Topics

late

AI

Amazon

Image Credits:Nigel Sussman(opens in a new window)

Apps

Biotech & Health

mood

Image Credits:Nigel Sussman(opens in a new window)

Cloud Computing

DoC

Crypto

Via Battery Ventures, shared with permission.Image Credits:Battery Ventures

endeavor

EVs

Fintech

Via Battery Ventures, shared with permission.Image Credits:Battery Ventures

Fundraising

appliance

game

Via Battery Ventures, shared with permission.Image Credits:Battery Ventures

Government & Policy

computer hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

distance

inauguration

TikTok

Transportation

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

AI technologies will facilitate make startups leaner and more price - effective , according to arecent written report from Battery Ventures . In turn , Battery anticipates that lower - burn startups will be worth more provided that their growth rate persist attractive .

The Exchange explores startups , markets and money .

It ’s an interesting dissertation . When we weigh AI from the startup perspective , we be given to think about what AI - powered computer software startups will themselves build . By flipping the question from what will AI software doforstartups , Battery can see a future in which inauguration are worth a greater multiple of their revenues . That could make more nascent technical school companies venture - backable , full - stop , and subsist startups more likely to be able to grow into prior evaluation marks .

At way out is the value of package gross . The repricing of tech shares in the comedown from 2021 ’s market excess is a well - trod account at this point , as is the perspective that startups should burn down less than they once did when money was cheaper and more plentiful .

But what ripe is a profitable inauguration if it conk out to acquire rapidly ? Little , it seems . So what venture investor would like more than anything — founders , too — is a universe in which each dollar bill of receipts that their startups generate is deserving more . That office would help speculation - math pencil out more neatly .

It ’s far easier to invest in startups that burn cash when the gross they are building is deserving , say , $ 9 in value , instead of $ 6 . Or $ 4 .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

The Battery argument break as follows :

permit ’s take each piece in order .

1.On the valuation insurance premium front for tech companies that meet the Rule of 40 , Battery writes that technical school care “ that show a Libra the Balance of maturation and profitability trade at a ~60 % exchange premium to those that do n’t . ” That ’s amassivedelta , and one that should help startup that are shoot for Rule of 40 experience sure-footed that they are focused on work that matters .

2.There are two lever in the Rule of 40 plot : How quick your inauguration grows and how much it burn off to get there . If you could ameliorate either metric , your score better . As startups are ontogenesis - focused by nature , their best bet is to not curtail taxation expansion but instead centre on cost cuts .

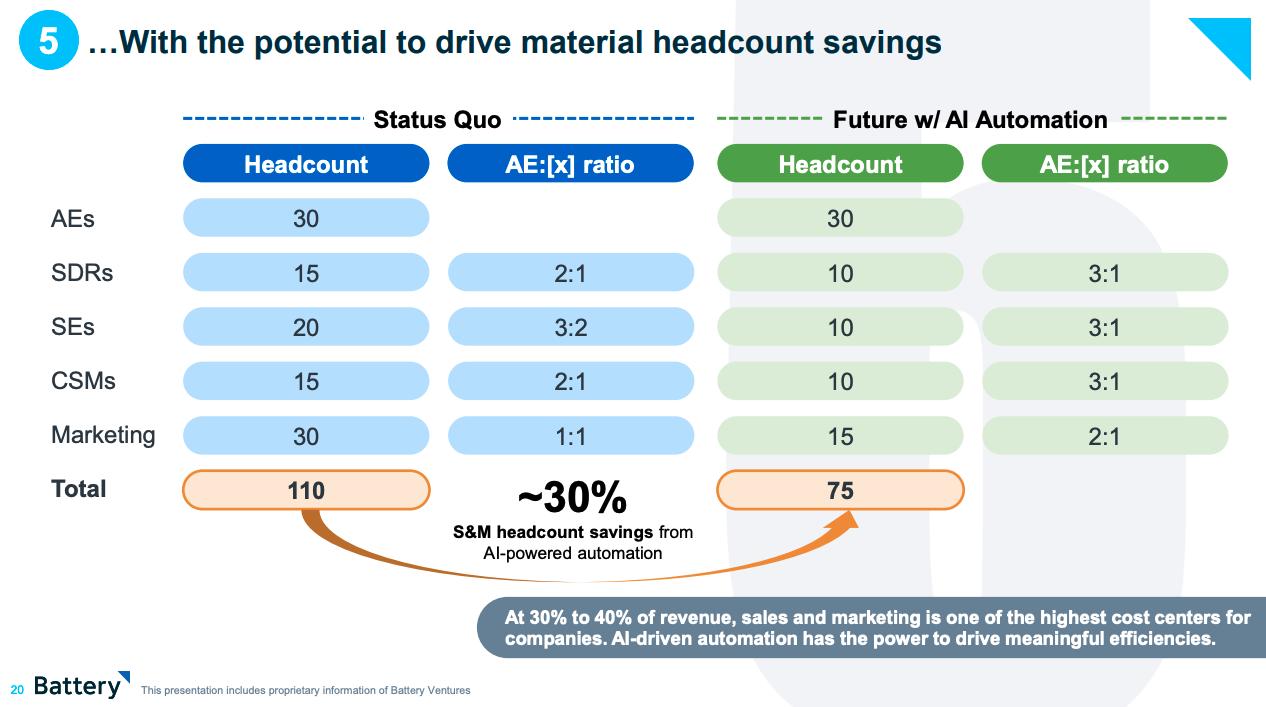

3.If startups are run to reduce spend in a manner that wo n’t occlude growth , they have to find efficiencies . In Battery ’s prospect , some of those spend cuts will come from AI - powered automation making sales and selling headcount leaner :

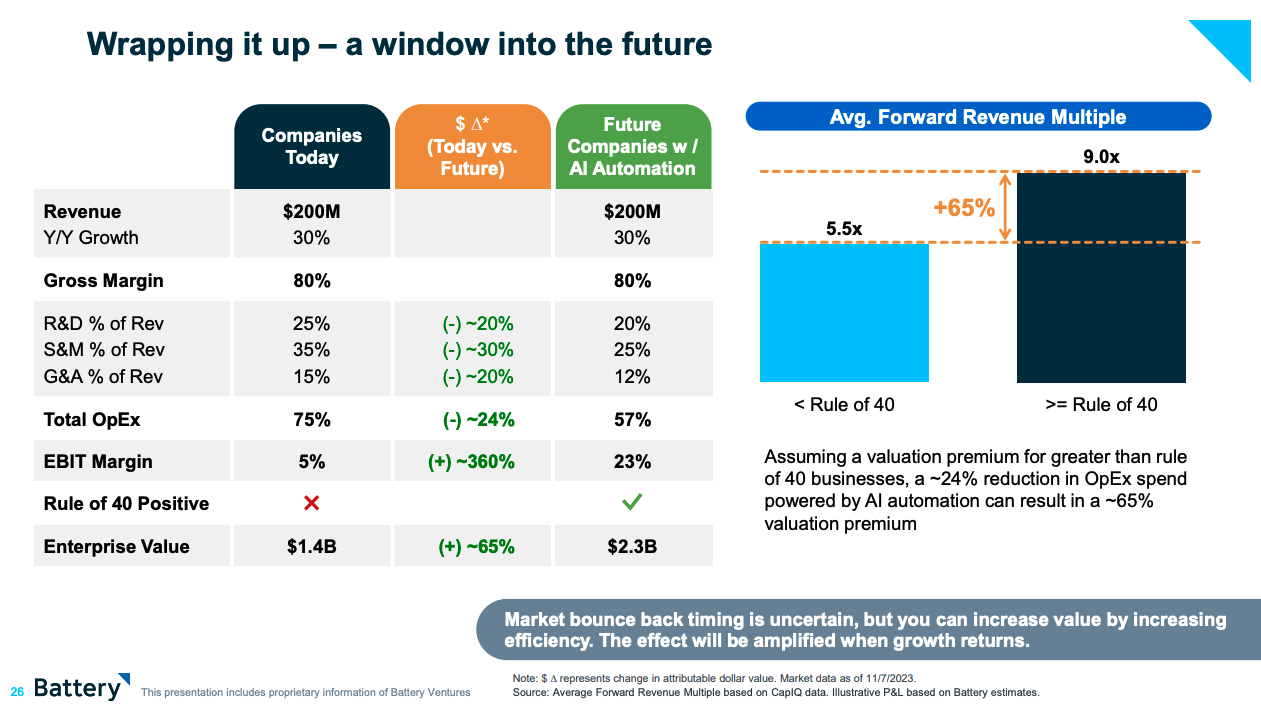

Notably , Battery expects AI - automation to repel like , 20 % monetary value savings to both R&D and G&A budget to boot . Those cost savings could shed 24 % off a scaled technical school company ’s operating expenses , boosting profitability and enterprise economic value sharply .

The speculation firm ’s math influence as follows :

Now , small startup hardly have $ 200 million worth of revenue . They also grow more quickly than the above representative and will therefore have negative exabit security deposit . But ! So long as they can gouge standardised AI - powered operating expense savings , they , too , can keep growth up while burning less . That should bring them closer to Rule of 40 passage and thus boost their note value .

A startup with $ 15 million Charles Frederick Worth of ARR at a 5.5x multiple is deserving $ 82.5 million . No small figure , but at 9x it ’s worth $ 135 million . That leavesmuchmore room for fundraising and the alike on its cap table . And you’re able to see that it ’s easygoing to defend prior valuations at a 9x multiple than anything closer to 5x .

The question I have after digesting the hereafter that Battery can spy in the space is just how long it will take for three-toed sloth - powered automation to show up in inauguration operating results . If the savings are even half as good as Battery seems to think that they may prove , inauguration could be in for a more efficient , and more worthful , future .