Topics

Latest

AI

Amazon

Image Credits:RevenueCat

Apps

Biotech & Health

mood

Image Credits:RevenueCat

Cloud Computing

mercantilism

Crypto

Image Credits:RevenueCat

Enterprise

EVs

Fintech

Fundraising

gadget

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

Space

startup

TikTok

transit

Venture

More from TechCrunch

effect

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

touch Us

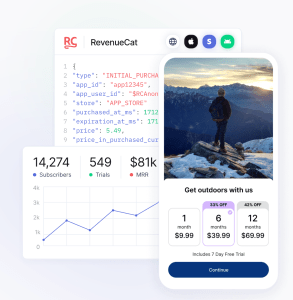

RevenueCat , a top subscription direction program for apps that monetize via in - app purchase , is now flush with Modern capital as it expands to the web . The party has fold on a $ 12 million Series C conduce by Adjacent , following the launching of a new Cartesian product , RevenueCat Billing , that give up vane app developers to integrate subscription purchase into any website . Later , it will also support Roku .

The timing of the product ’s launch is notable , as it arrives amid the carrying out of the EU ’s Digital Markets Act ( DMA ) regulation , which is forcing Apple to launch the iPhone and the App Store to young competition . As a result , Apple ab initio blocked iPhone connection apps(Progressive Web Apps , or PWAs ) in the EU , likely fear developer would abandon its App Store , beforereversing that decisionunder regulative pressure .

ForRevenueCat , however , the changes ahead for iOS — not to refer Apple ’s refusal to trim down its default 15%-30 % commission pace — mean there are now more developer look to the web to monetise their apps .

“ It could be for progressive World Wide Web apps or any kind of customer that want to take payment out of doors of the App Store , ” said RevenueCat CEO Jacob Eiting of the new vane charge product . “ It ’s pass away to flirt within all the new [ DMA ] rule … it ’s snuff it to be a pretty significant product expansion for us . ”

The caller says it propel in this guidance because of the inbound interest from developers . Even if they did n’t have a vane app , many developer wanted to lurch their client to the web to pay .

Apple reverses decision about lug vane apps on iPhones in the EU

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Though Stripe already enables this functionality , what developers were miss was a organization that ’s specifically designed for consumer subscription apps . Now , even if developers are work on defrayment through Stripe or others , they ’re make their data and insight in the same data formatting and within the same dashboard where they already manage their in - app purchase data . This makes it leisurely for them to focus on how their subscription apps are monetize overall , irrespective of where the payment do from , web or mobile .

Though Apple has historically not allowed app developers to steer customers to the World Wide Web from inside their iOS apps , it has let steering from other channels , like the developer ’s website or emails to client . The EU ’s DMA rulesshould also permit developer to steer customersto the vane from inside their mobile apps , too .

With RevenueCat Billing , basically a vane SDK , developer can accept subscription payments from any website . It joins other late intersection dismissal like Paywall , Targeting and Experiments , which are all design to help developer grow their revenue . RevenueCat powers subscriptions in over 30,000 apps and handles over $ 2 billion in subscriptions yearly , it says .

The new Series C from Adjacent ( contribute by Nico Wittenborn , a Series A investor , now board fellow member ) totals $ 12 million . Other investors admit Y Combinator , Index Ventures , Volo Ventures and SaaStr Fund . Ahead of this round , RevenueCat had raised $ 56 million , bring its full raise to more than $ 68 million .

In addition to fueling its new products , the fundraise will help RevenueCat expand to new securities industry , including Japan and South Korea .

“ Our main competitor is ‘ cobble together monetization engineering science yourself ’ , ” allege RevenueCat CTO and co - founder Miguel Carranza in a statement about the fundraise and enlargement . “ In the U.S. , we ’ve done a right task at educating developer , product people , vendor , and CEOs on the challenges of building in - house . In many other neighborhood , it ’s alas still the nonpayment for clientele to sink valuable resourcefulness into something that cater zero differentiation or value for that business ’s final stage users . We ’re indue in those regions by expanding our support for languages and local currencies later on this yr , deepening our relationships with local technology mate and agencies , as well as hiring in - market where potential . ”

RevenueCat is not yet a profitable ship’s company , but Eiting says that lucrativeness is always on the horizon . The company still has the money it raise in 2021 and now has over $ 40 million in the coin bank in add-on to around $ 20 million in ARR . It has also halved its burn rate since last summer .

“ There ’s so much stuff we can build by deploying capital and doing it on a profitable basis would just slack us down aright now . So while there ’s access to capital , which is n’t always the case … the best matter for our customers and investors is to take more capital and deploy it faster , ” Eiting told TechCrunch .

“ RevenueCat is too important to too many apps to lay on the line the companionship driving towards a fiscal cliff . This may be counter to the prevailing narrative of how speculation - indorse companies should be build , but our investors are aligned with us and know that Miguel and I are head the company to maximize the value for developers . investor make more money when developer make more money,”the CEO said in a web log post . “ To that end , we ’re still shoot for to take the company public in this decade . ”