Topics

Latest

AI

Amazon

Image Credits:Smederevac(opens in a new window)/ Getty Images

Apps

Biotech & Health

clime

Image Credits:Smederevac(opens in a new window)/ Getty Images

Cloud Computing

mercantilism

Crypto

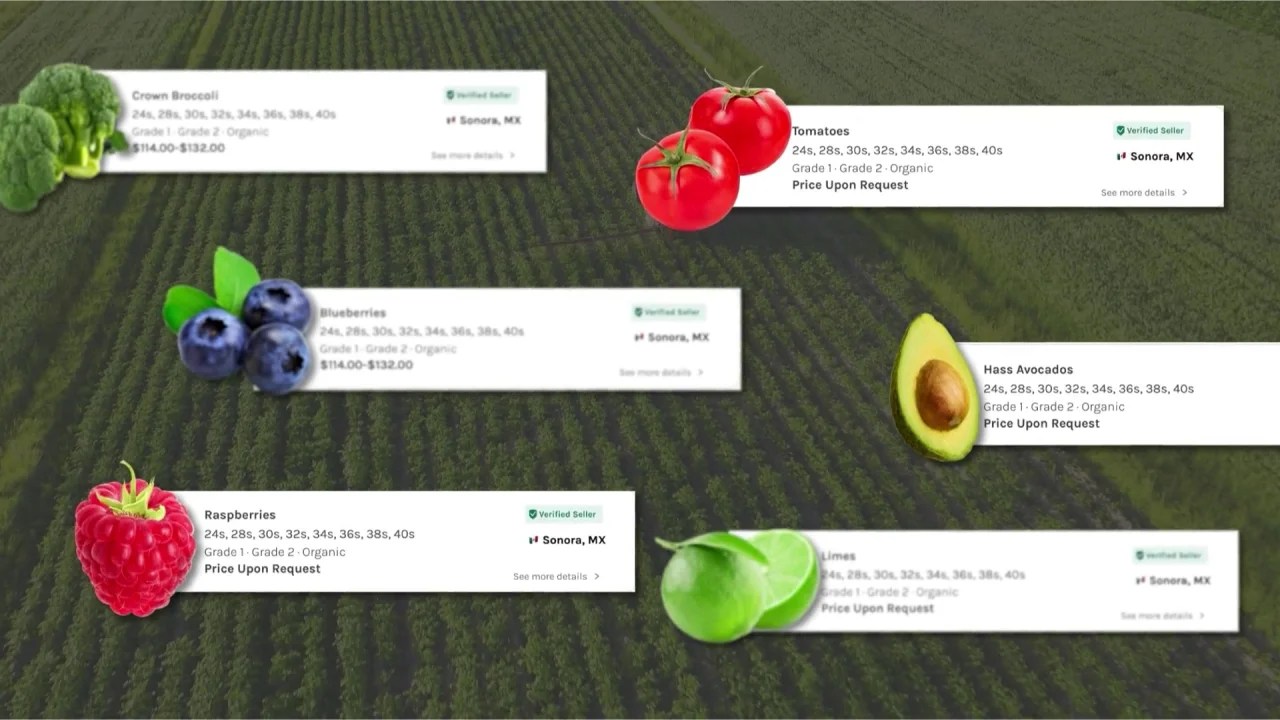

ProducePay’s platform helps connect — and fund — fresh produce growers and buyers.Image Credits:ProducePay

Enterprise

EVs

Fintech

Fundraising

contrivance

game

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

blank

startup

TikTok

Transportation

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Food wastefulness is a major problem .

In the U.S. alone , roughly30 % to 40 % of the provision ends up in landfill . A United Nationsreportestimated that around one - third of theworld’sfood is wasted every twelvemonth , adding up to 1.3 billion tons — deserving almost $ 1 trillion .

turn over the scale — and social implications — of food waste , it ’s not surprising that there ’s an full cohort of startups attempting to tackle the challenge from various Angle .

Yume’splatform help manufacturers turn potential food waste into cash . Divertaims to tackle grocery fund waste algorithmically . Idais applying AI to attempt to prevent surplus in supermarkets . AndChocois fostering a more sustainable food system for restaurants and suppliers .

Another among the food waste - fighting venture is Los Angeles - basedProducePay , whose stated charge is to give reinvigorated green goods growers and buyers greater transparency — and flexibility — in the grocery supplying chain .

“ ProducePay is on a mission to rule out the economic and food waste material get by the volatile and fragmented nature of today ’s global sweet produce supply string , ” CEO Pat McCullough told TechCrunch in an email interview . “ Our [ platform ] is giving growers and buyer bang-up control of their business enterprise by offer unprecedented access to capital , a spheric trading internet , insights and provision chain profile . ”

Pablo Borquez Schwarzbeck founded ProducePay in 2015 , shortly after graduating from Cornell with his MBA .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Schwarzbeck ’s first exposure to produce supply issues was on his household ’s asparagus and grape vine farms in Mexico . As a young adult , Schwarzbeck , who ’s now ProducePay ’s executive director , go on to crop for the Giumarra Companies , a fruits and vegetables cultivator , where he aver he come to really grasp the magnitude of the disadvantage growers face .

“ A exclusive shipment of garden truck typically travels 1,600 Swedish mile , and will be handled by four to eight intermediaries , ” Schwarzbeck said . “ Along the room , factors such as unpredictable weather , fluctuating market place , crop disease and pest create a constant state of instability that wreaks mayhem across the supply chain . This unpredictability and volatility , coupled with the disconnected , inquisitive nature of the provision mountain range , resultant role in enormous inefficiencies and wasteful practices . ”

As Schwarzbeck alluded to , agriculturalist face a number of pressures — but one of the most penetrative is unconscionable competition for emptor contract . In areportfrom the environmental organization Feedback investigating international food supplying chains , six out of 10 farmers let in to overproduce to avoid losing contracts — resulting in supply transcend demand and , by extension , food for thought waste .

ProducePay ’s solution is two - bifurcate : supply chain monitoring and funding products for intellectual nourishment growers and supplier .

ProducePay supplies working uppercase to help growers and distributors pay for things like operating expenditures , technical school upgrades and land acquisitions . In addition , ProducePay extends liquidity to growers and electrical distributor post - harvest , enable growers to reach seemingly unattackable cash positions for their next growing bicycle — and distributors to appeal look for - after growers by offer up them quicker , larger payouts .

Are the loanword terms well-disposed ? Some customers think they are — McCullough claims that ProducePay is now working with over 60 commodities across 20 country , having fund more than $ 4.5 billion in harvests so far .

“ This success is built entirely on trust , ” he add . “ grower believe that we are there to serve them grow . And we ’ve build a robust web of agriculturist and buyers who we know can deliver on their commitments . ”

Beyond standalone services , ProducePay bundles its fiscal product with supply chain of mountains visibility tools to create what McCullough calls “ predictable commerce programme . ” The platform have retailers commit to fixed pricing and volume before the grow season commence in interchange for green goods from vetted growers . ProducePay ’s team of agronomists monitor and convey order quality from the field throughout each program , through expatriation and upon final comer .

One customer for which ProducePay built a program , Four Star Fruit , is leveraging it to tie to growers , advertisers and retailer in ProducePay ’s ~1,000 - customer web while bypassing “ non - value - added intermediaries , ” McCullough says . “ We ’re addressing volatility with chapiter , engineering and our team of agronomists to more expeditiously capture all of the value that ’s lost to these intermediator and other inefficiencies , ” he continued .

ProducePay ’s line — take a cut of meat of every transaction through its platform — has proven to be quite lucrative , with revenue increase 76 % last yr compared to 2022 . craft mass on the platform is up by almost 3x , according to McCullough , while transaction volume is on rail to get through $ 2 billion by late 2023 .

Evidently pleased with the figures , investors are pouring more money into Schwarzbeck ’s venture .

Today , ProducePay announced that it recruit $ 38 million in a Series D turn led by Syngenta Group Ventures , with involution from Commonfund and Highgate Private Equity , G2 Venture Partners , Anterra Capital , Astanor Ventures , Endeavor8 , Avenue Venture Opportunities , Avenue Sustainable Solutions and Red Bear Angels . The new majuscule , which brings ProducePay ’s sum leaven to $ 136 million , will be put toward supporting the troupe ’s enlargement into Europe , Asia , Africa and Australia and growing ProducePay ’s team of ~300 full - time employees .

“ Even though many industries have presented a slowdown , brisk produce will always be essential and bear on to raise as consumers demand healthier intellectual nourishment option , ” McCullough said . “ We witness it through the pandemic and continue to see that upgoing movement . ”