Topics

Latest

AI

Amazon

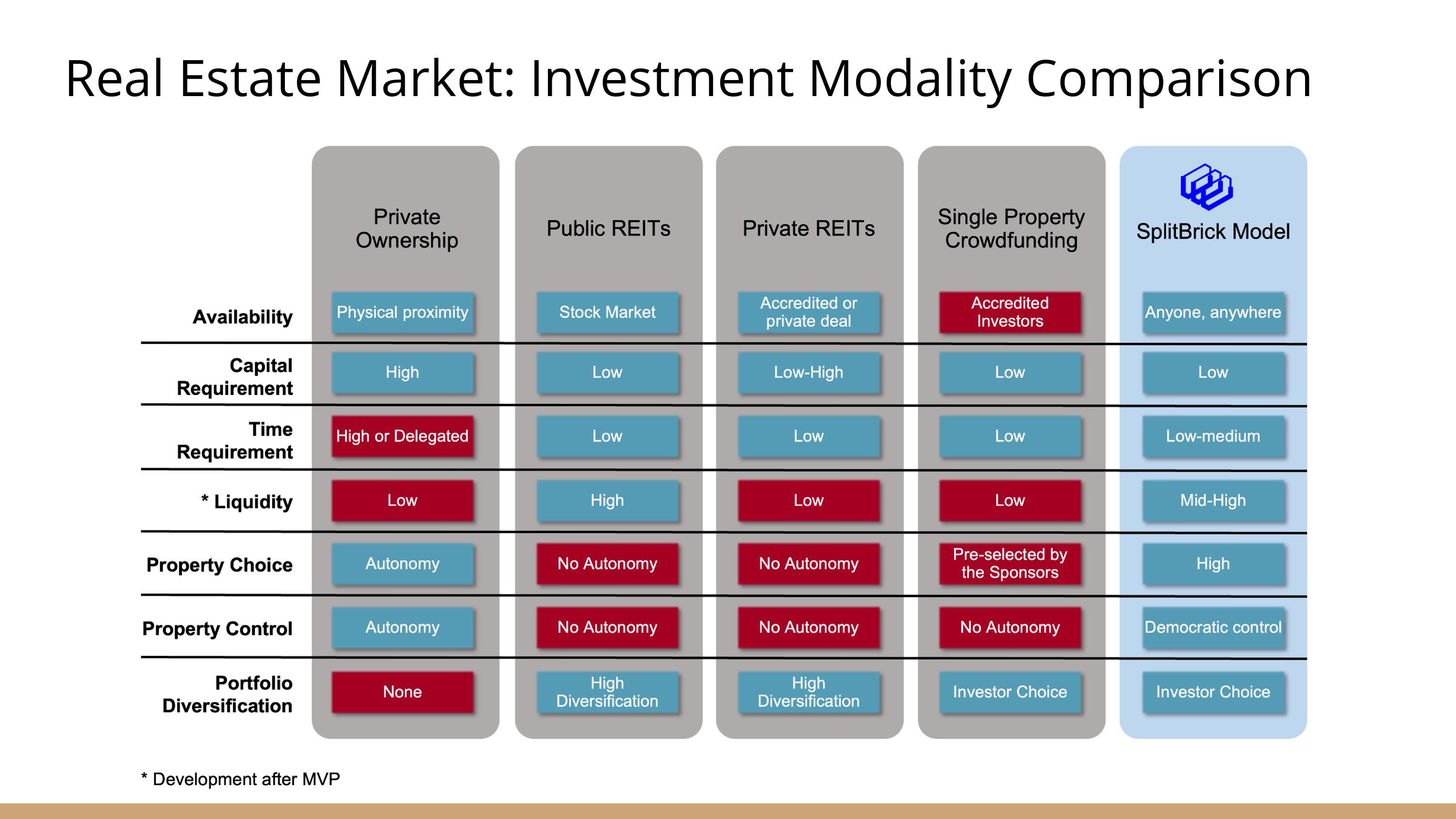

[Slide 3] Breaking out the various business models helps differentiate the startup.Image Credits: SplitBrick

Apps

Biotech & Health

clime

[Slide 3] Breaking out the various business models helps differentiate the startup.Image Credits: SplitBrick

Cloud Computing

Commerce

Crypto

[Slide 3] Breaking out the various business models helps differentiate the startup.Image Credits: SplitBrick

Enterprise

EVs

Fintech

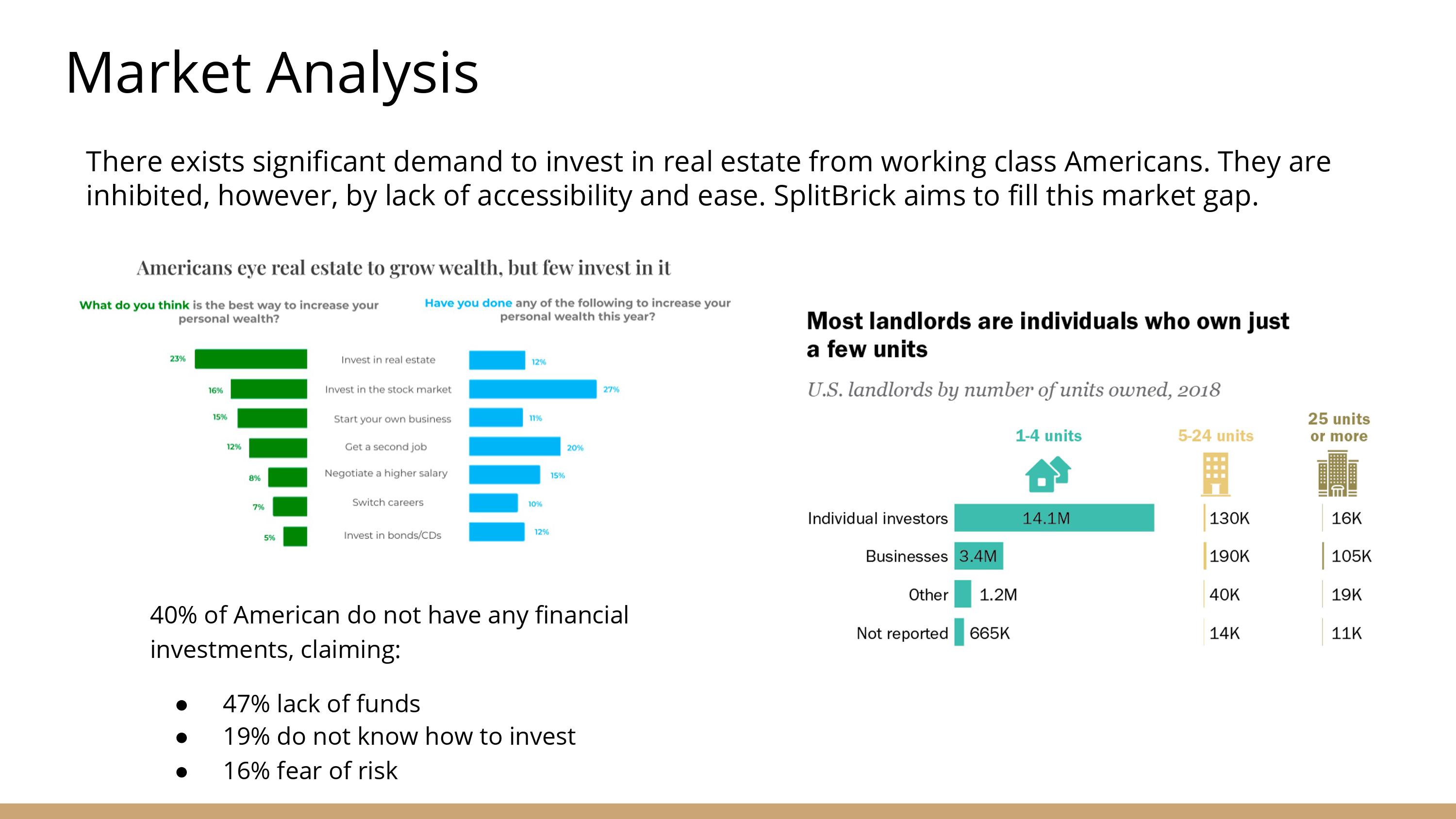

[Slide 5] A clear view of the market opportunity.Image Credits: SplitBrick

Fundraising

Gadgets

Gaming

[Slide 15] In the appendix, SplitBrick shows off a user journey that’s easy to follow.Image Credits: SplitBrick

Government & Policy

computer hardware

[Slide 4] A legal and operational nightmare.Image Credits: SplitBrick

layoff

Media & Entertainment

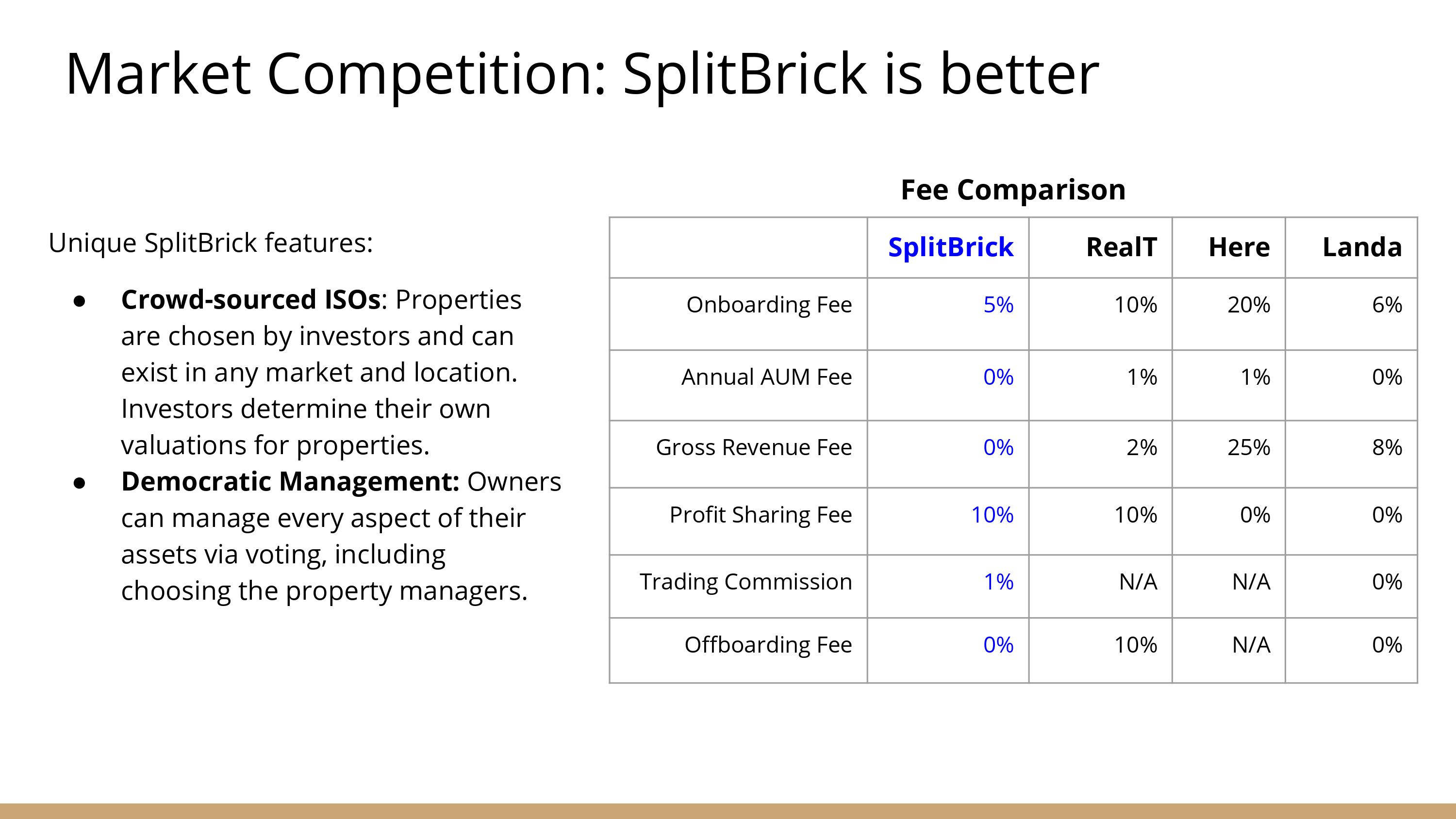

[Slide 6] Showing that you understand the market you’re entering can take many shapes. A solid competitor analysis is one of them.Image Credits: SplitBrick

Meta

Microsoft

Privacy

[Slide 11] Is this the right team to back to build in this space?Image Credits: SplitBrick

Robotics

Security

societal

Space

startup

TikTok

expatriation

Venture

More from TechCrunch

effect

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

reach Us

I do n’t often pluck down angel pack of cards for the Pitch Deck Teardown series for a pretty mere reason : The expectations that angel investors have from a pitch deck are moderately different from what professional institutional investors are appear for . Still , as I was wait throughSplitBrick‘s deck , I agnize I have some things to say .

For example , there are some major , profound problems with this deck that make the company middling much unimaginable to indue in . Let ’s take a look !

We ’re search for more unequalled pitch shot decks to tear down , so if you want to give in your own , here ’s how you may do that .

Slides in this deck

SplitBrick submitted an 18 - slide , unredacted deck . The slides are :

Three things to love

Sure there was a lot to dislike about this deck , but it ’s not all bad , and there are a few points worth highlight .

Great market context

It ’s rare that a startup pitching deck want to break down a variety of business concern simulation in an industry for position itself , but innovating on business example is a legitimate way to introduce , so it ’s a great thing to let in :

There ’s a motley of ways to get a cut of the property action at law . SplitBrick boldly offers a new choice and a fresh take on the market .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

This is a dandy representative of precede with what bring in you unique . There are a draw of challenges with SplitBrick ’s specific scheme , but this is incisively where this type of approach beam : Innovate on the aspects of the business that are good for disruption , and lead the rest alone .

A clear view of the market

I ’d have jazz to see some sources here to show where the info is coming from , but if we take the numbers at aspect value , this lantern slide does a great job of painting a light picture of a market worth taking a tightlipped looking at :

An elegant take at a product demo

SplitBrick is a very early - stage party and has therefore only build an MVP . That can be challenging to demo , but the company detect an interesting path to do it .

The appendix has six slides that together function as a footmark - by - step product demo . It shows how the fellowship is cogitate about its design language and exploiter journey , which is a really good solution that allows investors to co - dream with the father .

In the rest of this teardown , we ’ll face at three things SplitBrick could have improve or done differently , along with its full pitch pack of cards !

Three things that could be improved

As I mention in the introduction , I believe this troupe is not really investable as it was represent . Here are some of the braggy challenges :

Huge legal and operational red flags

Look at the flow of how SplitBrick is proposing to buy holding . If I interpret this sloping trough aright , anyone on the political program can propose to grease one’s palms a prop . Then the crowd tries to agree on what the cost should be , raises the money , and cause an offer to the possessor . If the leverage is successful , it is “ usable for direction ” by its shareowner .

Every stair of this physical process has Brobdingnagian sound and logistic challenges . To protrude , there ’s no vetting step to see whether the property is any trade good . In many holding markets , literal land sell so apace that I ca n’t imagine this outgrowth being fast enough to be successful . The buyer will belike not have heard of this , and so some random LLC ( that has n’t been incorporate yet ) trying to put a bid on a property will probably cause mental confusion . Then , if the offering is successful , the LLC has to be formed , but the SEC may have a matter or two to say about how exactly this is implemented . Then last , anyone who ’s ever own an investiture property knows that place management and maintenance can be an pure nightmare . That is n’t addressed in any way in the SplitBrick clientele modeling .

Now imagine 100 people buy a four - building block property together as an investment and somehow postulate to vote through a governance model on whether or not to replace a ceiling , who to charge as a prop coach , and who to hire the units to . To anyone who ’s been a part of a somewhat malfunction HOA , you have it away that this sounds like a nightmare . Based just on this sliding board alone , I made a genial note to run for the mound and never go near to SplitBrick as an investor . It fathom like a recipe for a large act of citizenry getting caught in legal and operational gridlock for the rest of eternity .

Competitive landscape

Real estate is a mature diligence , and of row there are quite a few competitors in this space already that have solved aspects of this in elegant ways . But there are no competitors mention on the competition slide :

The “ unequalled features ” name here sound like awful idea . If I were think of investment , I ’d have a lot of questions about financial and effectual liability , regulatory landscape painting , and how the company is contrive to tackle some of these thing once it starts operations .

More significantly , though , the competitor landscape painting misses some major , redoubtable competitors that are out there . Pacaso(PitchBook reports it has raised almost half a billion dollars),Arrived(whichraised $ 60 million to day of the month , including from Jeff Bezos),Loftyand many other participant are out there . In add-on , Fractionalseems to have build up something that vocalise almost exactly the same as SplitBrick — and it ’s raised almost $ 20 million .

Against this private-enterprise landscape , and with the major sound hurdles SplitBrick is facing , without having explain how what it is doing is defendable , I ’m not seeing any cause to invest in SplitBrick .

Lackluster team

The team is the one thing that sets other - degree startups asunder from the competition . Sadly , base on this delivery deck , SplitBrick does n’t tick that box :

Real the three estates is a specialized diligence , full of sound and regulatory hurdling and with a ton of formidable players operate in the market already . In a domain of powerful incumbents , as well as experient and well - funded startups , you ’d have to bestow a truly special team to compete . This slide does n’t tell that floor .

A group of hungry , high - muscularity entrepreneurs can get a lot done , for sure , and I would be enthralled to be proven unseasonable . However , this is an industry that is full of incredibly experient , gray - hairy billionaire . They may not be as tech savvy as a crowd of recent computer science graduates , but they are n’t dazed .

Launching something that is , at once , a blockchain - similar root , that ’s also a market , a fintech play , and a tangible estate company is not for the faint of heart . When I put on my investor glasses , I see at the whole coast deck of cards and I get the impression that it ’s a little on the naive side . There ’s nothing in the deck that makes me think that the founders have found anything that ’s new , innovative or vendible .

In the words of the investors on “ Shark Tank ” : I ’m out . And I ’d be very surprised if angel investors who empathize the market would fare to a different close .

The full pitch deck

If you want your own pitch deck teardown sport on TC+,here ’s more data . Also , tick off outall our Pitch Deck Teardowns and other pitching advice , all collected in one handy shoes for you !