , here ’s how you’re able to do that .

Slides in this deck

Metafuels was kind enough to partake in its full deck of cards with TechCrunch+ for this teardown . There are some small-scale redaction , but the bulk of this sliding board deck is intact .

Three things to love

If you ’ve been reading my Pitch Deck Teardowns , even skimming the leaning of slides above will make you go , “ Uh - oh , Haje ’s not gon na be happy with this — there ’s a ton of entropy missing ! ” And yes , you would dead be right . This is an interesting challenge with deep tech startups , however : If it ’s going to take a hot minute to get your production to market , there will , by definition , be a band of things missing .

Is it a bird? Is it a plane? No, it’s a high-soaring market size

It takes a special kind of chutzpah to say “ all aircraft fuel ” is your securities industry , but that ’s what Metafuels is doing here .

The market size of it for sustainable aviation fuel ( SAF ) is currently moderately limited . In 2022 , around 300 million liters of sustainable aviation fuel was produced , and that double up this year to more than 600 million liters , per the International Air Transport Association ( IATA ) . That is a drop in the regular ocean of all fuel used worldwide . There was a important dip during the pandemic yr , butin 2019 , around 360 billion liters of fuel was used by commercial-grade airway .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

In other words , SAF represents around 0.17 % of all airmanship fuel consumed .

It ’s no surprisal , then , that Metafuels decided to set out its projections from 2030 . That ’s when the company will gain its stride go into full production , and when the market is probable to take off . The self-aggrandising forcing social occasion is the RefuelEU Aviation regulation , which sets object for blending sustainable fuel in with its petroleum counterparts .

Metafuels tells the story well : You get a picture of a rapidly grow marketplace , and the company positions itself as a important thespian in it .

you’re able to learn from this sloping trough how to tiethe “ why now ? ” part of your storyto wide macro changes . If you know which mode the flatus is blow , you could set your company up to make the most of it .

Let yourself nerd out about the tech

When you ’re building a deep tech company , the tallest terminal in the tent is always going to be the technical school itself . What haveyoufigured out that nobody else has been able to nail down ?

Metafuels has found the one exception to the “ your investors do n’t give a crap about your product ” rule : This is a mystifying tech company that will fail or succeed whole based on what it ’s capable to give up on the tech side . It ’s refreshing to see a three - slide solidification ( slides 3–5 ) talk through the process , how it works at scale , and how the companionship can produce the fuel at a reasonable Mary Leontyne Price .

A clear roadmap

Make it work , then make it exploit at small scale , then scale to yield scale . This is a pretty obvious road to take , but it ’s seldom spelled out this clearly . swoop 10 then breaks down how the party can scale from 50 liter per day to 700 million liters per day — that ’s a hell of a grading operation .

The main takeaway from this part of the deck is to keep an eye on the futurity and how you could scale later . Having a clear persuasion of the unit economics in particular ( i.e. , how the financials of your products alter as you start increase volume ) is often a crucial part of the story .

Here , Metafuels is talking about producing 1 to 2 liters per day , then scaling that by 700 million . That ’s . . . a hell of an undertaking . And while the manufacturing processes and factory for produce that much fuel will be expensive , the cost per liter will come down dramatically . Metafuels is undertake that attractively in this deck .

In the rest of this teardown , we ’ll front at three thing Metafuels could have improve or done other than , along with its full pitch deck of cards !

Three things that could be improved

There are some absolute doozies in this deck .

So about that team slide . . .

This slide is a letdown for a number of reason , the most important one being it does n’t separate us why someone should gift in this team . The squad slide should shout , “ You ’d be perfectly off your rocker if you do n’t indue in this squad . ” This slideway does n’t quite do that .

Sure , we have a mechanical engineer , a chemical technologist and whatever a “ Dipl . Ing . ( Industrial ) ” is , but it ’s almost sorely innocent of any grounds to commit . Who are these people ? What have they done in the past ? What do they have that , say , LanzaJet ’s founders do n’t ?

sin , even just letting ChatGPT sluttish on the founder ’s LinkedIn page produces something far better than this sloping trough :

Saurabh Kapoor , with his screen background in mechanically skillful engineering and roles in uncontaminating vigor , is dead suitable to direct a sustainable aviation fuel society . His experience includes co - founding Metafuels , focus on atomic number 6 - neutral air traveling , and Industria Mundum , a consultancy in decarbonization . His piece of work in undertaking evolution and risk management at notable firms like Capture Power Limited and GE Power further underscores his expertness in the field of sustainable energy solution .

This is a full example of what not to do with a team playground slide . startup should do their best to ensure that your investor have a fighting chance of understanding your inauguration and founding squad well and thoroughly .

Where the hell is the competition slide?

face , pretending you do n’t have competitors is not a great feel , especially when you ’re kind of a latecomer to the secret plan . It ’s crucial to excuse what is happening in the market and how your technical school or approach differs from what ’s out there . A couple of ready Google searches tells me that the challenger in this space is fierce :

There ’s a whole bunch of players in this space , and not address any of them in the pack of cards is a greenhorn mistake .

Startups should tilt into their competitive landscape . If you ca n’t explicate how you are different or better , or somehow have an border over your competitors , you ’re going to have a raspy time .

No clear ask and use of funds

The ship’s company does n’t specifically say how much it is raise , nor does it go into detail about how it is going to deploy the funds . Those inside information could be inferred from the deck , of course , but from a storytelling gunpoint of view , it ’s absolutely crucial to be far more denotative about the fundraise and what the deliverables are for this cycle .

As a inauguration founding father , your fundraising goal should be specifically tailor to turn over the milestones necessary for your next financial backing round . This mean focusing on reducing risks related to product ontogeny , expert challenges , regulatory approving , and fiscal metrics . You must select key metrics and set specific , realizable and mensurable goals . Additionally , you should postulate your team in a detailed discussion about the resource need to hit these milestone . This includes budgeting for growth , operation and merchandising , and adding a contingency buffer zone for unforeseen expense . reach these milestones is critical for securing future support and ensure the growth and achiever of your startup .

I was surprised to see so little of this in Metafuels ’ deck . It ’s clear that the party has done some gravid medium- and long - terminal figure planning , so tying its current fundraising around to specific milestones would have been pretty easy and would have made conversation with the investors so much easy along the way .

The full pitch deck

If you want your own pitch deck teardown featured on TC+,here ’s more information . Also , check outall our Pitch Deck Teardowns and other pitching advice , all collected in one ready to hand place for you !