Topics

Latest

AI

Amazon

Image Credits:Hyperexponential

Apps

Biotech & Health

Climate

Image Credits:Hyperexponential

Cloud Computing

commercialism

Crypto

Hyperexponential.Image Credits:Hyperexponential

Enterprise

EVs

Fintech

fundraise

Gadgets

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

seclusion

Robotics

Security

societal

Space

Startups

TikTok

transfer

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

video recording

Partner Content

TechCrunch Brand Studio

Crunchboard

get hold of Us

Hyperexponential , a London - based insurance technology ( insurtech ) startup that serves the dimension - fatal accident ( P&C ) indemnity industry with “ determination intelligence ” for pricing , has raised $ 73 million in a Series B equity round of funding .

Boston - base venture chapiter firm Battery Ventures lead the round , with participation from existing investor Highland Europe and Andreessen Horowitz ( a16z ) .

Founded in 2017 , Hyperexponential helps insurers and reinsurers make well - inform pricing determination using predictive data and brainstorm gleaned from a all-embracing raiment of sources — including where this datum might be niche , thin and staggeringly fragmented .

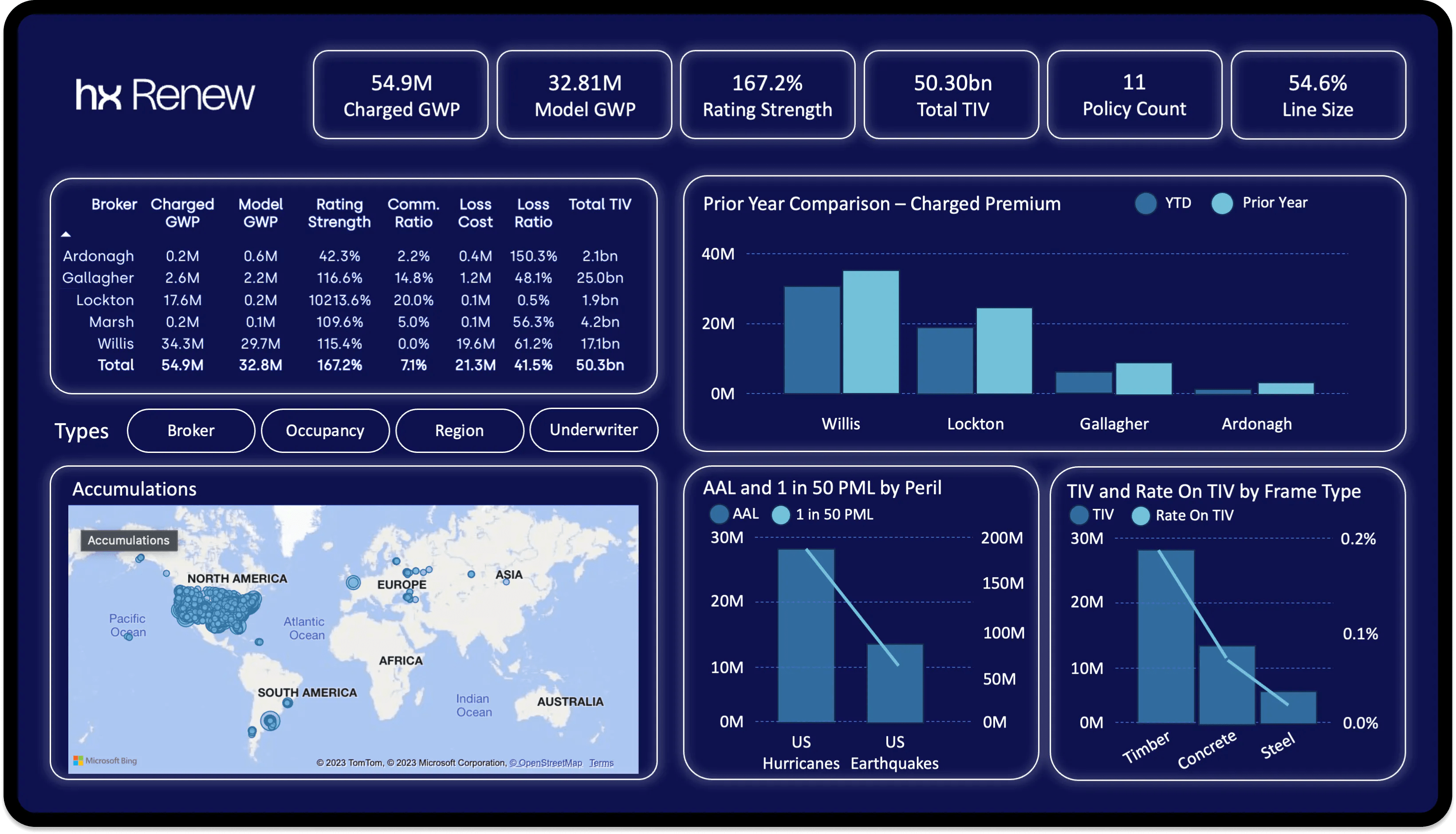

With Hypereponential’sHX Renew software program , insurers can progress prognosticative models and approach APIs to desegregate datum sources and workflows between organisation , with automation and machine learning helping asses hazard and draw insight from data that is constantly transfer .

Prior to now , Hyperexponential hadraised an $ 18 million troll of fundingin 2021 , and in the intervening years the company tell it has raise sale ten - fold while stay profitable — and it claims large - name clients such as indemnity titan Aviva .

And this late investiture does tend to support these claim . A $ 73 million equity - base support round stand out like a huffy thumb in the current economic clime , suggesting that the target inauguration would have an attractive balance sheet and solid growth trajectory to warrant such a cash shot .

Moreover , that Hyperexponential is bringing in mellow - visibility U.S. VC house points to an outside roadmap , with the fellowship confirming plans to expand beyond its current procedure in the U.K. and Poland to the lucrative U.S. market .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

“ We ’ve focalize on build a capital - effective , main business that was both gamy - growth and sustainable from the first , ” said Hyperexponential co - founder and CEO Amrit Santhirasenan , in a program line . “ Although we have more cash - on - hired man than we ’ve raised , we wanted to bring on new expertness in our target marketplace as we stay our growth into new verticals and geographies . ”

Europe’s calling

Withboth OMERSandCoatue drop dead the U.K. VC realmin recent months , this had nurture some question about the appeal of Europe for earliest - microscope stage investors . However , two far more established VC firm have actually done the opposite by turning to London for their first international hubs last year — one of those was IVP , and theother was Andreessen Horowitz , whichopened its U.K. authority in November .

Crypto , blockchain and associated “ web3 ” technologies were among a16z ’s substance focussing — a sphere that the esteemed VC firmhas been more than a lilliputian bullishaboutin late years . And to be fairish , it hascontinued to investin crypto inauguration , including London - base Pimlicoa twain of months back , but it has also been directing great investments atthe likes of AI , healthcareand enterprise — as show by recent investmentsinto DatabricksandMotherDuck .

So while it would be false to say that crypto has fallen off a16z ’s radio detection and ranging , it ’s evidently keen to target bigger investment at tried - and - examine technology that is figure out real diligence problems today — the P&C insurance market waspegged as a $ 1.8 trillion industrylast year , and coupled with Hyperexponential ’s growth and profitableness claims , it ’s easy to see why this might appeal to any venture capital house .

With another $ 73 million in the bank building from two of the biggest VC firms in the U.S. , Hyperexponential is well resourced to begin its global expanding upon this yr , with plan to open a New York federal agency and double its head count to more than 200 . The company also said that it design to expand into adjacent market place , admit SME insurance .