Topics

Latest

AI

Amazon

Image Credits:Neon Money Club

Apps

Biotech & Health

Climate

Image Credits:Neon Money Club

Cloud Computing

Commerce

Crypto

Neon Money Club is a creative studio that focuses on fintech products.Image Credits:Neon Money Club

endeavor

EVs

Fintech

Fundraising

Gadgets

punt

Government & Policy

computer hardware

Layoffs

Media & Entertainment

Meta

Microsoft

concealment

Robotics

certificate

societal

Space

inauguration

TikTok

transportation system

speculation

More from TechCrunch

consequence

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

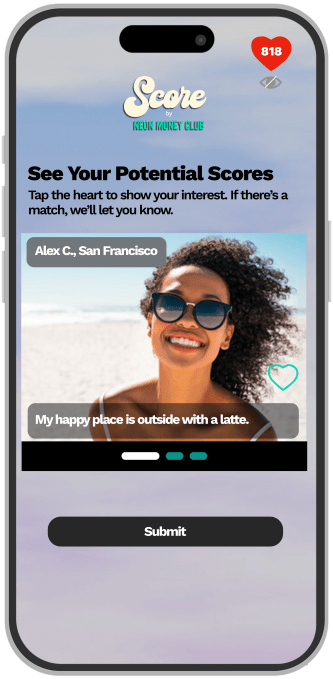

There is a new go steady app just in time for Valentine ’s Day , but there ’s a catch : You must have at least a 675 credit grade to use it . Launched today by fiscal program Neon Money Club , Score is a dating appfor people with salutary to excellent quotation , and it look for to serve raise awareness about the grandness of monetary resource in relationships .

“ We want to take the conversation to areas where finance is n’t traditionally discussed , ” Luke Bailey , co - founder and CEO of Neon Money Club , told TechCrunch , adding that traditional methods of provoke financial knowingness are outdated . “ Before you could educate people , you need to get their attention . With Score , we ’re bringing the conversation to date stamp . ”

talk about money is often uncomfortable , but the reality is that finance can be an authoritative part of relationships for a lot of people . grant to CNBC , most U.S. citizens think debt is a solid grounds for adivorce . Indeed , financial issuesare one of the conduct causesof divorcement in this country .

The estimation for the app was conceive atlast twelvemonth ’s AfroTech . Neon Money Club was already looking for a way to address recognition wellness , and it throw off a party that saw century of masses oversupply the streets of Downtown Austin . As people run along up , Bailey and his squad started to ponder what they could postulate these partygoer that would make them find prosperous talking about finances .

“ We decided to ask one question : ‘ What should the minimal course credit grievance be for someone you ’re date ? ” Bailey say . “ That doubt later became Score . ”

The app will only be uncommitted for a limited time ( around 90 day ) , and prospective users must apply to get access . On sign up , Neon Money Club will do a soft credit check on exploiter that will not impact their credit report card , and the sexual conquest will not be exhibit on the app , Bailey say . If O.K. , drug user will have access to financially like - minded citizenry on the app . multitude are also not matched based on credit tiers , so someone with a score of 700 can match with someone who has a score of 800 . From there , it ’s swipe left or right as common .

The exclusionary aspect of the app is no doubt going to fray some people the wrong way , especially when you consider that theaverage U.S. citizen’scredit sexual conquest is 716 , with Black and Hispanic peoplemore likely than other racial groupsto have a account below 640 . When asked about how masses could perceive the app as perpetrating the class watershed , Bailey said that having good credit is more aspirational than it is classist . He also pointed out that it ’s completely possible to have ahigh income with low credit rating . Those denied access to Score will be sent to resource to improve their fiscal literacy and tocredit constructor Grow Creditto facilitate them advance their credit scores , he said . “ Afterwards , those the great unwashed are sent back to us to specify for our products , ” Bailey said , add that it ’s an by choice positive cycle . “ There postulate to be more consciousness about the doors that can be opened with a good credit story . ”

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Neon Money Club set up in 2021 with the aim of tracking financial literacy , and last year became thefirst Black - own technical school businesstolaunch a acknowledgment cardwith AMEX . The circuit card allows people to commute credit placard points into cash that they can then clothe in the stock market .

The caller has nurture more than $ 10 million in venture capital , according to PitchBook .

“ We involve more creative and diverse vocalism in the world of finance , ” Bailey said . “ We are n’t the only people who think like this . The industry just needs to open up more doors for others like us . ”