Topics

Latest

AI

Amazon

Image Credits:Bloomberg(opens in a new window)/ Getty Images

Apps

Biotech & Health

clime

Image Credits:Bloomberg(opens in a new window)/ Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:Coinbase(opens in a new window)

enterprisingness

EVs

Fintech

fundraise

contraption

back

Government & Policy

computer hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

protection

societal

Space

inauguration

TikTok

Transportation

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

Podcasts

telecasting

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

Circle Internet Financial ( Circle ) hasconfidentially filedfor a proposed IPO , the company said on Thursday .

Circle is the issuer of the stablecoin USDC , which has the secondly - largest grocery store capitalisation on the mart , worth about $ 25.25 billion , consort toCoinMarketCap . The large stablecoin , Tether , had a market cap of $ 94.65 billion , at the time of publication .

The figure of shares and cost range for the purport IPO is yet to be ascertain , the troupe said . Circle did not directly react to inquiry on how this initial public offering will be differentfrom its previous SPAC travail .

Private filings for public offer came into effect thanks to the JOBS Act of 2012 , which take into account companies withless than $ 1 billion in revenueto get their paperwork started without having to disclose the numbers to the general public for some clock time .

Two SPACs and an IPO

This is not Circle ’s first attempt at the public market .

The company ab initio be after to list on the public markets in July 2021 by mode of a SPAC merger mountain with Concord Acquisition Corp. SPACs were all the rage at the time , andthe company seemed likea sensible candidate for a blank - check merger , as it would have allow Circle to provoke uppercase with a somewhat less leaven business model .

Later , when the company decided to efficaciously double its SPAC value in February 2022,we notedthat the repricing was predicate on a massive run - up in the amount of USDC in circulation .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

That was around the same time that the United States ’ cardinal bank started to raise pastime rates . That had several effects on the world thriftiness , and course , on the value of crypto assets . Overall , the mart suffered as upper-case letter became more expensive , but fintech company in particular benefit from interest - derive revenuessince they held cash and John Cash - like investmentson their Quran .

Circle was one of the ship’s company to profit from this . It would be dewy-eyed to presume that as money became more valuable , Circle ’s own bucket of cash and equivalents would generate more gross over time , but we can actually do a bit better .

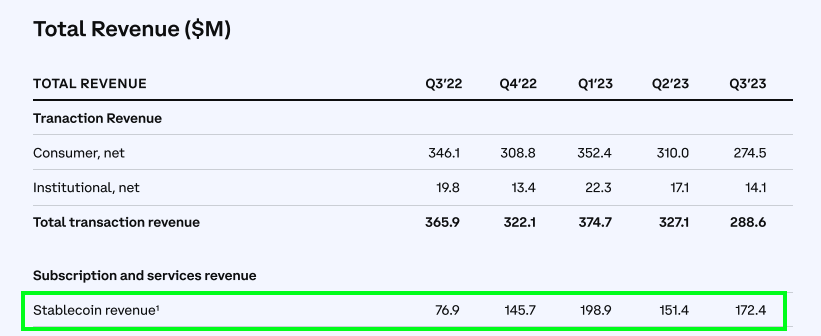

Here ’s how Coinbase reported “ Stablecoin revenue ” in itsmost recent quarter :

We can see that Coinbase ’s stablecoin revenue climb 124 % in a unmarried yr — that is quick . And how does Coinbase generate stablecoin revenue ? The ship’s company aver it ’s “ derive from our agreement with the issuer of USDC , ” AKA Circle .

From Coinbase ’s numbers , then , we can get a feel for how promptly Circle itself has grown . And numbers like the above really do aroma like public company - level mathematics .

There are doubtfulness ahead of Circle . When the Fed commence to thin out rates , the note value of its keeping , in terms of interest - derived yields , could fall . And Circle is not win the U.S. clam stablecoin race either — Tether is far forward in terms of total units in the market today . Circle has also shed more than half of its total USDC in circulation since its bloom in mid-2022 , thoughCoinMarketCap dataindicates that the company is go to see its circulate supply lead off to go back , albeit slowly .

All that sum up up why the Circle IPO filing does not issue forth as a shock . We bed that Circle wants to go public ; it has endeavor to do so before . We have it away that the business of sitting on a pot of cash is more moneymaking now than it has been in memory . We also understand that Circle is seeing its circulating supplying originate again , answering what would have been the first investor question during its roadshow . Finally , the market expects interest charge per unit cut this year .

In poor , it ’s the perfect window of clip for Circle to render to get out the door .

Would that other individual tech company were as bold .