Topics

Latest

AI

Amazon

Image Credits:ReelShort

Apps

Biotech & Health

Climate

Image Credits:ReelShort

Cloud Computing

Department of Commerce

Crypto

Image Credits:Appfigures

Enterprise

EVs

Fintech

Image Credits:Appfigures

fund raise

Gadgets

Gaming

Image Credits:Appfigures

Government & Policy

computer hardware

Image Credits:Appfigures

Layoffs

Media & Entertainment

Image Credits:Appfigures

Meta

Microsoft

secrecy

Robotics

security measure

societal

quad

Startups

TikTok

transfer

speculation

More from TechCrunch

upshot

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

reach Us

WasQuibijust ahead of its meter ? Quibi father Jeffrey Katzenbergultimately blame the COVID-19 pandemicfor thefailureof his short - form video app , but maybe it was just too before long . New app store data point designate that the idea Quibi popularized — original shows reduce into curt clips , offer up immediate entertainment — is now making a comeback . In the first quarter of 2024 , 66 curt dramatic event apps like ReelShort and DramaBox pulled in disc revenue of $ 146 million in global consumer disbursal .

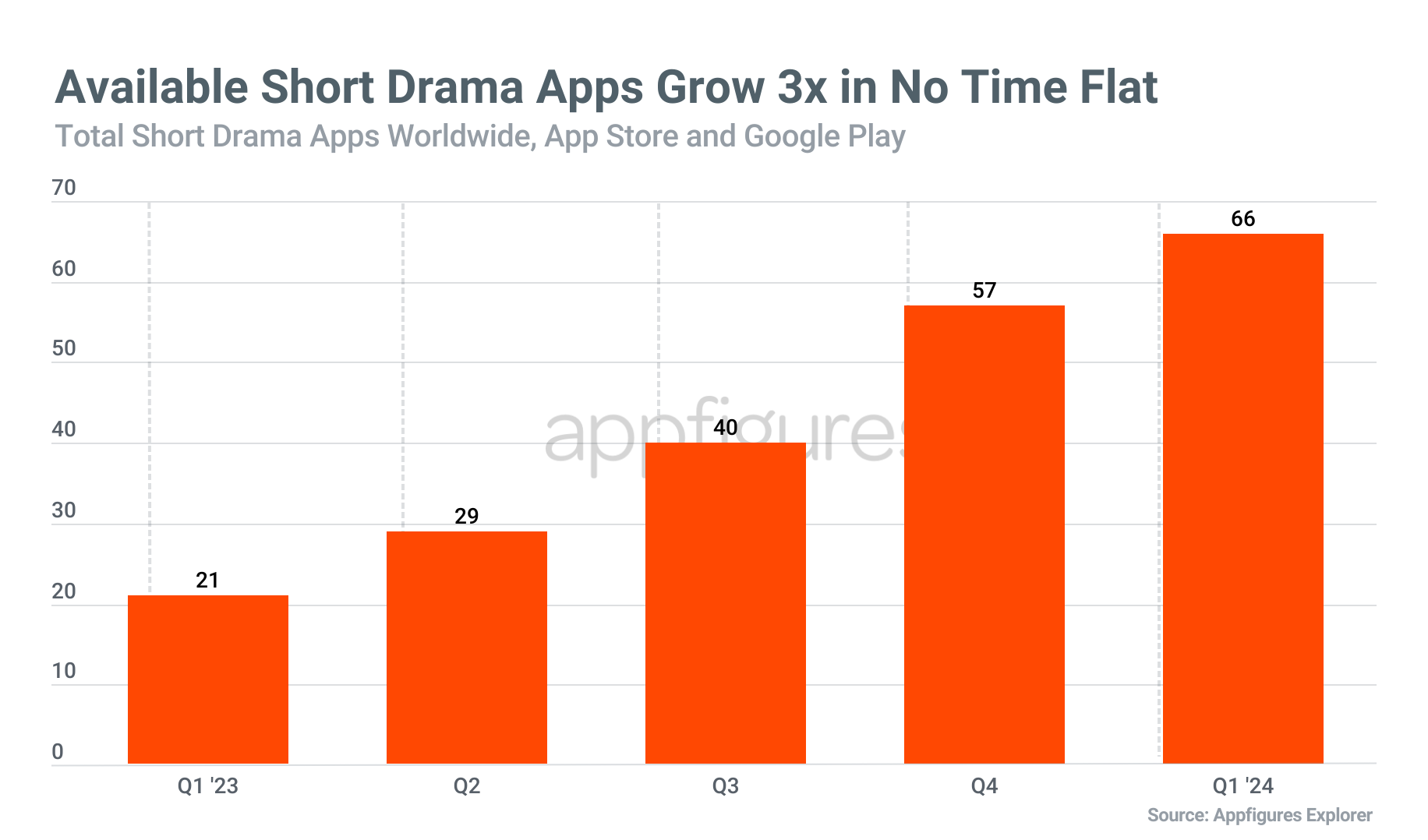

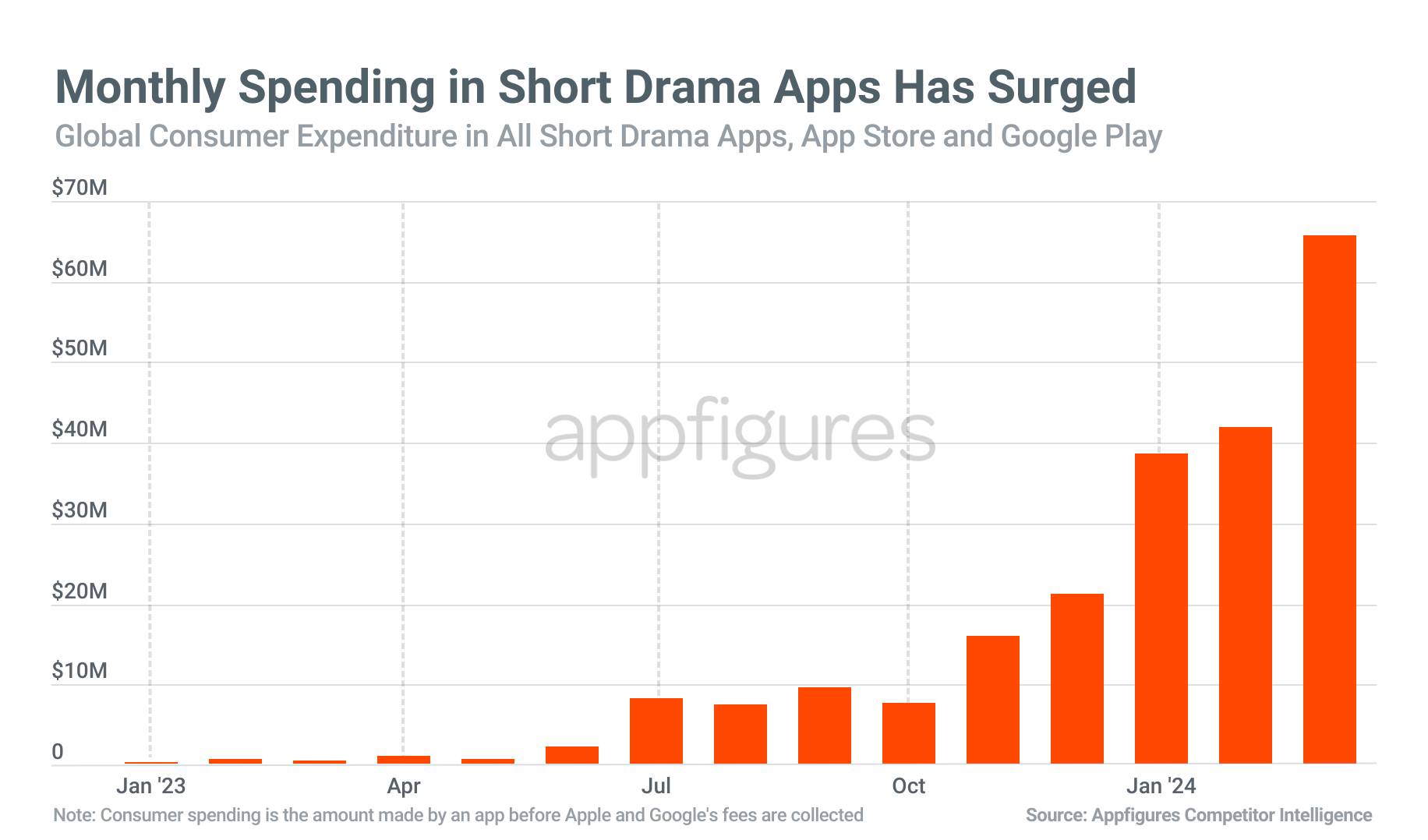

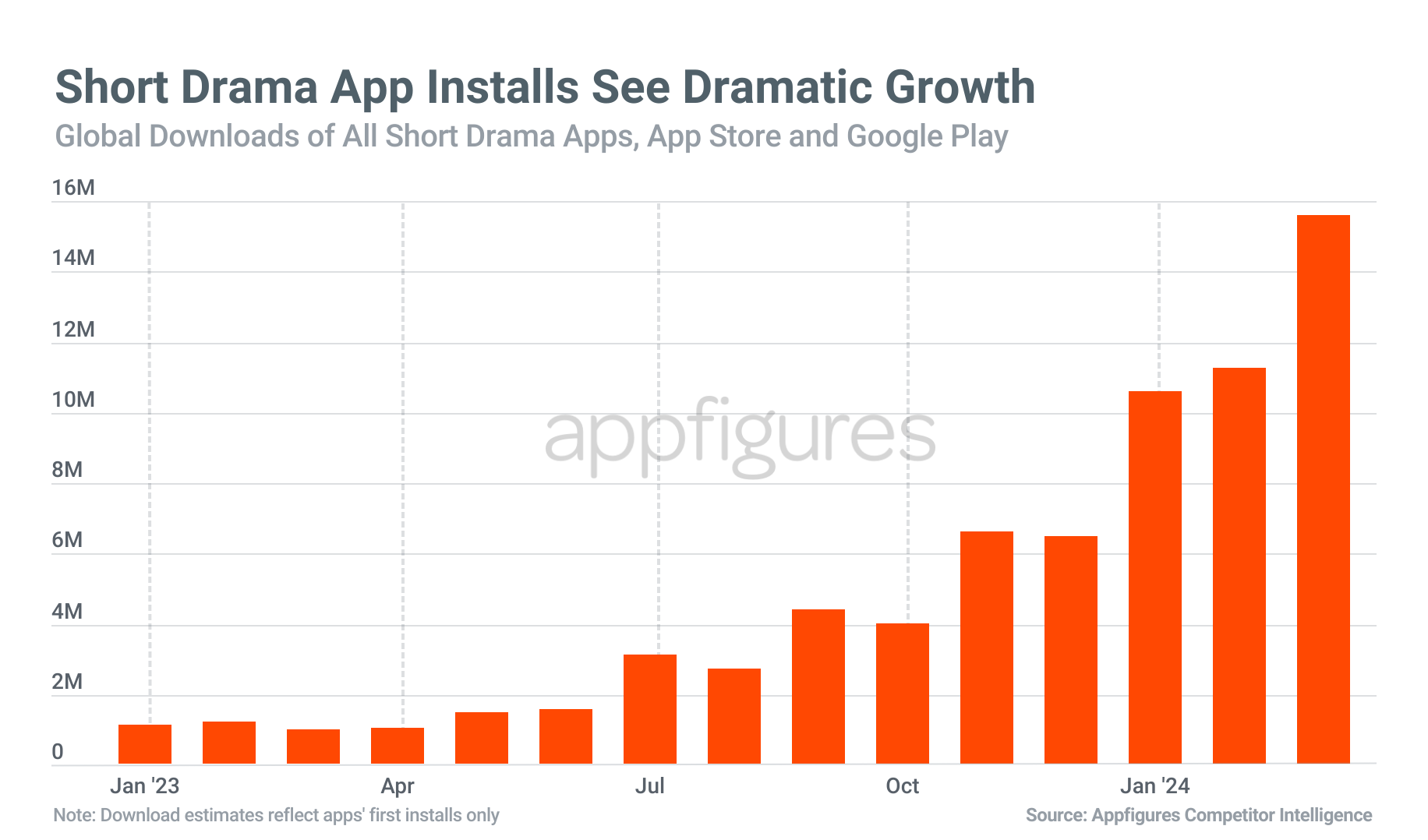

This represents an over 8,000 % increase from $ 1.8 million in the first quarter of 2023 , when just 21 apps were available , harmonize to data from app intelligence firmAppfigures . Since then , 45 more apps have link up the market , earning approximately $ 245 million in gross consumer spending and reach some 121 million downloads .

In March 2024 alone , consumers spent $ 65 million on brusque drama apps , a 10,500 % increase from the $ 619,000 spent in March 2023 .

It appear the gross growth began to speed in dusk 2023 , perAppfiguresdata , top to a vast tax income jumping between February and March of this twelvemonth , when world revenue grow 56 % to reach $ 65.7 million , up from $ 42 million . In part , the gross outgrowth is tied to the larger number of apps available , of course , but marketing , ad spend and consumer interest also played a role .

The top apps by taxation — ReelShort ( No . 1 ) and DramaBox ( No . 2 ) — bring forth $ 52 million and $ 35 million in Q1 2024 , respectively . That ’s around 37 % and 24 % of the revenue generated by the top 10 apps , respectively .

The No . 3 app ShortTV grossed $ 17 million globally in Q1 , or 12 % of the total .

What ’s interesting about these apps , compared with Quibi ’s former attempt to carve out a niche in this space , is the contented caliber . That is , it ’s much , muchworse than Quibi ’s — and Quibi’swas not always groovy . AsTechCrunch wrote last yearwhen describing ReelShort , the write up in the app are “ like snippet from depleted - quality soaps — or as if those wandering storytelling games come to sprightliness . ”

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Regardless of the terrible acting and writing , the apps have seemingly witness a piece of an hearing .

By both installs and revenue , the U.S. is by far the leader in terms of top market for this cohort . But overall , the charts change in terms of which commonwealth are download versus compensate for the message .

By installs , the top market after the U.S. are Indonesia , India , the Philippines and Brazil , while the U.K. , Australia , Canada and the Philippines make up the top markets by revenue , beyond the U.S.

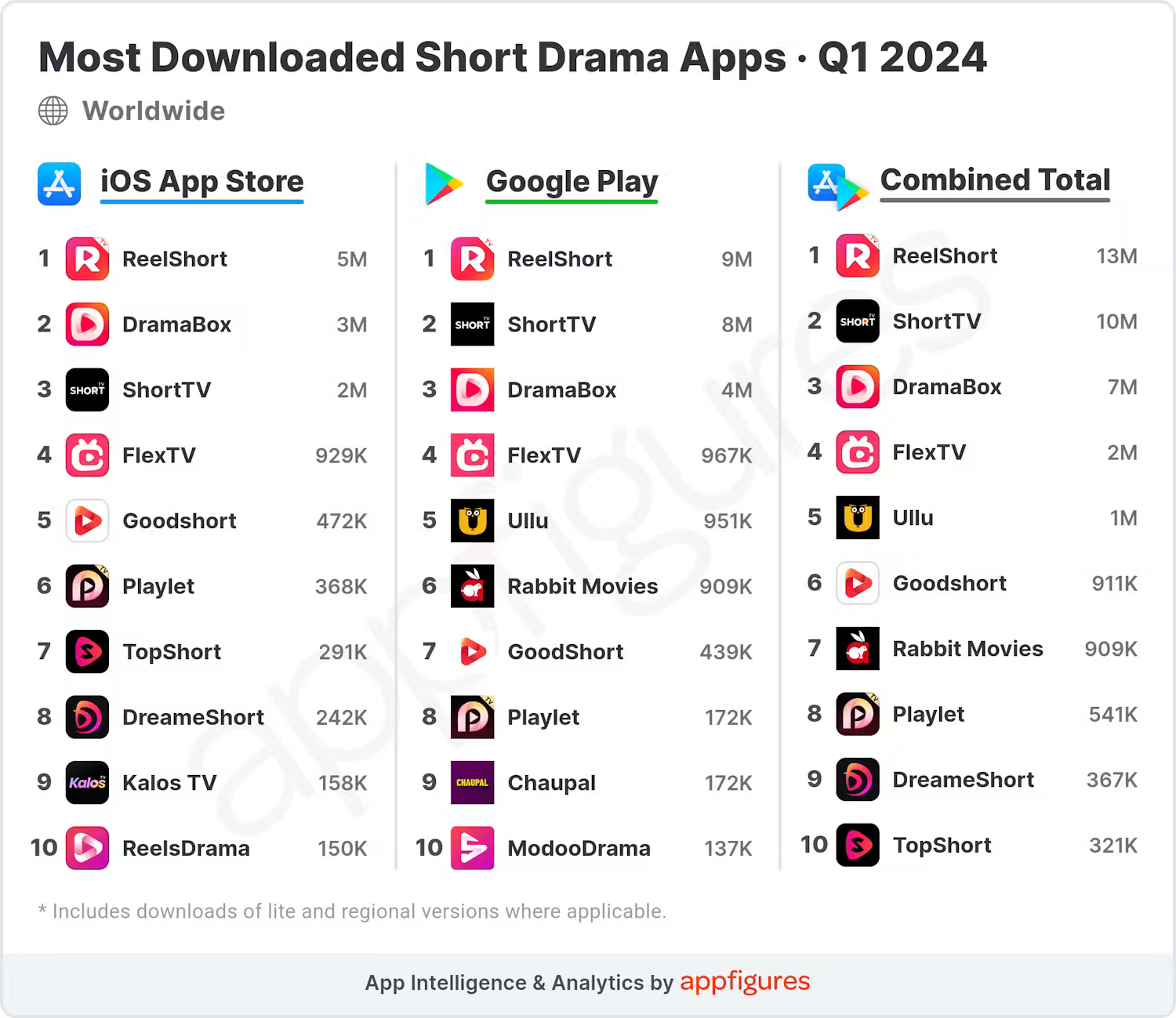

In Q1 2024 , short play apps were installed nearly 37 million time , up 992 % from 3.4 million in Q1 2023 . By downloads , ReelShort and ShortTV are the top two apps , with the former accounting for 37 % of installs , or 13.3 million , and the latter with 10 million installs , or 27 % . DramaBox , No . 2 by consumer spending , was No . 3 by installs with 7 million ( 19 % ) downloads .

Mirroring wider app store trends , the majority of the taxation ( 63 % ) is generated on iOS , while Android report for the bulk ( 67 % ) of downloads .

Though there ’s growth in this securities industry , these apps see nowhere near the attraction that their nearest competitors — brusque - form telecasting and streaming video recording — do . Short drama apps take a 6.7 % share of the total across all three categories combine , up from 0.15 % a year ago . But the wider video app marketplace makes a deal more money .

For example , the top 10 apps across the combine three family , which admit apps like TikTok and Disney+ , made $ 1.8 billion in Q1 .