Topics

in vogue

AI

Amazon

Image Credits:Phospholutions(opens in a new window)

Apps

Biotech & Health

clime

Image Credits:Phospholutions(opens in a new window)

Cloud Computing

Commerce

Crypto

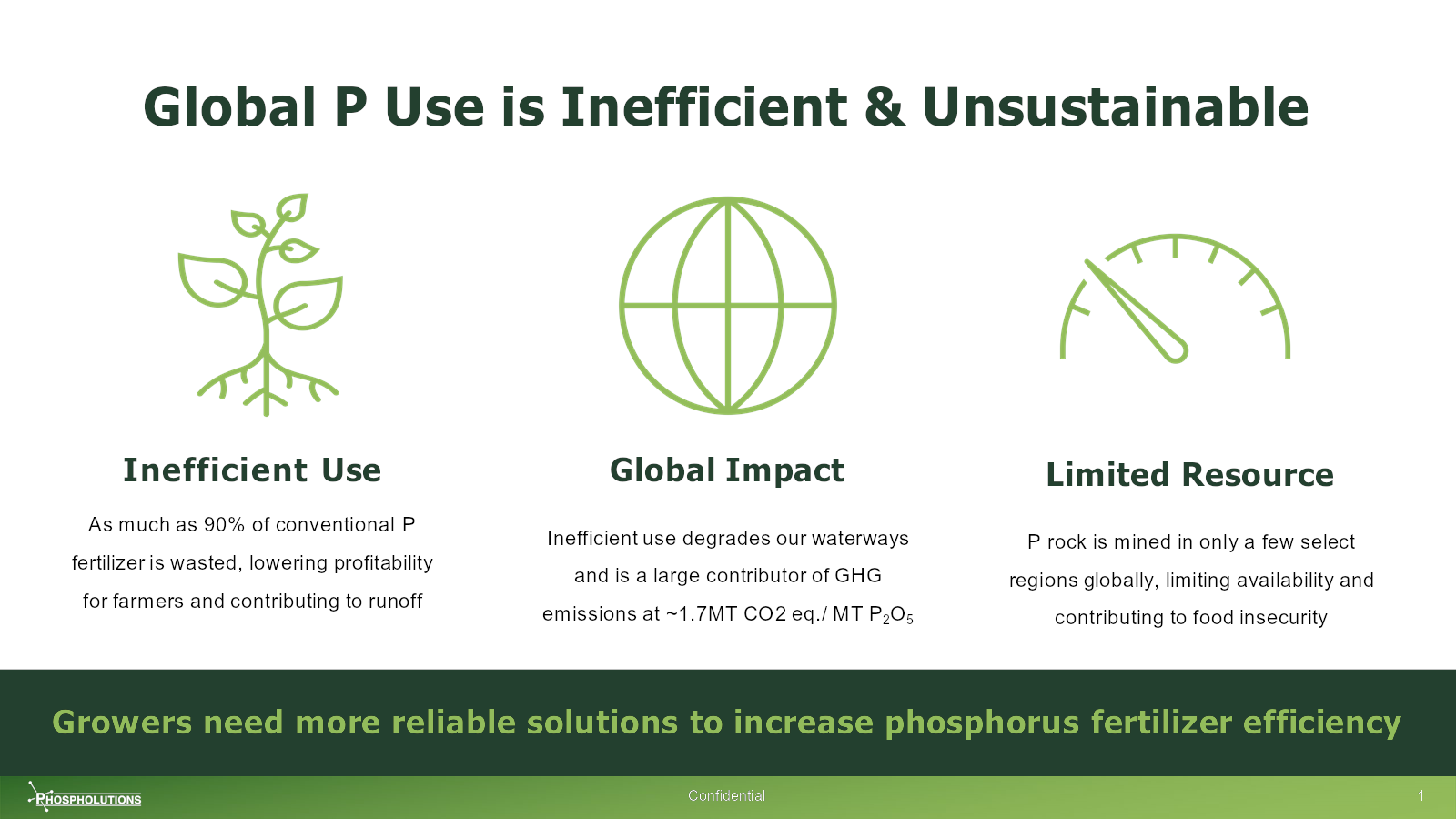

[Side 2] Clarity right out the gate.Image Credits: Phospholutions

Enterprise

EVs

Fintech

[Slide 3] “What happens if we don’t address this problem.”Image Credits: Phospholutions

fundraise

Gadgets

Gaming

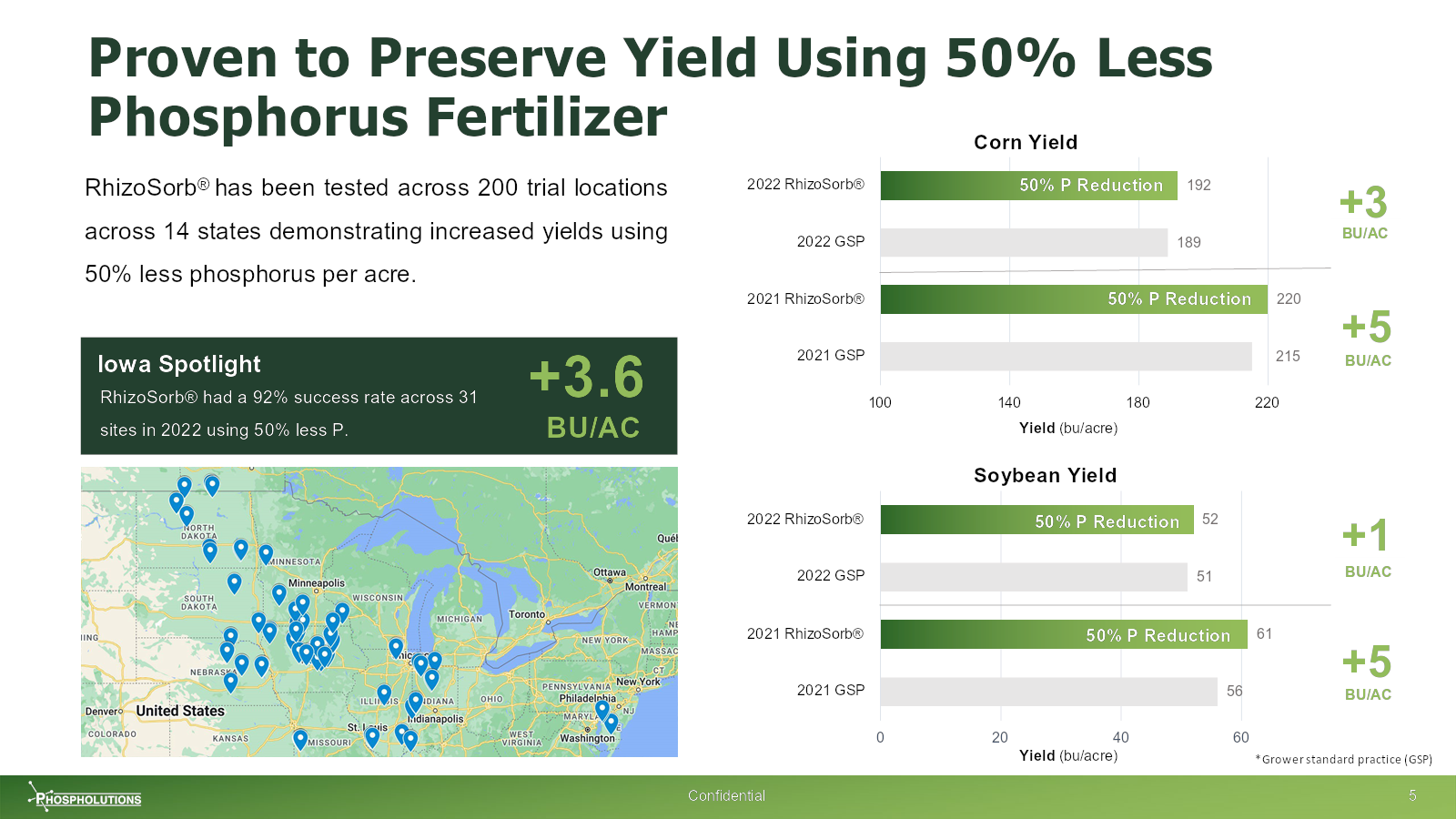

[Slide 7] Backed by data. Yummy.Image Credits: Phospholutions

Government & Policy

computer hardware

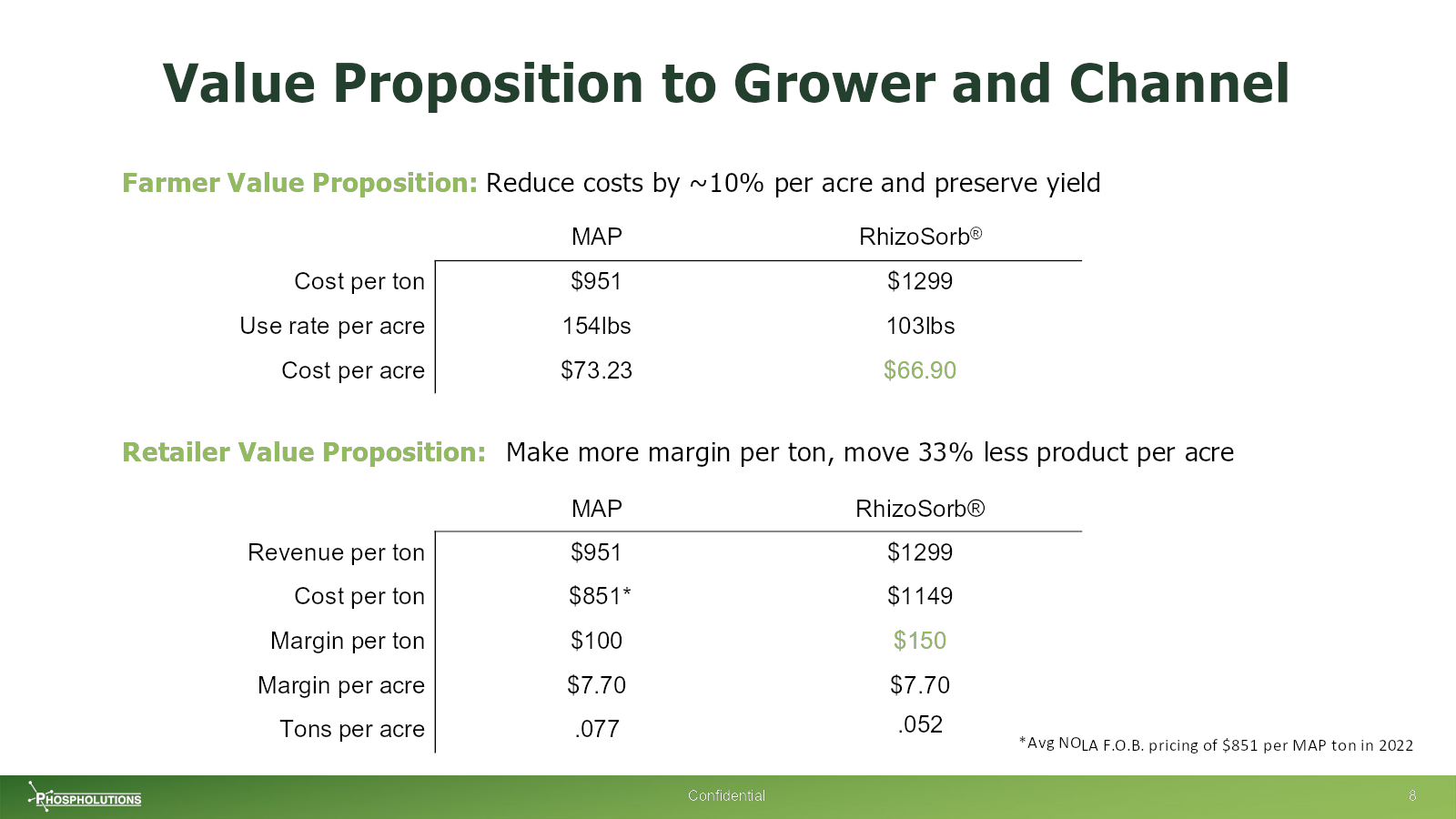

[Slide 10] This is unnecessarily hard to read.Image Credits: Phospholutions

Layoffs

Media & Entertainment

[Slide 18] H’okay, then.Image Credits: Phospholutions

Meta

Microsoft

Privacy

Robotics

Security

societal

Space

startup

TikTok

transport

Venture

More from TechCrunch

result

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

I have n’t seen a tidy sum of agriculture technical school startups submit their pitch decks for this series , so I was delighted to get one fromPhospholutions , whichjust closed a $ 10 million circle , bring in its total funds raised to $ 32 million .

The squad initially said they used the pack of cards to raise a Series B round , which confused me , but upon reading the closet information more carefully , it seems they made a misunderstanding . I would unremarkably let people get off with this kind of stuff , but this deck is riddle with subject that could have been quash by simply pay more attention to contingent .

We ’re looking for more unique pitch decks to tear down , so if you want to submit your own , here ’s how you may do that .

Slides in this deck

Parts of Phospholutions ’ deck are fairly heavily redacted , which makes it heavy to get the full depiction , but there ’s still plentitude to get into .

Three things to love

Phospholutions ’ slant deck is a captivating showcase of innovation and strategic insight , be the essence of an in effect pitch . It is a harmonious portmanteau word of compelling storytelling , clear time value propositions and persuasive data point head that together create a compelling narrative .

To P or not to P

I bonk how the title get proper to the heart of thing . “ Global atomic number 15 Use is Inefficient & Unsustainable ” is all we had to say , really .

investor who are familiar with ag tech believably cognize this well — the marketplace has a few incumbents that have done well over the years , and if Phospholutions has an innovative take on this problem , it ’ll be an obvious investment to say yes to .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

I like the simplicity of the nontextual matter . I like that the company hint at the impact of the problem ( “ lowering profitability for farmers ” and “ ineffective use take down our watercourse ” ) in summation to mention the problems themselves . All very good storytelling points .

The bottom line , “ grower need more authentic resolution . . . ” advise a solution - oriented approach and communicates what require to be done . throw that this is a pitch deck , it ’s obvious what ’s about to happen next .

There ’s quite a morsel of information on this sliding board , but I care how each period lead logically to the next , create a narrative menstruum that helps result the eye and prompts the reader to stay set-aside . It ’s also scannable , so you may chop-chop absorb the substance , too . Very clever .

A couple of low quibble : I have a go at it that phosphorus abide for phosphorus , but the writer in me stay fresh stumble over abbreviations that are n’t excuse . Also there ’s no shortage of room on this slide , so whileof courseGHG stands for greenhouse gases , you may yield to spell it out . And “ ~1.7MT CO2 eq / MT P2O5 ” is a mickle of ABC’s soup to throw on an early slide .

I ’ll get off my soapbox now , but attending to detail matter !

Contextualizing the near and medium term

I rarely see startups do this , which is a ignominy , because it helps build up narratives very well :

The grocery opportunity chute go on where the trouble slide allow for off . Again , there ’s alotof text here , but it works . The master point are made with nontextual matter , and thing are further broken down and endorse by claims with just a little hint of crisis .

segment the content into the “ Today , ” “ Short Term , ” and “ Long Term ” buckets let the reader understand how the market dynamics will modify over sentence . It ’s good storytelling , but it also does something more important : It suggest that the founder have an eye on the future and are skating toward where the Robin Goodfellow is sound rather than where it is . Investors wish to see founder who have an heart on the futurity .

The other storytelling win here is that while it is not expressed in this slide , it sets the stage for charter action : natural process that Phospholutions is positioned to provide , of course of action .

Real impact

The deck spend a bit too much meter on the merchandise , in my opinion . But the flip side is that it gets a lot of thing extremely correct . This slide , in particular , does a lot of the heavy lifting :

Phospholutions ’ RhizoSorb is more expensive than the choice and the deck address that in two ways : by showing that the product is more in effect , and therefore , you have to practice less to get ranking yields . The deck of cards spends a pot of time on this degree . I ’m take up that ’s the event of the team getting a circumstances of pushback on the pricing .

The thing I like about this set of slides , however , is that it really run deep into the proved efficacy . If an investor asks for more information , there is alotof it .

In the rest of this teardown , we ’ll take a look at three things Phospholutions could have improved or done other than , along with its full pitch deck !

Three things that could be improved

The pack of cards begin off quite well , but then it splutter out of steam about halfway through .

Attention to detail

A typo or two is n’t going to prevent an investor from investing . But the truth is , if the deck has so many mistake that it starts to become detectable , it reflect poorly on the founders .

Page 2 of the rake deck is labeled as slide 1 , which is puzzling , because most PDF viewers countenance you easily jump to another page . varlet 4 and 5 are both keep down 3 , then on page 17 , the numbering goes from 15 to 18 , to 17 , then back to 18 again . Most presentation design package automatize the page enumeration , so it ’s beyond me how this happen .

mayhap it ’s a small thing , but hope me on this : When investors are discussing the IN and out of a pitch shot deck , they ’ll be referring to page Book of Numbers . That ’s not a effective time to introduce defeat . When the page phone number do n’t jibe up , it makes communicating about a deck puzzling .

And this slide is frustrating to me . Spreadsheets usually right - align numbers because they are knockout to scan and read otherwise . Also , using a grand extractor can further improve readability ( $ 1,299 versus $ 1299 ) .

I know I ’m pointing out the small thing , but it all tote up up .

Too much detail, and not enough

The team slideis vital . This is not how to do it :

Your investor is n’t going to care who the regional sales manager or the HR administrator is ; they are n’t going to be dealing with any of these people in any path . What ’s more , a full administration chart like this can actually be harmful , because it ’s too much selective information , and almost none of it is interesting or relevant to your enhance money .

But fine , since you’vegivenme all of these name , I ’m go away to look for variant . And guess what ? I found many . There are a gross ton of mismatch between occupation titles and what ’s on this slide ( of course , it ’s potential that some people catch advancement or new title since the fundraise ) , and there are a bunch of other little problems as well .

The lesson here is that if you put something on a chute , verify a bare Google lookup ca n’t disprove it . Some venture house have alotof associates doing due diligence , and many of them are absolute sticklers for details .

There ’s another boner here : The deck highlight that they do n’t have a VP of R&D. For a tech startup raising from VCs , that ’s a fantastic way to fritter away yourself in the foot . technical school is of import for tech investor .

The biggest job is that nothing on this slide convinces me the older leaders is the right squad to die hard this party . A more effective way to do this would be to pull out the three or four central staff office who are sound to move the needle for Phospholutions , and then highlight why they are uniquely positioned to take the caller to the next horizontal surface . Highlight how they are part of your competitive advantage .

Where’s your traction?!

This deck does have a number of redactions , so it ’s entirely plausible that there is a slide with adhesive friction selective information , so take this one with a exigency of saltiness . . . .

Still , I ’m very disordered why the adhesive friction information is n’t presented front and center . The company looks like transport product , so product takings , sales graph and other diachronic metric should be included in great item . The redacted slides seem to be focalize more on the future . An investor would consider that a pretty serious defect , specially because this company ’s been operating for seven twelvemonth or so .

The full pitch deck

If you want your own pitching deck teardown featured on TC+,here ’s more entropy . Also , check outall our Pitch Deck Teardowns and other lurch advice , all accumulate in one handy place for you !