Topics

Latest

AI

Amazon

Image Credits:Nigel Sussman(opens in a new window)

Apps

Biotech & Health

clime

Image Credits:Nigel Sussman(opens in a new window)

Cloud Computing

Commerce

Crypto

Data from PitchBook.Image Credits:Alex Wilhelm / TechCrunch

go-ahead

EVs

Fintech

fund raise

Gadgets

punt

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

seclusion

Robotics

Security

Social

Space

startup

TikTok

Transportation

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

picture

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

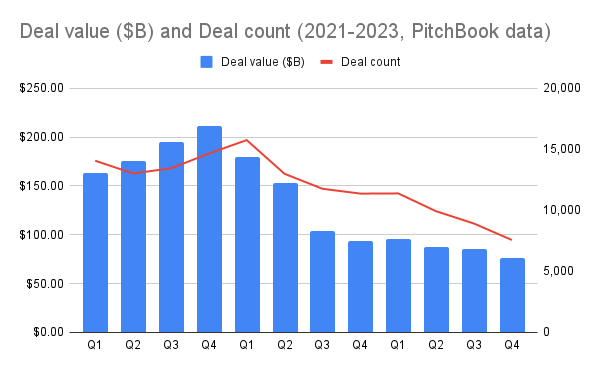

Even though intelligence of potential interest charge per unit cuts has led to optimism that the IPO window might reopen and things might improve in startup res publica , it appears the global venture capital market has yet to level out : Early data fromPitchBookindicates global VC investing in inauguration continued to slide in the fourth quarter of 2023 .

The Exchange explores inauguration , markets and money .

While thing aredown crisply in the United Statescompared to the foolhardy day of 2021 , investment trends seem to have mostly reached a new normal — U.S. inauguration raised $ 37.5 billion in Q4 2023 , which was n’t much less than the $ 37.6 billion they raised in Q2 2023 and the $ 39.8 billion in Q4 2022 .

In line , here ’s what ’s bump globally :

We are still going down , folks !

To be reliable , I had expected to rule a pretty boring number in Q4 , in orbit of recent investment trends , and not a nadir . However , full - yr totals lead me somewhat astray .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Startups across the worldly concern levy about $ 345.7 billion last yr , per PitchBook . That ’s not a huge departure from the $ 333.4 billion enkindle in 2019 or the $ 351.2 billion stir in 2018 . However , the Q4 2023 result of $ 76.6 billion is the lowest amount startup have upraise in a fourth quarter since 2017 . So , 2023 as a whole look better than it really was because we saw more money raised in the early quarters .

So , the spot has been worsen steady and if this continued weakness endure in the raw year , we could start to see global VC investment retreat to prior norms .

This is not an academic datapoint ; it bespeak that the pangs we ’ve been feeling in various startup markets is very real . This is what I am babble about :

It ’s somewhat tough out there .

That ’s a shame . One of the more interesting ( and supporting ) developments of the 2021 speculation gravy was that lots of cap was invested in historically underinvested areas . That trend has about go away , meaning that an entire grip of startups out there is plausibly observe that critical origin of capital letter have melt .

To be more cynical : The trend of every major geography seeing speculation working capital interest come out to have been — for now — aZIRP ( zero interest - charge per unit policy ) phenomenon . Alas .

What ’s worse , investors themselves are levy less capital now . According to PitchBook , speculation chapiter firms across the world raise only $ 160.9 billion in total last year , the last-place figure since2015,when VCs raised just $ 119.3 billion . For reference , VCs raised $ 174.9 billion in 2016 , and that routine get up to a peak of $ 379.7 billion in 2021 .

Just to unite the dots : Venture capitalist kindle less money last year , so there ’s probably less capital available for investment this twelvemonth . That intend there ’s no reason to anticipate venture investment to rebound in a material way .

Of course , things could turn around . There ’s a chance interest rates might be rationalize this yr , which could help wake things up from the current downturn . Without something significant changing the moral force , I ca n’t rule a solid argument for why 2024 global speculation activity should recover . sealed markets like Europe and the United States appear best positioned to have a estimable year , but for the ease of the man , prospects reckon dim .