Topics

Latest

AI

Amazon

Image Credits:shapecharge / Getty Images

Apps

Biotech & Health

clime

Image Credits:shapecharge / Getty Images

Cloud Computing

mercantilism

Crypto

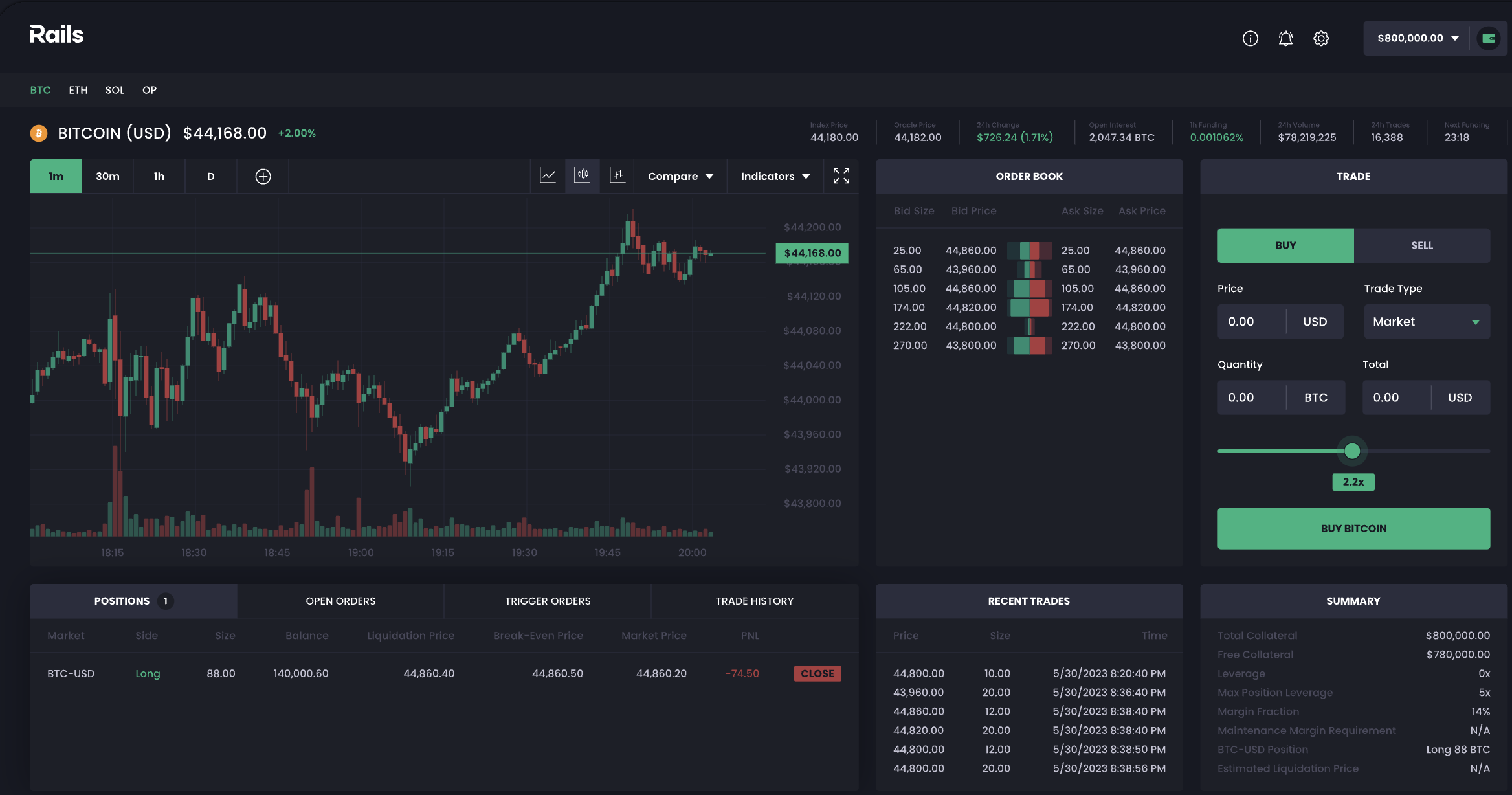

Image Credits:Rails(opens in a new window)

initiative

EVs

Fintech

fund-raise

gadget

Gaming

Government & Policy

ironware

Layoffs

Media & Entertainment

Meta

Microsoft

privateness

Robotics

Security

Social

Space

startup

TikTok

Transportation

speculation

More from TechCrunch

consequence

Startup Battlefield

StrictlyVC

Podcasts

TV

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Rails , a decentralised crypto exchange , has raised $ 6.2 million in attempts to fill the null FTX leave behind after crashing in 2022 , the startup ’s co - founder and CEO Satraj Bambra exclusively say TechCrunch . It is presently in the other stages of launching an seaward service of process in select crypto - favorable countries , which does not include the U.S.

The crypto community is watching Rails because it ’s attempting to straddle the watershed in crypto exchanges by building out both centralized and decentralised underlying technology .

The round was led by Slow Ventures with investment also from CMCC Global , Round13 Capital and Quantstamp . The capital is earmarked for technology team hiring and expanding its licensing and regulative scheme to make the exchange “ fully compliant , ” Bambra said .

While FTX had a plethora of problem , peculiarly misusing customer alluviation , Rails highlight its client sediment safety as well as the crypto derivatives , orperpetual futuresside of trading ; something that institution have been neglect since Sam Bankman - Fried ’s interchange went defunct .

“ There ’s a big interruption , especially on the constant [ future ] side with how institutions like to have photograph , ” Bambra said . He co - constitute the company with his wife Megha Bambra and the former COO of Grindr , Rick Marini . The married man and wife team previously co - founded a startup , crypto pocketbook BlockEQ , that sold to crypto trading program Coinsquarefor about $ 12 million CAD , or $ 8.8 million , in 2018 .

Bambra shared that he ’s heard from boundary funds saying they desire to trade crypto , but do n’t have a path to do so ; Rails hopes to be that porta . Its chief clientele will be market maker on the supply side and in the first place institutional clients and gamy - net - deserving investor on the demand side .

For context , ceaseless futures contract trade proportional to the spot cost . So , for deterrent example , citizenry are n’t bribe the genuine bitcoin itself but are buying contract bridge that mirror the Mary Leontyne Price through another asset like stablecoin USDC . “ It helps you play the direction of the market in a much more risk - deal way of life and that ’s why we ’re focused on that , ” Bambra articulate .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

And typically investors and user alike trust banks , fiscal institutions and exchanges to carry their funds , but Rails is going the self - detainment route , which mean the owner of the assets has total control over them .

Rails has already onboarded north of $ 10 million in capital too soon in a “ individual mode , ” before it opens to the public in September or Q4 of this year , Bambra said . In May , it will spread its rally to select beta testing recipients to start trading and check it ’s working by rights .

The inauguration ’s commutation is n’t available in the U.S. and Bambra said it ’s “ still zoning through where it ’ll be , ” and will have an solvent nearer to September . “ Onboarding capital will be from friendly jurisdictions . ” When require which ones , he said there were “ none he can share at this time . ”

“ We just require citizenry to use their money and that ’s why we have decentralize custody , ” Bambra say . “ It ’s a marriage ceremony between central computation and decentralized custody . ”

Central computing aid ascertain risk of exposure management , so trade orders can have a reliable and well - managed environment , make executing prompt and tight , he supply . But decentralized custody permit people to be the owners of their funds , not the substitution .

“ It ’s all focused on drug user experience . Using Rails , you ’ll sign in and bless up , but we ’ll educate people on give birth funds on [ crypto ] wallets and how to withdraw , ” among other objectives .

To mend FTX ’s trouble , there needs to be an on - Ernst Boris Chain resolution , Bambra thinks . That centralised computing was something Rails saw with FTX as “ being really , really good , ” but when it come to decentralized telephone exchange like dYdX that subsist today it was n’t as solid , Bambra thinks .

But being a hybrid of decentralised and centralized is better than being to the full one side or another , he added . “ For people who have n’t traded crypto before that want to , it ’s difficult and cumbersome . For people who trade it day in and day out , they are n’t comfortable putting the size they used to put on decentralised exchanges . ”

And users will sense a “ concentrate ” experience , without realizing that “ everything except your money is decentralized , ” Bambra said . All the death penalty will be centralized , but money is stay fresh in smart contracts , a self - executing activity on the blockchain that ask no go-between , that will be audited .

So the squad direct to bridge the gap between fundamental computing and decentralised custodying of assets , through cryptography and blockchain technology , to allow for machinelike visuals into what ’s really being executed on the telephone exchange and with fund .

After the anticipated public launching after this twelvemonth , rail desire to centre on expanding its social mapping , leaderboard capabilities and make partnerships with industry players to expand the merchandise . “ We ’re very merchandise concentre , ” Bambra said . “ We ’re not an opportunistic startup . ”