Topics

belated

AI

Amazon

Image Credits:Michael Nagle/Bloomberg / Getty Images

Apps

Biotech & Health

Climate

Image Credits:Michael Nagle/Bloomberg / Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:Tim De Chant/TechCrunch+

Enterprise

EVs

Fintech

Fundraising

gizmo

Gaming

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

privateness

Robotics

Security

societal

Space

startup

TikTok

expatriation

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

picture

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Consumers in the U.S. have the storage of a goldfish .

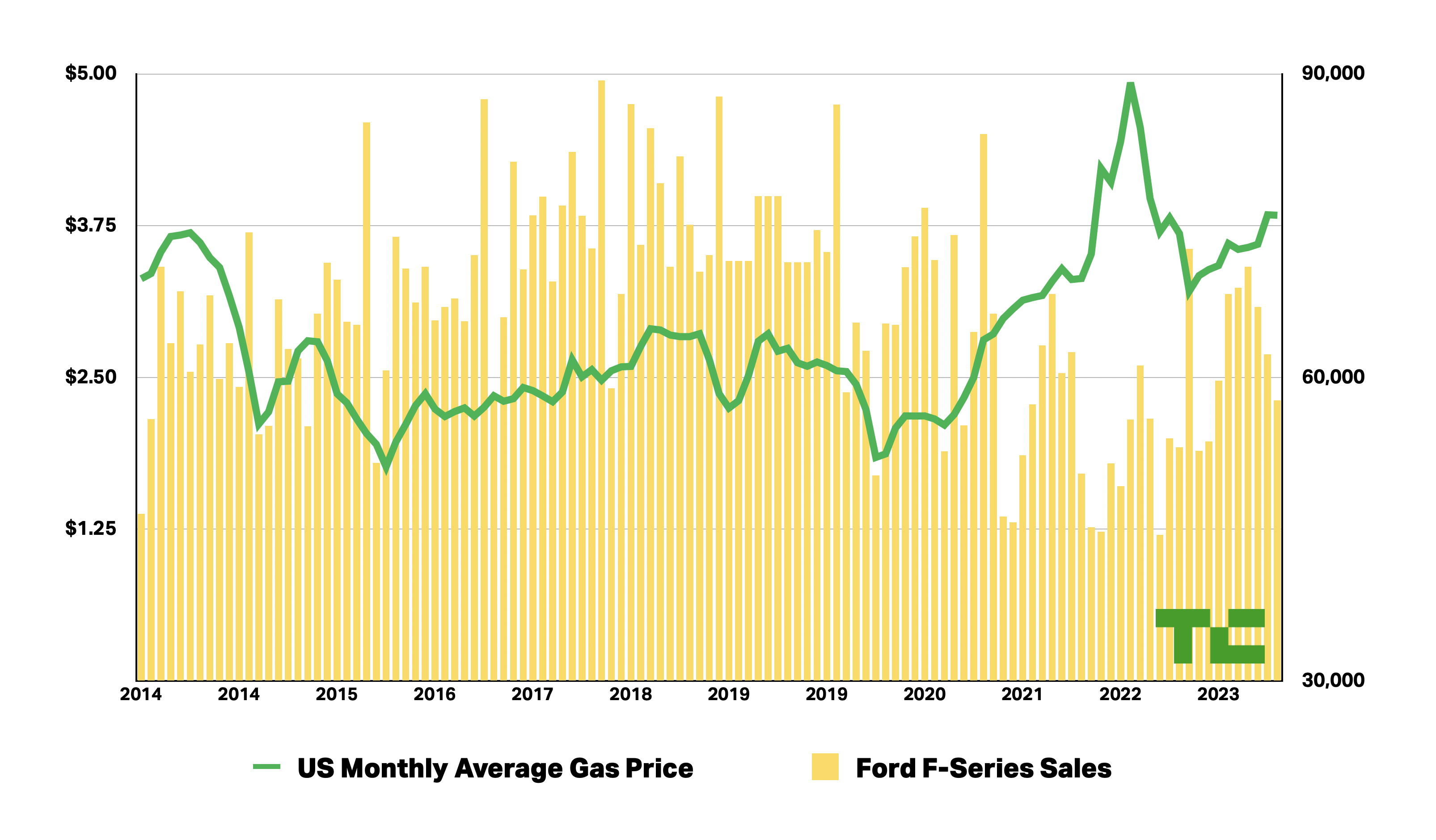

When gas prices are up , they seek out more fuel - effective transfer . But when they ’re down , they rush to buy the large motortruck possible . Just take a look at Ford F - Series sales agreement data point from the last decade juxtaposed with average monthly gas pedal prices .

See ? Goldfish .

It change by reversal out U.S. automakers resemble their client base . A few years ago , they were bullish on electric vehicles . But now , after just a couple years of serious investiture , they ’re startle to getcoldfeet .

Ford and GM , in especial , have say that they ’re just responding to their customers ’ needs . And maybe they are ! Some consumers stay wary because EV charging still sucks . Others have been scared off by high Mary Leontyne Price . ( Arguably , these are both self - inflicted wounds : Legacy auto manufacturer have refused to deal charging a cardinal part of the possession experience , and Ford and GM have continually hiked EV prices in a mode that ’s out of step with the market place . )

Such customer reactivity can be an plus in normal times , tolerate companies to adjust their product line to ride the ups and down of the market . Yet in times of transition , when the future is in fluxion , it can be a frightful way to run a business .

Legacy automakers have long say that their profitable poser lines would be a strength as the market transition to galvanising vehicles . All three company have herald that they ’d be commit billions in developing EVs and making the barrage fire that power them , and it would appear that the design is working out just fine .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Over the last decade , car maker have flocked to crossover , SUVs and pickup trucks , three segment that are the most profitable . U.S. automakers have gone further than most . Ford even went as far as to stop develop mass grocery elevator car , focusing rather on crossovers , sport utility vehicle and pickups with the episodic Mustang coupe thrown in for branding purposes .

How ’s it been shape out ? Pretty well , really . Ford reported $ 1.2 billion in net income for Q3 , not uncollectible given headwinds induced by theUAW rap . GM did better , raking in $ 3.1 billion in the same one-quarter . Stellantis does n’t in general announce its quarterly earnings until November , but it had a gangbuster first half of the twelvemonth , post $ 12.1 billion in profit .

So why have Ford and GM decided to pump the brakes on their EV plans ?

Both companies have said that need for EVs has been softening . Jim Farley , Ford ’s CEO , notice that “ affordability is an proceeds ” for consumers when it comes to EVs . Little surprisal given that the company has significantly increase the price of its F-150 Lightning . Despite a recent price gash for sure models , the cheapest trim , which is targeted toward fleet customers , still lists for $ 10,000 more than when it was first announced .

For mainstream customers who thought they ’d be able to snag a well - equipped , foresightful - range electric truck foraround $ 74,000 — about theaverage for an F-150when accounting for tax credit — they quickly learned the price would actually be tight to $ 89,000 . For those who do n’t desire a full - size truck , the average selling price of a Mustang Mach - E is nearly $ 60,000,accordingto Cox Automotive , well above the industry norm . lilliputian wonder the great unwashed have set out to shy aside from Ford ’s electric offerings .

Ford and GM executives have also cited significant losses per fomite as a reason why they ’re slow up their EV rollout . Ford is “ trying to find the balance between price , margin and EV requirement , ” Farley said . As evidence , the companionship say it lost an estimated $ 36,000 per EV last quarter .

It ’s on-key that Ford would fall back even more money if it cut Mary Leontyne Price further . But that ’s how it mold for new businesses , which is basically what the EV divisions at these company are . There ’s a period of time of high investment and low tax income that lead to losses . Over metre , though , the investment phase starts to ante up off , and the company can start making up for its losses . It ’s called theJ curve , and it ’s essentially private fairness ’s total sales pitch .

Automakers and their shareholders need to disabuse themselves of the notion that EVs will be profitable today or tomorrow or even a few yr from now . modulation take fourth dimension . Yes , legacy gondola caller have significant resource they can draw on to help keep costs in melodic phrase . But the EV transition is still radical enough that they ca n’t expect that expertise to make up the difference from day one .

Ford and GM only started warm to EVs after spring up covetous of Tesla ’s skyrocket share damage . Reasonable citizenry can reason about whether Tesla ’s valuation is justify , but it was at least partly make on a decade of dedication to EVs . EVs are dissimilar enough from fossil - fuel vehicles that live auto maker are still in the learning phase . Ford and GM should have perpetrate year ago when it was clear that EVs were no longer low - power , light - range commuting appliances .

reckon if Henry Ford had determine to take his foot off the gas . In the first two years of yield , Ford soldabout 30,000Model Ts . At that time , cavalry were still the independent anatomy of transportation and demand for automobiles could n’t have been less certain . But he stuck with it , and a decade later the company sold nearly 1 million Model Ts in a single twelvemonth . Hemming and haw over EVs may please shareholder today , but it almost certainly wo n’t a X from now .