Topics

Latest

AI

Amazon

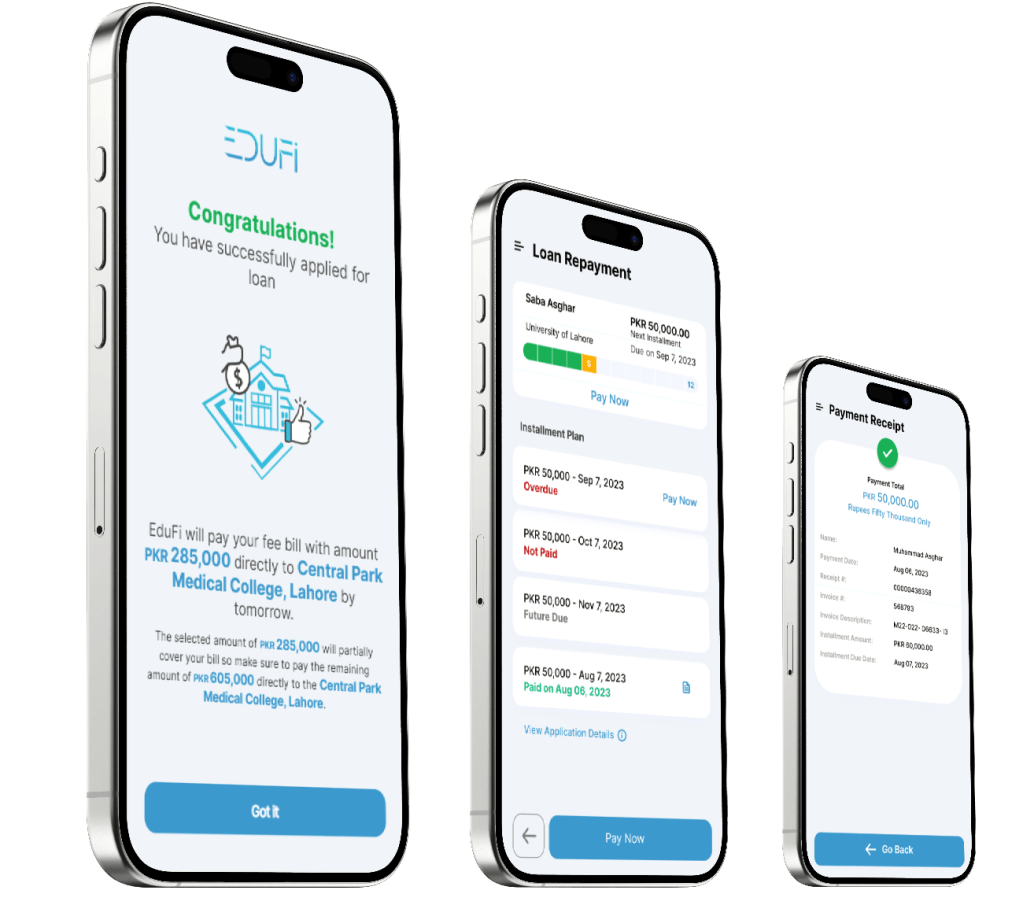

Image Credits:EduFi app repayment screens / EduFi

Apps

Biotech & Health

mood

Image Credits:EduFi app repayment screens / EduFi

Cloud Computing

Commerce

Crypto

initiative

EVs

Fintech

Fundraising

Gadgets

punt

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

certificate

societal

distance

Startups

TikTok

Transportation

speculation

More from TechCrunch

consequence

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

EduFi , a fintech inauguration that enable financially strapped students to secure loan for their education , has raise $ 6.1 million in a pre - seed round led by Zayn VC with participation from Palm Drive Capital , Deem Ventures , Q Business and angel investor .

The Singapore - based inauguration has launch an artificial intelligence - power study now , yield later ( SNPL ) lending platform and its nomadic app in Pakistan , a res publica that does not have student loan products as a category ; instead , users take personal loanword with high interest and protracted process , Aleena Nadeem , founder and chief operating officer ofEduFi , tell TechCrunch .

EduFi want to address the state ’s two issue — high impoverishment levels and broken literacy rates — via its fintech platform . In Pakistan , about 40 % of students advert secret schoolsdue to public schools ’ poor quality , resulting in spending more than $ 14 billion on their education every year . Moreover , over 50 % of the adult universe in Pakistandoes not have access to financial servicessuch as bank invoice and insurance .

Nadeem , an MIT graduate who previously work at Goldman Sachs and Ventura Capital , had reckon first - hand many children struggle with financial obstacles to get a lineament education while working atProgressive Education connection(PEN ) in Pakistan . PEN is a nonprofit organization that give detached and quality education to children who ca n’t afford it .

“ Many children in Pakistan make it to high schooling , but there is a sharp pearl in those who are able to reach a high college education , ” Nadeem allege . “ This drop is where EduFi is adjudicate to inject capital letter into the gap between high school day graduation and first - year university admission . ”

The two - yr - old company has already had partnerships with 15 university , allow the app to be useable to about 200,000 scholar who must pay up their fees for undergrad , Master ’s and Ph.D. across Pakistan .

When a student ( or a parent ) applies for loans via the app , EduFi requires the applicant ’s ( scholarly person or parent ) financial status . For object lesson , the previous 12 month ’ bank statement or a generator of income that can back their loan repayments , such as a salaried caper , a modest business , or freelance study . Once a scholarly person loan readiness is approved , EduFi sends the money directly to the college ’s bank building .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

During its genus Beta phase for the last 18 months , EduFi test its credit model against 80,000 consumer finance loans banks had made . The inauguration claimsthat its credit scoring system allows for the diffusion of pupil loan within 48 hour of coating and the agile disbursal of the loanword . EduFi , which has receive approval for a license to make loans from the Securities and Exchange Commission Pakistan ( SECP ) , is expect for the licence to be granted , which is require in November . Nadeem said it is presently validating its product and serve with likely customers and take in feedback and data to improve its servicing .

The company says it upend the traditional bank glide path , which imply gamey - interest rate and a complicated app process , as well as takes at least three to four weeks to approve . EduFi ’s digital lending app offers users a commodious , straightforward process and compromising loan terms and experimental condition .

“ Education offers hope and can change the biography of masses . I am one example of one thousand thousand out there . EduFi offers this hope and will be a trigger for variety in the life of people as we move up one of the braggart burdens on aspiring families,”Nadeem said . “For example , students in dental or medical schools have to pay upwards of $ 8,000 upfront , which is not sustainable for many in Pakistan . Every student we ’ve helped is a will to the ambitiousness , chance and authorization we are striving for at EduFi . ”

The companionship will use the pre - seed capital to progress to more client , optimize its program , expand to neighboring countries and launch other fintech products , including student recognition cards .

“ This is a significant step towards achieving fiscal inclusion for middle and low-toned - income families . In Pakistan , family spend more than 50 % of their income on their kid ’s education , which has become progressively gainsay due to inflationary pressures . EduFi ’s advanced approach will help alleviate this burden and empower families to endow in their children ’s future , ” Faisal Aftab , general married person and founder at Zayn VC , said in a statement .

Zenda get under one’s skin $ 9.4 M to streamline school day fee defrayal and management