Topics

previous

AI

Amazon

Image Credits:ONYXprj / Getty Images

Apps

Biotech & Health

clime

Image Credits:ONYXprj / Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:Synergy ResearchImage Credits:Synergy Research

Enterprise

EVs

Fintech

Fundraising

Gadgets

stake

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

seclusion

Robotics

protection

Social

place

inauguration

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

newssheet

Podcasts

video recording

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

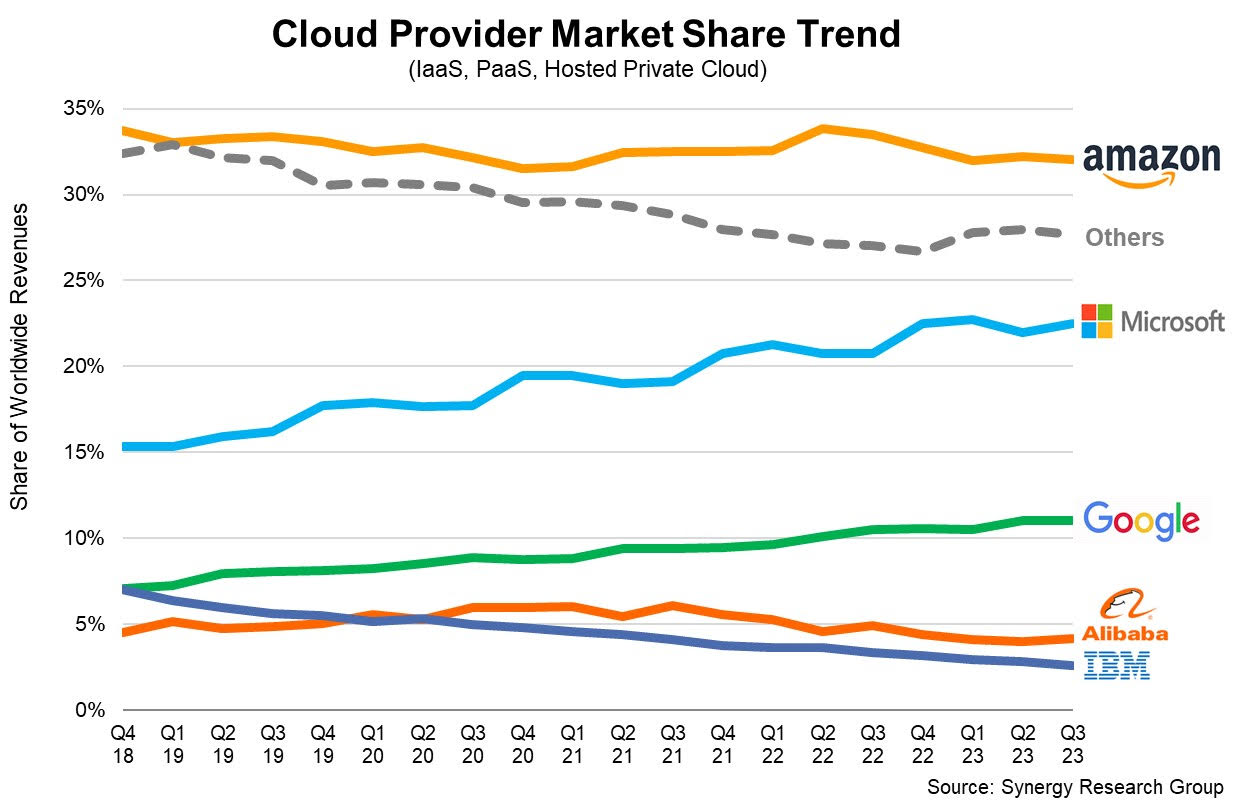

We ’ve talked about the first to market vantage before , and it surely applies when it comes to the cloud base food market . WhileMicrosoft made headlinesthis week for its AI implementation , and Alphabettook a big stock hitfor its fragile swarm escape , Amazon outgrowth has softly settled into down double - digits growth .

And it still is very much in control of the very bombastic cloud infrastructure market , precisely because it was first , and the others continue to play catch - up all these days later . To give you a common sense of just how cock-a-hoop Amazon ’s lead is , consider this data point from Synergy Research : “ The relative scale of their cloud operations now shows Microsoft being twice the size of Google , with Amazon being almost equal to the other two combined . ”

This fourth Synergy reports the cloud base market reached over $ 68 billion worldwide , up by $ 10.5 billion or 18 % over the prior class . It marked the 5th full-strength quarter where the cloud market grew by that dollar bill amount , and it ’s good for a run rate of around $ 257 billion , a thumping market place that is continuing to grow .

How did that work out in price of mart share number ? Well , Microsoft continues to grow its share in telling mode take in another point this preceding quarter to 23 % , while Amazon has fairly much view as steadfast for days at around 33 % and Google held unfluctuating at 11 % over the anterior poop . That work on out to just about $ 22.4 billion for Amazon , $ 15.6 billion for Microsoft and $ 7.4 billion for Google ( as you could see , Synergy ’s math oeuvre ) .

Bear in judgment , however , that these percentages are for an ever - develop gross pie , so hold steady still represents substantial growth in a marketplace that has been uprise by around $ 10 billion per quarter over the last five quarter .

In spite of that , cloud increment had begun to decelerate for the first sentence this year due to economical doubtfulness , cost cutting and less experimentation on the part of large initiative buyers . We ’ve get word it take its bell , particularly on Amazon , but this quarter AWS stabilized at around 12 % growth , the same as last quarter . While look at with changing grocery dynamic , Amazon is also dealing with the law of nature of large numbers where as it uprise , it becomes much hard to support earlier growth . It defied that legal philosophy for a long time , but it seems to have take hold of up with it .

As productive AI begins to take hold this year , it is already beginning to have an impact , and we could get to see an acceleration as the demand produce for cloud service to store , process and wield the magnanimous amounts of data require to function large language role model , not to note the complete compute big businessman LLM consume .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Microsoft seems to be the first to have benefited from that with its multibillion - dollar investments in OpenAI , but it ’s still early on , and Amazon and Google will also belike gain from that demand in the coming quarters as both also have been adding merchandise and Robert William Service to deal this marketplace modification at a rapid rate .

Microsoft cover bright blue growth of 29 % in the late quarter , while Google Cloud was up 22 % year over twelvemonth , but had a cloud earnings miss of $ 8.41 billion versus $ 8.64 billion the street was expecting . Investorspunished Alphabet stockfor the miss , in spite of good number across other sectionalization .

Per common it ’s important to note that Google Cloud revenue numbers admit its SaaS offering , and Synergy only count IaaS , PaaS and host secret swarm service of process , which account for the difference in Google ’s overall in public report number , and the number Synergy reported .

While startup might not manage about the horse race around swarm mart share , it ’s worth infer how other buyers and investors perceive the biggest players and how their orchestration affect a market that many startups will be using to build their companies .