Topics

in vogue

AI

Amazon

Image Credits:Bryce Durbin/TechCrunch

Apps

Biotech & Health

mood

Image Credits:Bryce Durbin/TechCrunch

Cloud Computing

mercantilism

Crypto

Image Credits:Braid

endeavor

EVs

Fintech

Image Credits:TechCrunch (screenshot)

fundraise

Gadgets

Gaming

Image Credits:Convoy

Government & Policy

Hardware

Image Credits:Daylight

Layoffs

Media & Entertainment

Image Credits:Fuzzy

Meta

Microsoft

Privacy

IronNet founder Keith Alexander at TechCrunch Disrupt in 2017.Image Credits:Noam Galai / Getty Images

Robotics

security measure

Social

Image Credits:Mandolin(opens in a new window)

Space

startup

TikTok

Image Credits:Veev

conveyance

Venture

More from TechCrunch

consequence

Startup Battlefield

StrictlyVC

ZestMoney founders resign as Goldman Sachs-backed fintech struggles to raise funds.Image Credits:ZestMoney

Podcasts

Videos

Partner Content

Image Credits:Zume

TechCrunch Brand Studio

Crunchboard

Contact Us

Not every startup crash is an FTX or Theranos . They do n’t all cut so brightly and burst so spectacularly . More often than not , there wo n’t be some high - profile royal court case and prison time . Amanda Seyfried is n’t going to dally you in the made for Hulu movie .

The story of most startup unsuccessful person is far less exciting . The timing is n’t right-hand , financing dry up , runways carry out . Of late , a lot of macroeconomic ingredient have come into play , as well . These past few years have been peculiarly brutal for startup land . accord to a recentPitchBook survey,“approximately 3,200 secret venture - backed U.S. companies have gone out of business this year . ”

blend , those companies raised northward of $ 27 billion . Even more starkly , it ’s a figure that does n’t admit companies that break down after going public or were capable to find a buyer . That , after all , would really be stretch out the definition of a “ inauguration . ”

It ’s deserving note , too , that “ failure ” is subjective . Does bankruptcy qualify ? It ’s surely not a good signal with respect to your fellowship ’s wellness , but plenty of companies have managed to ricochet back to some degree . This particular question has been lawsuit for sight of treatment around the onetime TechCrunch virtual watercooler .

For the rice beer of a patch title “ The Startups We Lost , ” I ’ve opted to limit the list to those inauguration that — to the best of our knowledge — have hit the point of no return . Pushing up daisies . Pining for the fjord .

As the final day hang off the calendar , let ’s take a moment to think of some of the startup that did n’t make it .

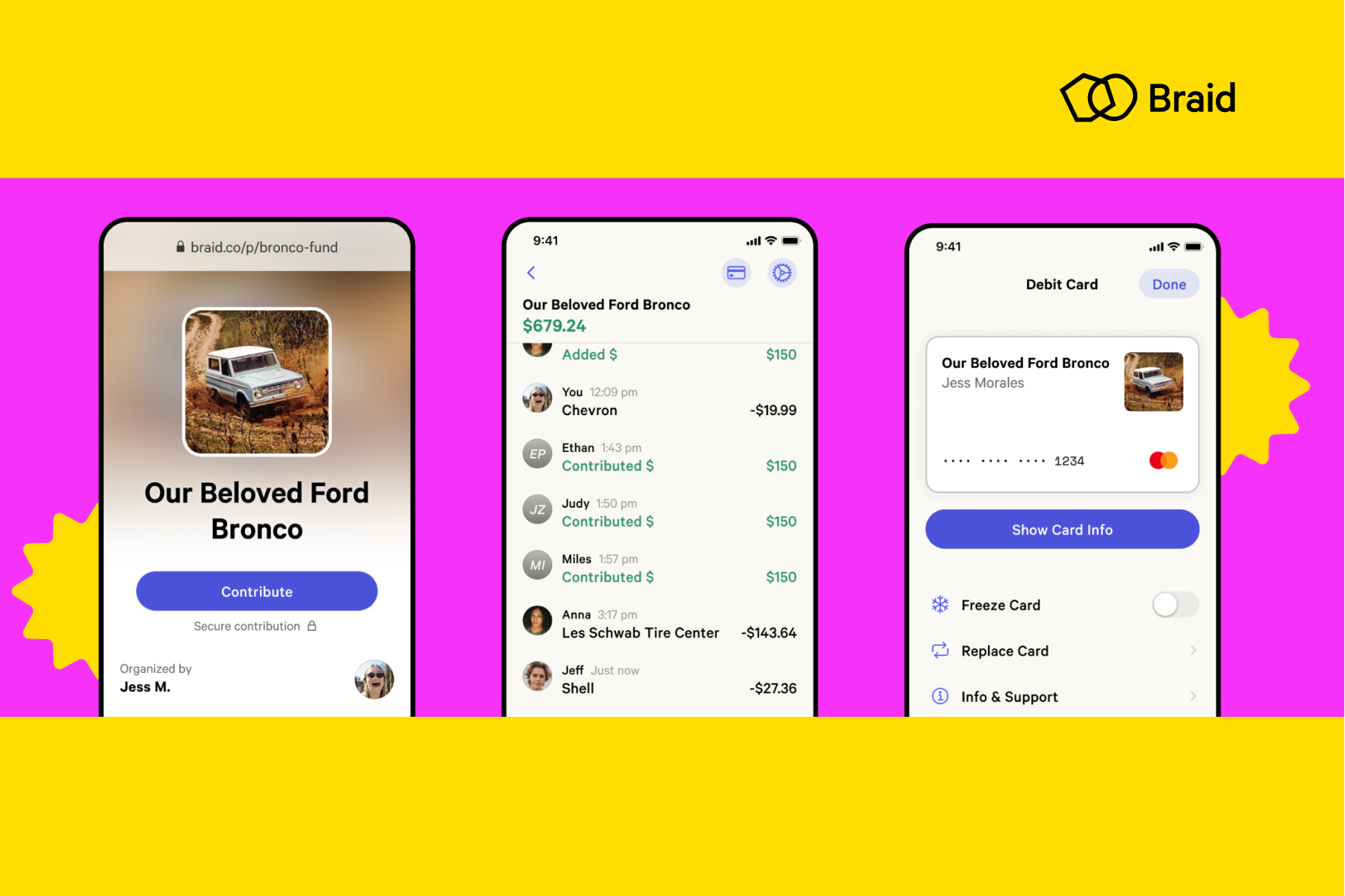

Braid

Founded 2019$10 million raised

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

In October , Braid , a four - year - old startup that aimed to make portion out wallet more mainstream among consumer , announced it hadshut down . Founded in January 2019 by Amanda Peyton and Todd Berman ( who leave in 2020 ) , San Francisco - base Braid set out to offer friends and kinsfolk an FDIC - underwrite , multiuser account that was designed to make it well-fixed “ to pool , manage and expend money together . ” Braid raised a sum of $ 10 million in funding “ over multiple rounds ” from Index Ventures , Accel and others .

What was refreshing about this closure was Peyton ’s candor about what conduce to Braid ’s demise . Ina blog post , Peyton said that Braid had close its doors in September , and delineate her experiences — and error — in build the company , ultimately gain that it was n’t going to be a practicable business speculation . An estimated 91 % of startup flunk . If more founders share their experience like Peyton did so others could learn from them , maybe that number would go down .

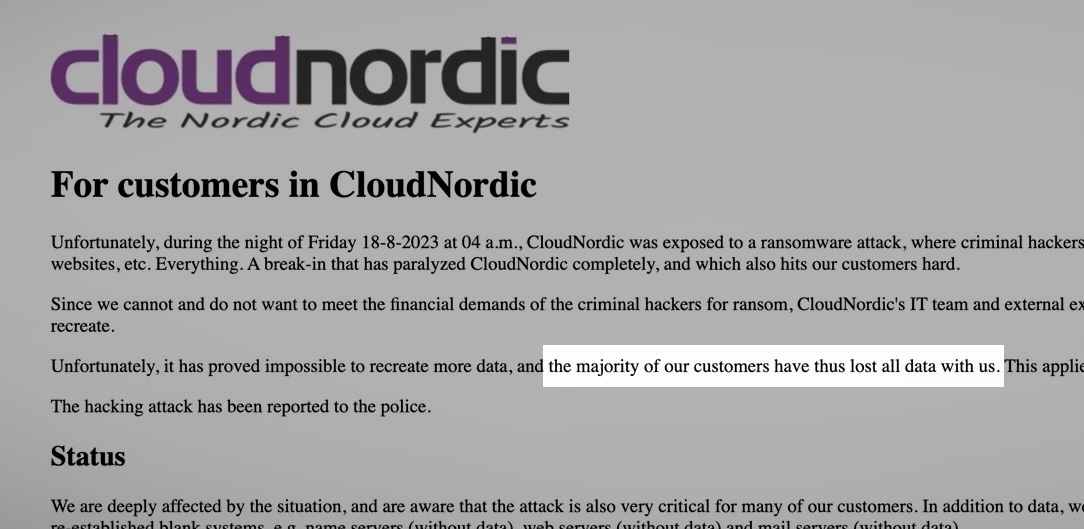

CloudNordic

establish 2007

CloudNordic might not be a household name , but a destructive ransomware onset on its systems propelled the company into the limelight — and its ultimate demise . The Danish cloud innkeeper provider shut down this yr after close to two decades of operationfollowing a ransomware attack that wiped out the company ’s systems and destruct all of its customers ’ datum . The company said it did n’t have the money to yield the hackers , andwouldn’t even if it did . With no option left , the company closed its door .

Convoy

Founded 2015More than $ 1 billion raised

The digital freight brokerabruptly closedin October 2023 , just eight months after the Seattle - ground companyraised $ 260 millionin fresh funding that pushed its rating to $ 3.8 billion . Convoy , founded by former Amazon and Google exec CEO Dan Lewis and CTO Grant Goodale , will survive on — sort of .

Supply chain logistics platformFlexport acquired the assetsof the shuttered digital freight internet with plan to restore Convoy ’s trucking logistics services for customers . Flexport did n’t learn the business or any of its liability , but its CEO say it did design to retain “ a small radical of team members from their core product and technology team . ”

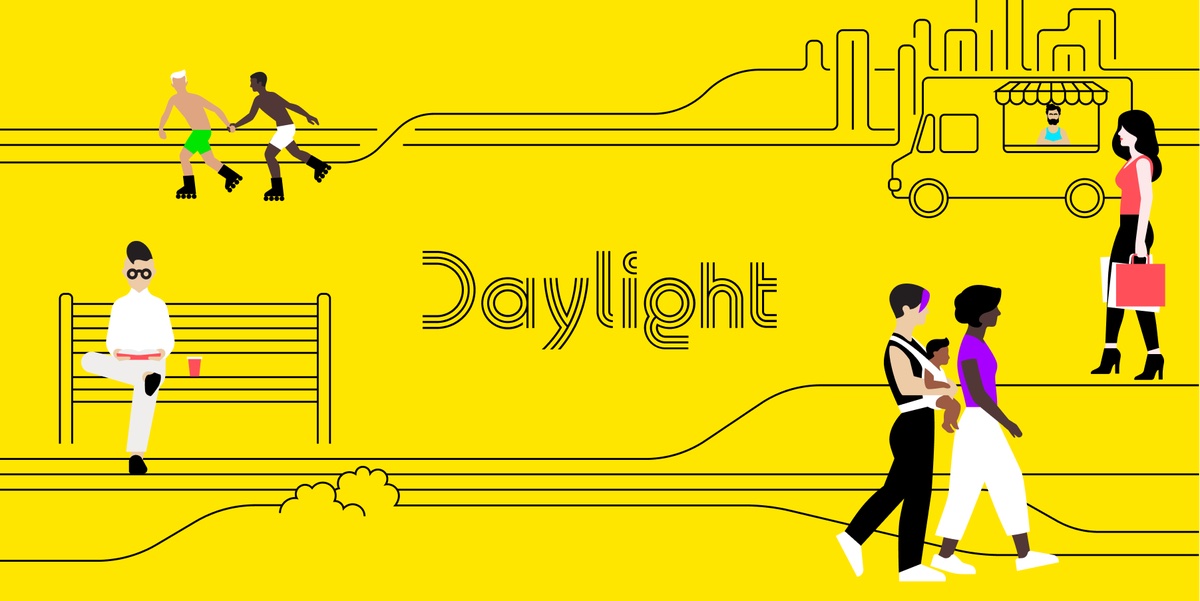

Daylight

Founded 2020$20 million raised

In May 2023,Daylight , an LGBTQ+ banking chopine that had raised $ 20 million in funding , announced it would beshutting downand discontinue operations on June 30 . The promulgation come months after NY Magazine print an volatile feature on the neobank . Thearticlehoned in on Daylight , whose seminal fluid and Series A fundraises TechCrunch had coveredhereandhere , respectively . NY Mag ’s piece detailed a lawsuit brought on by three former employee as well as alleged fabrication and inappropriate behavior on the part of conscientious objector - laminitis and CEO Rob Curtis .

In ablogpublished in May , Curtis said he felt like “ now is the right time to drop dead this market . ” We heard in October that the courtship had been dismissed by a federal court and that Daylight was acquired , but Curtis declined to notice further when we arrive at out . It was a disappointing outcome but one that highlighted the challenge of neobanks that target specific demographic . At the attack of the COVID-19 pandemic , we saw a flurry of such startups raising money , but since then , thing have been relatively quiet . Part of the challenge is allow for differentiated services that are actually unique to a certain residential area . Since Daylight ’s closing , Curtis has move on to a tequila - pertain speculation .

Fuzzy

Founded 2016$80 million raised

Some inauguration die long , draw out deaths . Not Fuzzy . The best-loved care telehealth startup was here one day and gone the next . In February , the firm wasreportedlyhyping its growth on internal Zoom outcry . Within calendar month , the company had closed up shop . Fuzzy ’s site was take down without any warning issued to customer .

From the strait of thing , even some top execs wereleft wonderingprecisely what had happen to the inauguration . That certainly has n’t stop the contest from attempting tocapitalizeon Fuzzy ’s death .

IRL

Founded 2016$200 million raised

IRL ’s meltdown was a raging mess . In 2022 , the event organizing social app laid off one - quarter of its 100 or so employees . Co - father and CEO Abraham Shafi put the rap on an extremely volatile marketplace , while stating that the company ’s cash runway would last at least until 2024 . Then it shut downthis June .

No social web is altogether devoid of bot , but an interior investigation by its board of directors found that such account plant around 95 % of its 20 million active monthly user . In a lawsuit filedlast month , IRL ’s carbon monoxide gas - founders accused their investors of falsifying that figure in guild to countermine the firm , which was previously valued at $ 1.17 billion .

IronNet

Founded 2014$400 million raise

IronNet , constitute by former NSA director Keith Alexander , was a once - promising cybersecurity startup , which at its peak raised more than $ 400 million in funding . But in the end , IronNet was no match for food market force play ( and poor leadership ) . Aftera bumpy ride fit world and rounds of layoffs , Alexander leave as CEO in July and was replaced with the president of the companionship ’s largest investor . IronNet scrambled to stay afloat , but lasted only a few weeks longerbefore it laid off everyone else and filed for bankruptcy .

Mandolin

Founded 2020$17 million upraise

wad of inauguration struggled through the pandemic . Others thrived . establish in June 2020 , the concert livestreaming platform was the right inauguration at the right time . After all , it had only been a few month since venues across the U.S. closed their doors indefinitely . Mandolin ’s subsequent rise was fleet , take on on big name consequence with artist ranging from Lil ’ Wayne to the Lumineers .

A yr after its institution , the Indianapolis - base firmraised a $ 12 million Series A , follow a $ 5 million seed polish the previous October . In 2022 , it seemed as though the platform was still fly high , even as venue across the country had re - open . Mandolin diversify into other aspect of the live music experience , including locus partnership and merchandizing .

This April , however , the inauguration announce on Instagram that it was closing up shop . “ After 3 unbelievable years , ” it remark , “ we are sad to denote that Mandolin will no longer be offering the digital lover experiences you ’ve come to have it off . ”

Veev

Founded 2008$597 million raised

Veev , a genuine estate developer turned technical school - enabled prefab homebuilder , as of November was on the verge ofshutteringafterreaching unicorn position last year , according to multiple report card . Calcalistreportedon November 26 that the company — which raised a staggering $ 600 million in total,$400 million of which was securedin March of 2022 — was fail to have to shut up store after an “ abrupt cancellation of a uppercase - raising initiative . ” Later that week , it was reported that Veev was “ undergoing settlement . ”

It was a routine of a shocking good turn of events considering just how much money the society had resurrect not even two year prior . The closure was not the first startup failure for Veev cobalt - laminitis Heller and Ami Avrahami . Another one of their proptech ventures , Reali , began a shutdown in August of 2022 afterraising more than $ 290 million in debt and equity financial support . Zeev Ventures was an investor in both companies .

ZestMoney

Founded 2015$121 million raise

In mid - May , Manish reported on the fact that founders of ZestMoneyhad resign from the startup . The Indian fintech , whose power to subvent low ticket loans to first - time internet customer , once drew the backing of many high - profile investors , including Goldman Sachs . By December , Manish had reported that ZestMoney wasshutting downfollowing unsuccessful elbow grease to find a emptor .

The Bengaluru - headquarter startup — which also identified PayU , Quona , Zip , Omidyar web and Ribbit Capital among its backer — employed about 150 people and had conjure up over $ 130 million in its eight - year journeying .

Zume

Founded 2015$445 million raised

“ Pizza was our prototype , ” carbon monoxide gas - founder and CEO Alex Garden toldme in 2018 . Three years after its founding , Zume made a major pivot . While it will forever be remembered as the pizza golem startup ( that ’s a hard indistinguishability to judder ) , the Southern Californian company roll a wider meshwork . First it was exploring non - pizza livery hand truck . Two years afterwards , it pivoted into sustainable food packaging .

Throughout its many lives , one certainly ca n’t pin Zume ’s ultimate demise on a nonstarter to adapt . Nor was it a lack of financial support , as the troupe raised nearly half - a - billion in its eight - twelvemonth history . That include a 2018 SoftBank daily round of $ 325 million that valued the company at N of two billon .

Zume liquidated its plus in former June .

The convicts of Silicon Valley , 2023 edition