Topics

Latest

AI

Amazon

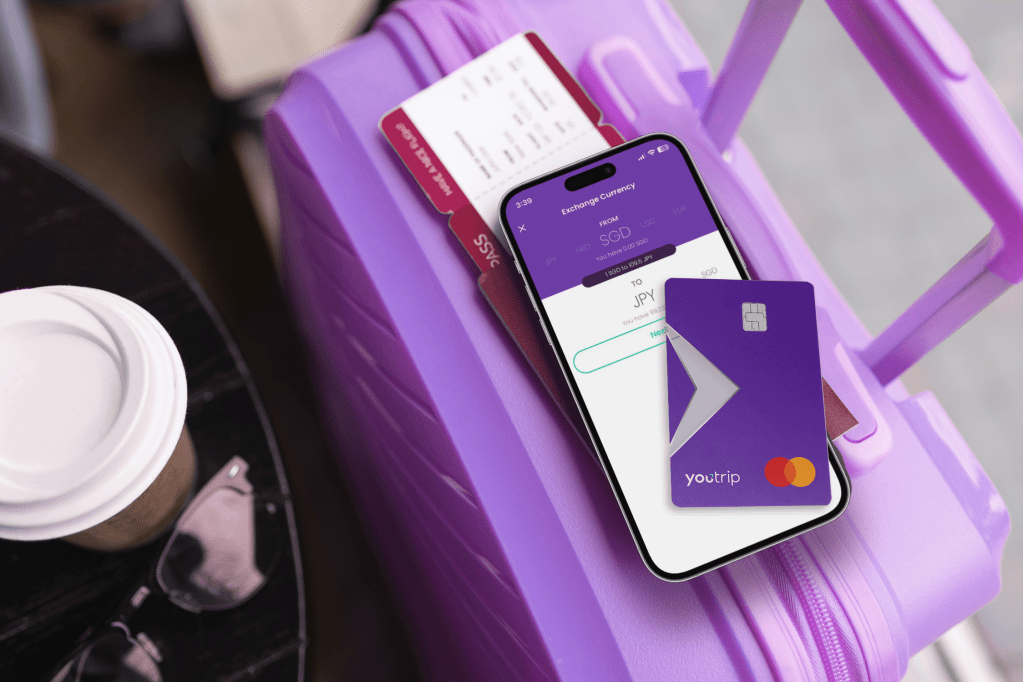

Image Credits:YouTrip

Apps

Biotech & Health

clime

Image Credits:YouTrip

Cloud Computing

Commerce

Crypto

Group photo of YouTrip’s Singaporean team.Image Credits:YouTrip

go-ahead

EVs

Fintech

Fundraising

Gadgets

game

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

place

Startups

TikTok

conveyance

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

touch Us

YouTrip , a Singapore - base fintech that provide multicurrency wallet for consumer and line accounts with bodied cards for SMEs , has its eyes on growing throughout Southeast Asia after landing a Series B led by Lightspeed . The round was $ 50 million , and brings YouTrip ’s total raised to $ 100 million since it found in 2018 .

Since its inception five years ago , YouTrip has sue close to $ 10 billion in annualized transaction volume and its e - commerce defrayal volume has grown 238 % in annualized transaction volume since its Series A in 2021 .

TechCrunchlast covered YouTripin November 2021 , when it raise a $ 30 million Series A lead by prominent kinsfolk offices in Asia who wanted to be unidentified but were returning investor . Founder and CEO Caecilia Chu say TechCrunch that YouTrip ’s support by family offices establish it an advantage , because those relationships tend to be very prospicient - terminus . This time YouTrip made the decision to work with a venture - back company .

At the clip of our last conversation with Chu two days ago , YouTrip was recuperate from the pandemic as change of location resumed in Southeast Asia , especially Singapore . It was also preparing for the launch of YouBiz , its incarnate card , as more SMBs borrow digital fiscal religious service . YouBiz allow them to charge payments , receive money and invoice consumers from around the world , in multiple currency .

The company say YouTrip ’s consumer multicurrency disbursement in Singapore and Thailand has grown considerably over the last two class , and its user base has tripled over that time . They ascribe this to post - pandemic change of location recovery and the continued maturation of e - Department of Commerce in the area .

Meanwhile , its B2B product YouBiz has onboarded more than 3,000 enterprise since its launching last May and contrive to double that routine by 2024 . Its primary target customers for YouBiz are businesses that have less than 100 employees . Many are in the technical school industry , include IT supplier and startups that run to be former adopters of raw digital products , but Chu say YouTrip has also seen traction from more traditional sectors like change of location representation and health care .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

The most common utilization case for YouBiz include business travel , and digital selling spend , because Google , Facebook and subscription tools are generally bill in USD , and the card gives SMEs FX savings . company also expend YouBiz ’s remittal services to pay supplier and remote workers . Chu say e - mercantilism is becoming increasingly of import for YouBiz because of its YouBiz fringe benefit programme , which works with partners to give customers cash - back good deal and is meant to further more frequent and larger minutes .

Tailwinds dedicate YouTrip a increase advantage include the remain digitisation of SMEs and consumer drug abuse , which was speed by the pandemic .

In terms of intersection ontogeny , YouTrip plans to increase its use of AI and other emerging engineering for personalized feature like smart budgeting and customized fiscal insight . For YouBiz , the company will uprise its portfolio of services for SMEs ’ cross - border increment architectural plan , including young lineament for its disbursement management capabilities and tot up credit lines .

In addition to accelerating its external market expansion , Chu is excited by new regularisation in Singapore that willraise e - pocketbook transaction caps by three or four times .

“ We find is it is a corking opportunity for us to build more for be customers , so we are go to add more FX related service in there ’s , include overseas transferral , oversea receive money and more when the wallet boundary increase , ” she says .

One of YouTrip ’s and YouBiz ’s discriminator from other multicurrency wallets and SME account / corporate batting order is their focussing on localization , she says . This establish YouTrip a large market share .

“ For every market , we tailor our mobile apps and also the lineup design even , for each of our marketplace . By being so localized and concenter , from the pick of partner and so forth , it really play out nicely for us , ” Chu says .

“ The localization strategy was one we think gives us an vantage , particularly on consumer digitalisation and consumer fintech developments , ” she added . “ What we are very excited about right now is the digitalisation of SMEs as well . I think there is the need and opportunity brought to us by the pandemic . Companies are really looking to automate themselves and they need to be able to have a outback workforce , and everything needs to be digitalized and automatize . ”

But she notes that 99 % of SMEs still apply traditional Sir Joseph Banks , instead of neobanks and other fintechs .

“ I think the opportunity there is even larger and the revolution has just take off , ” she says . “ We are very excited to get in there with the infrastructure that we have already built . We are one of the very few SME fintechs that own our own permission and a proprietary technical school stack . ”

In an investor statement , Lightspeed partner Pinn Lawjindakul say , “ My personal experience of the pain in the neck point reinforced my conviction in what the YouTrip deal has establish . Their multi - currency digital payments weapons platform enables everyone to have a safer , sassy and superior experience with foreign currency and digital payment . ”

need to invest in startup ? Here are 4 ways to get started as a solo general practitioner