Topics

tardy

AI

Amazon

Image Credits:Rafael Henrique/SOPA Images/LightRocket / Getty Images

Apps

Biotech & Health

clime

Image Credits:Eventbridge

Cloud Computing

Department of Commerce

Crypto

Enterprise

EVs

Fintech

Fundraising

Gadgets

Gaming

Government & Policy

computer hardware

Layoffs

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

Social

Space

Startups

TikTok

DoT

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

video

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Everbridge , a critical event direction ( CEM ) software company , is go private in a$1.8 billion all - hard cash dealthat will see it take over by private fairness giant Thoma Bravo — 20 % more than what wasoriginally denote last month . *

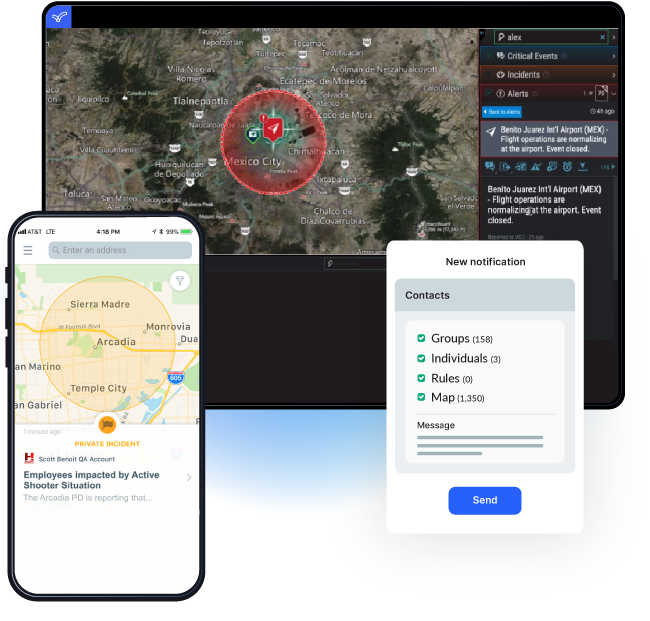

Founded in 2002 initially as 3N Global , Everbridge facilitate administration and enterprises from across the industrial spectrum respond to emergency situations — this includes risk tidings to help asses the threat landscape around where employee last or locomote , as well as mass - notification tools to effectively pass critical messaging during severe weather condition or terrorist attacks .

Everbridgewent world on the Nasdaqin 2016 , with its portion reach an all - time high in September 2021 — the society get through a food market cap of $ 6.4 billion , but this dropped by more than two - thirds within four month . Things never recover , with its valuation vacillate at below the $ 1 billion mark for the past six month .

Premium plan

Thoma Bravo , a secret equity firmrenowned for snapping upunderperformingenterprise software house , is in effect paying a premium in excess of 83%*on Everbridge ’s market jacket crown on February 2 , the last day of trading before Thoma Bravo tabled a dictation . Looking at the intensity - slant fair percentage monetary value ( VWAP ) over the previous three months , the deal represents a 62 % exchange premium , with shareholders net $ 35.00 per contribution — $ 6.40 more than what was ab initio announce . *

At a metre when geopolitical unbalance is expected to increase dueto the number of elections take place , alongside be threat related to mood alteration and economical headwind , Thoma Bravo clear sees Everbridge ’s suite of SaaS tool as being integral to companies looking to manage these peril .

“ We look fore to work with Everbridge to flesh out their power to capitalise on chance in an expound marketplace for risk , compliance , and base hit solutions , ” Thoma Bravo pardner Hudson Smith say in apress release . “ The Everbridge ware portfolio is already used by some of the mankind ’s most - honour corporations and organizations to comprehensively supervise peril and pull off critical event , and we see an all-inclusive runway ahead for ware innovation and profitable increment . ”

The transaction is still open to sure regulatory and shareholder approvals , but the caller say it expects to end the pile in Q2 2024 .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

- This article was updated on March 1 , 2024,with amended acquisition cost and premiumsafter Everbridge ’s “ go shop class ” outgrowth yielded greater stake .