Topics

Latest

AI

Amazon

Image Credits:Bryce Durbin

Apps

Biotech & Health

Climate

Image Credits:Bryce Durbin

Cloud Computing

Commerce

Crypto

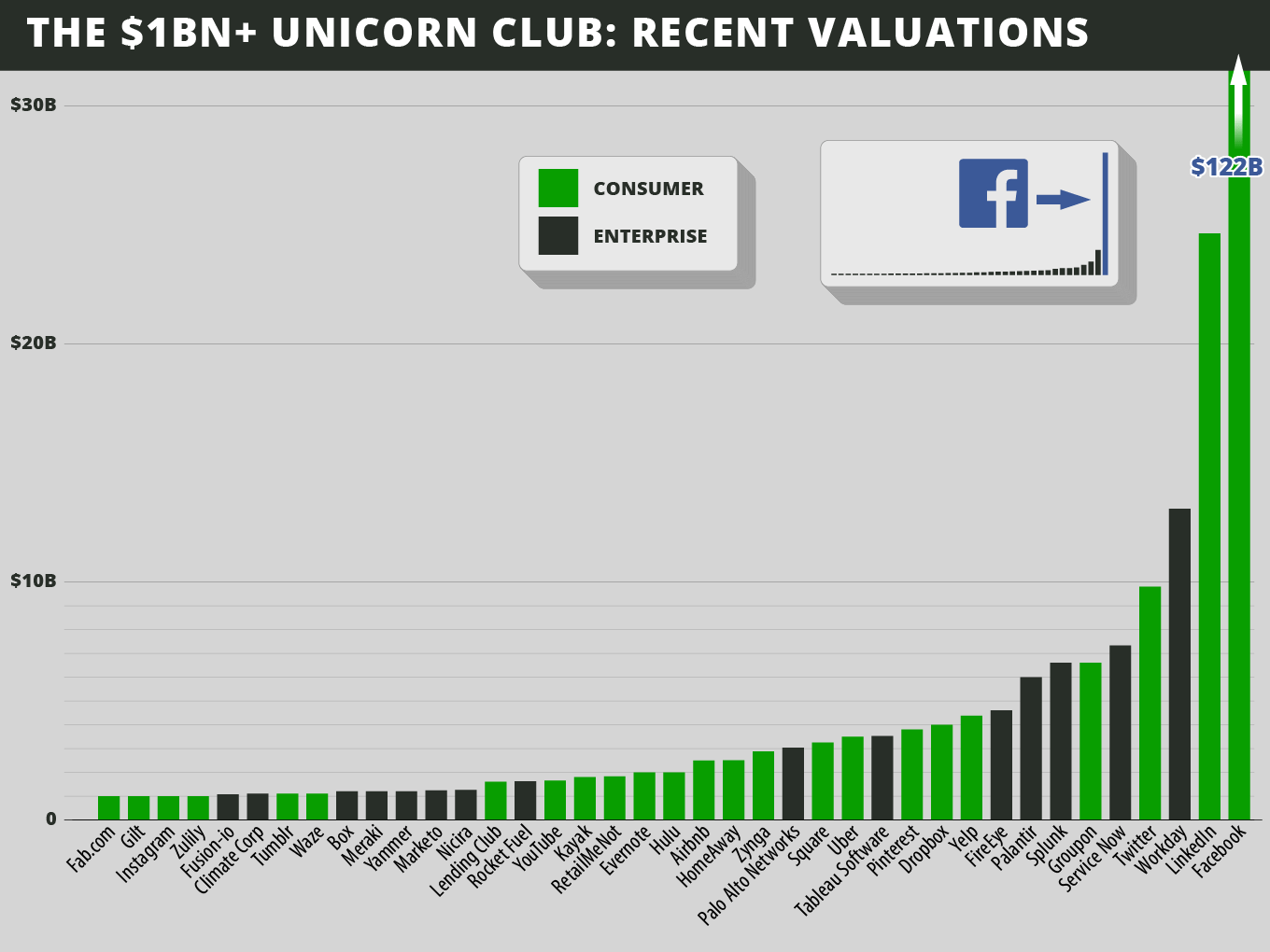

The most successful VC-backed U.S. tech companies less than 10 years old in 2013.Image Credits:Cowboy Ventures

Enterprise

EVs

Fintech

Capital in the VC ecosystem tripled in a decade. Source: NVCA Q3 2023 VC Monitor, NVCA 2022 Yearbook, Federal Reserve Economic Data.Image Credits:Cowboy Ventures

fund raise

Gadgets

Gaming

Investment in private companies mirrored the Nasdaq climb. Source: PitchBook-NVCA Venture Monitor, NVCA 2022 Yearbook, Federal Reserve Economic Data.Image Credits:Cowboy Ventures

Government & Policy

ironware

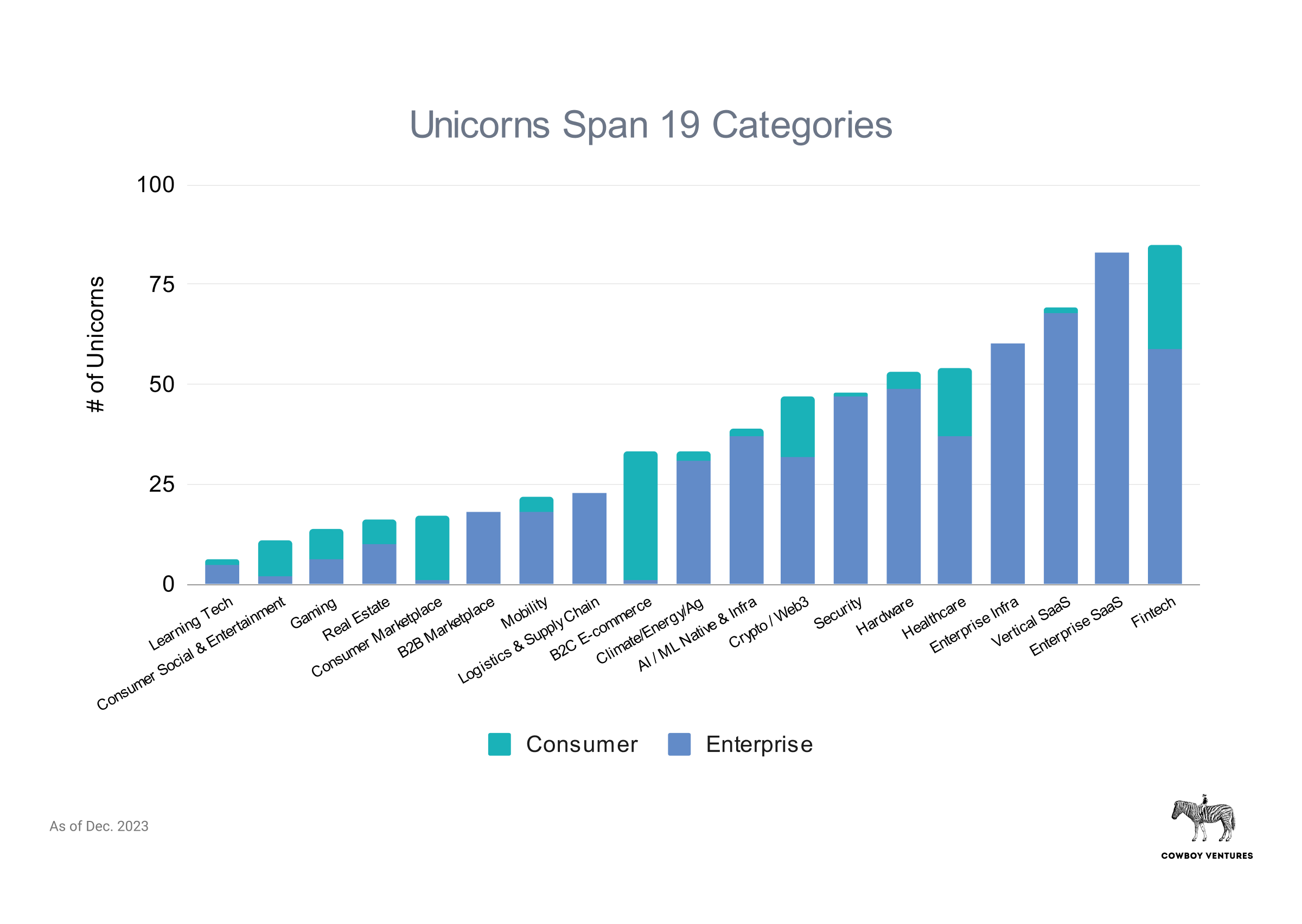

Unicorns in 2023 innovate across an array of sectors.Image Credits:Cowboy Ventures

Layoffs

Media & Entertainment

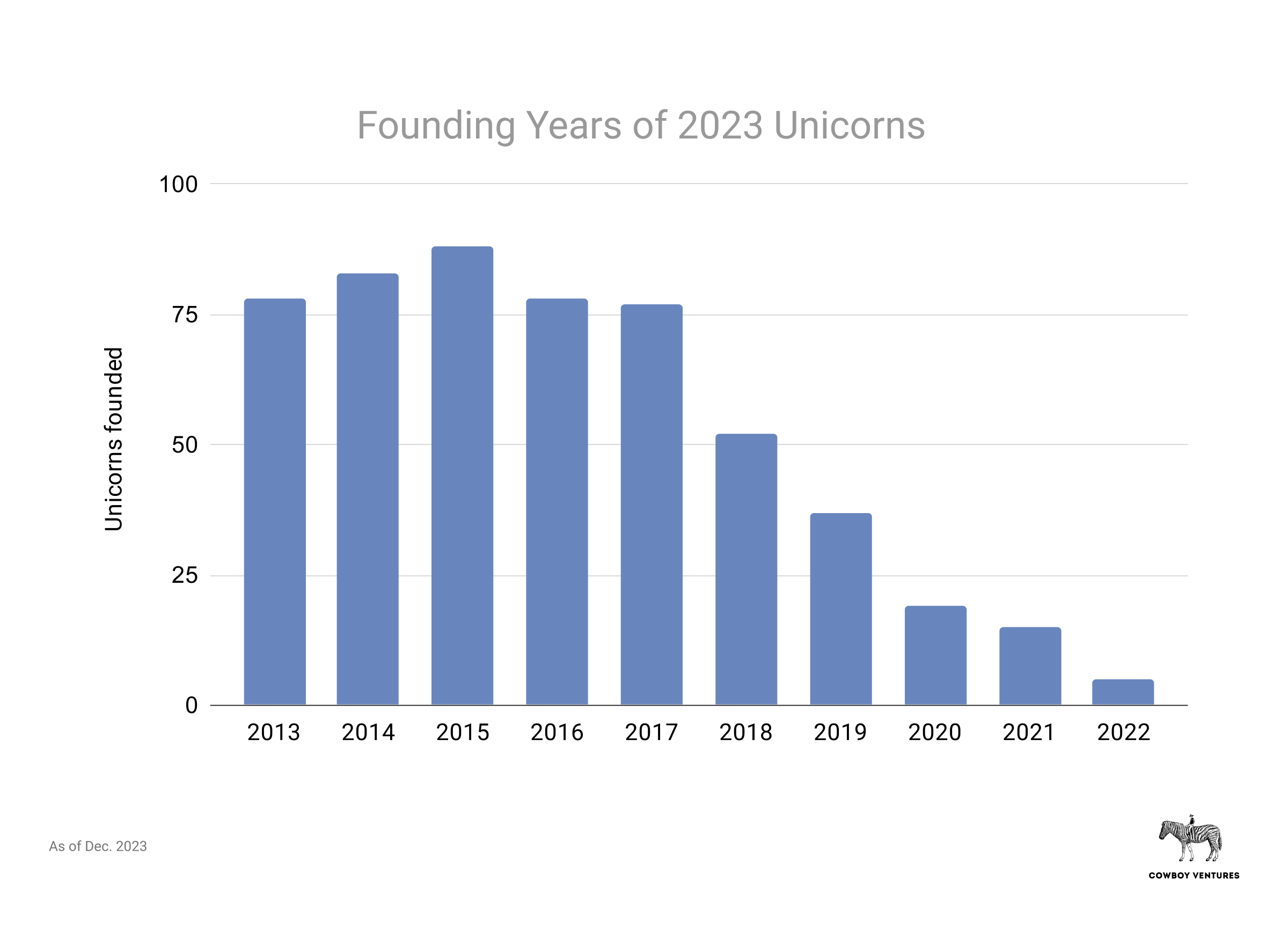

Companies of all ages became unicorns in the run-up.Image Credits:Cowboy Ventures

Meta

Microsoft

Privacy

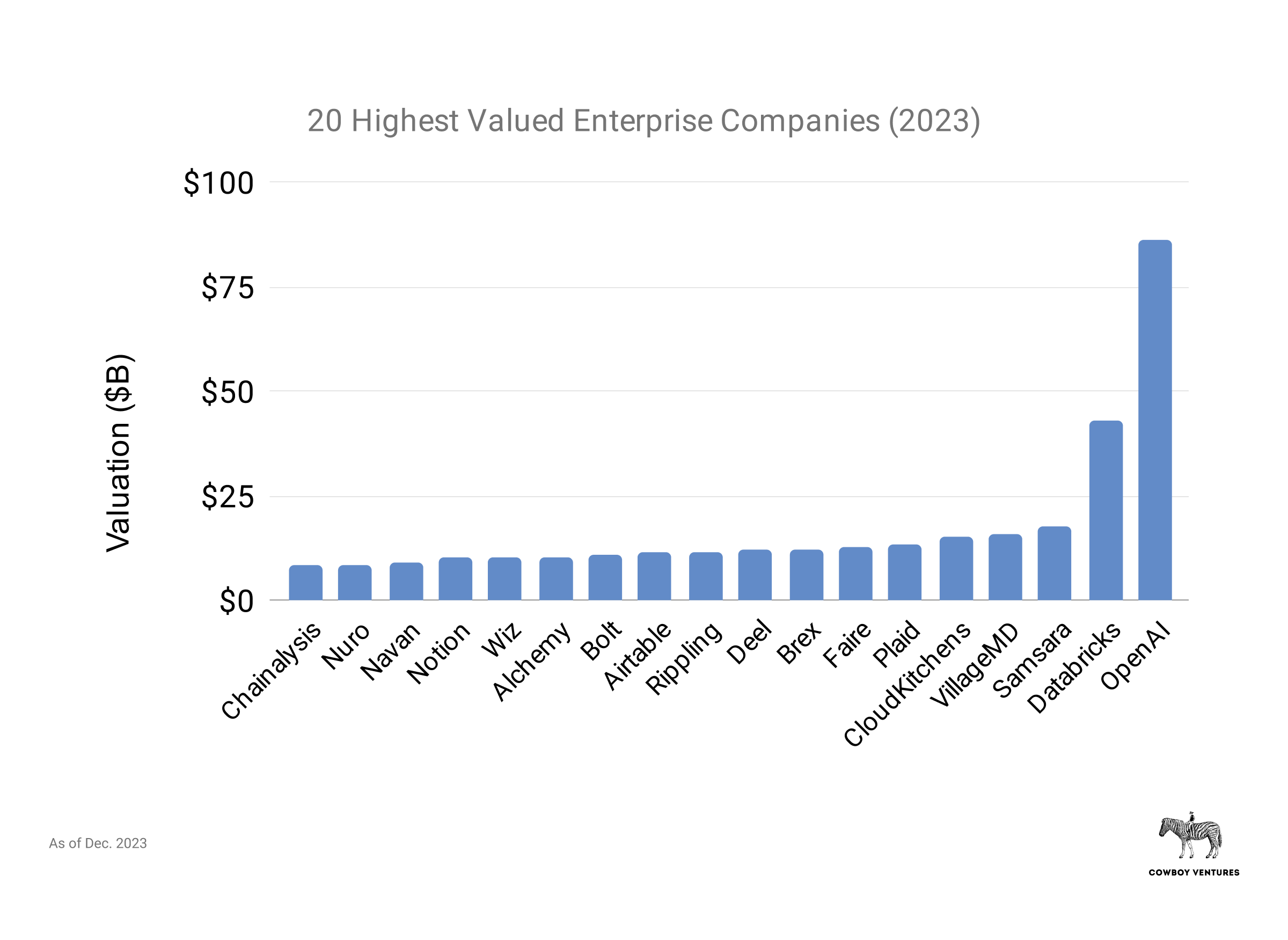

Enterprise companies are worth $1.2 trillion, 80% of aggregate value.Image Credits:Cowboy Ventures

Robotics

Security

Social

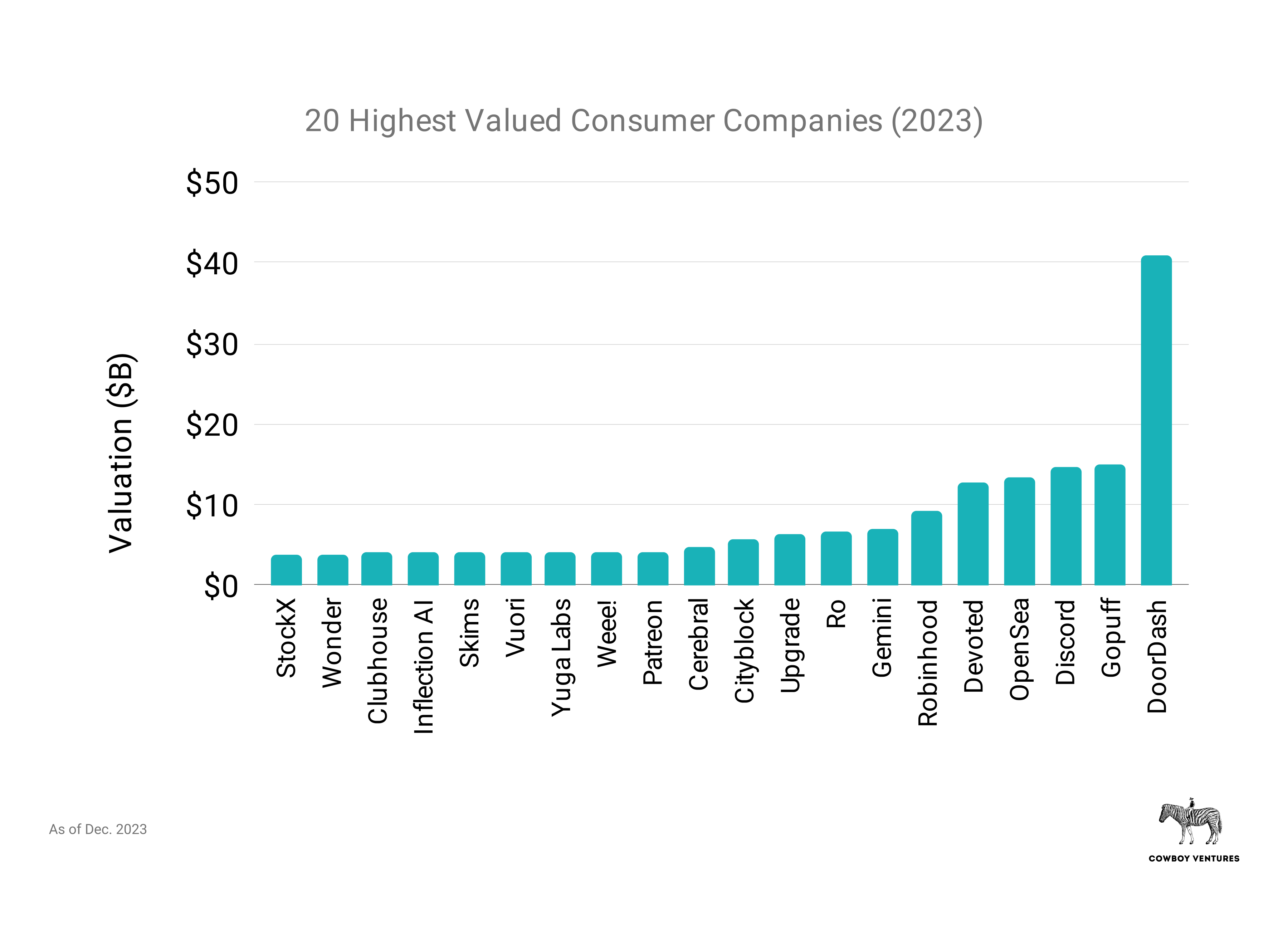

Consumer companies comprise 20% of our list.Image Credits:Cowboy Ventures

quad

Startups

TikTok

A spate of ZIRPicorns was crowned when rates troughed. Sources: PitchBook, Federal Reserve Economic Data. Note this includes all VC-backed companies valued at $1 billion for the first time in a given year, including those founded before 2013.Image Credits:Cowboy Ventures

Transportation

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

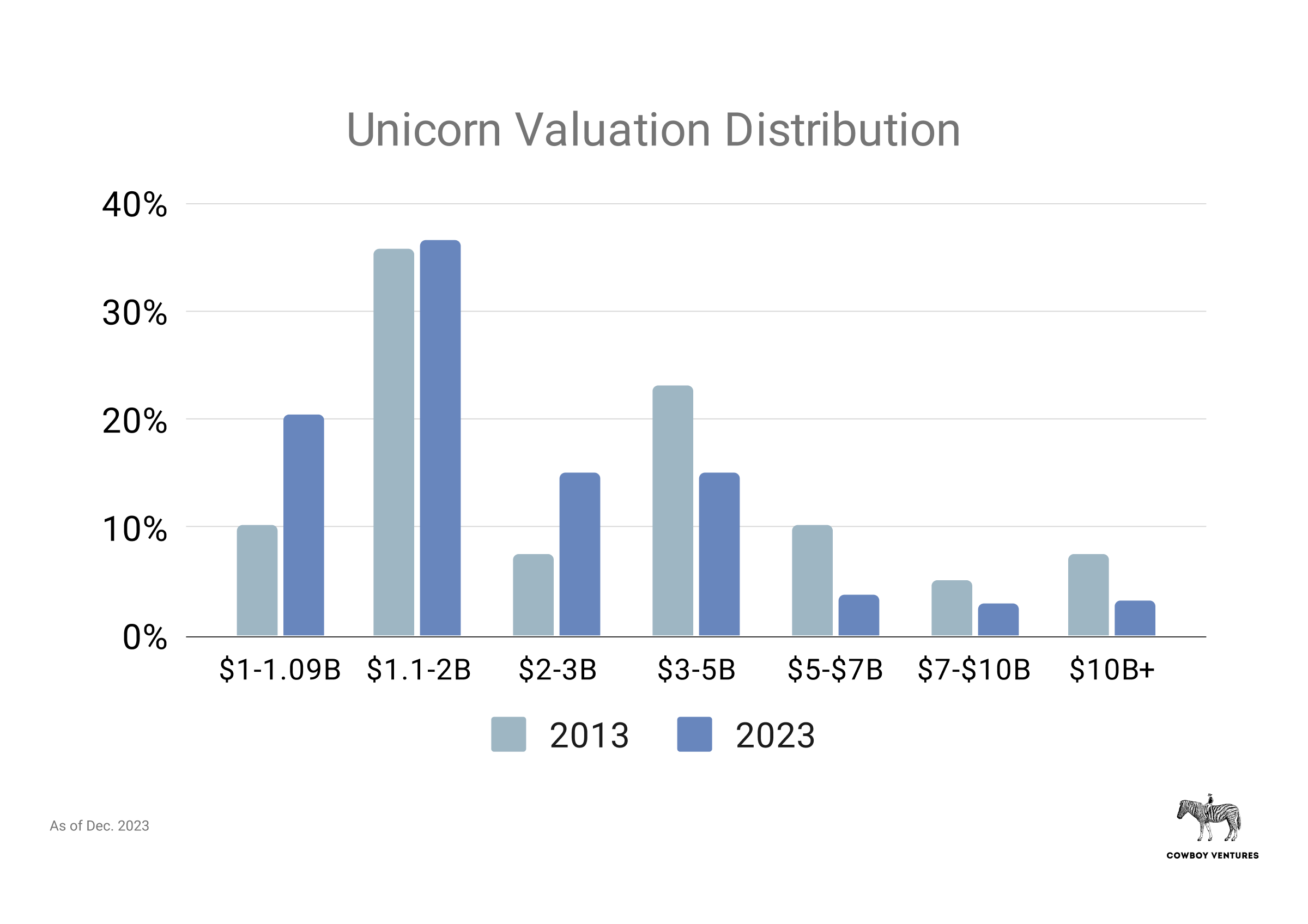

Valuations skew lower in this herd, and many are on the cusp of being a unicorn.Image Credits:Cowboy Ventures

Podcasts

video recording

Partner Content

An echo of Moore’s law? Unicorn growth tracks compute power growth. Source: Our World In Data, plus PitchBook’s list of total U.S.-based private unicorns (including those founded before 2013). Note this chart is for illustrative purposes.Image Credits:Cowboy Ventures

TechCrunch Brand Studio

Crunchboard

reach Us

Image Credits:Cowboy Ventures

It ’s been a decennium since publishing “ Welcome to the Unicorn Club , ” so it ’s a upright clock time to reflect on what ’s befall since .

In 2013,Cowboy Ventureshad just gotten start . To inform our investiture strategy , we assembled and studied a dataset of U.S.-based , VC - back startups that had grown to be worth more than $ 1 billion within 10 years , using the term “ unicorn ” as a tachygraphy to catch how magical these companies seemed .

Ouroriginal analysisfound only 39 unicorn out of the thousands of startups that had been founded by then . Some highlights :

Just 14 of 532 unicorns are public today.Image Credits:Cowboy Ventures

2013 to 2021: A rising tide for VC funds, startups and valuations

historic rejoinder , grow markets ( include societal , mobile , cloud , mercantilism security , crypto and AI ) , COVID - geological era effects andlowinterest rates aim 3x more working capital ( $ 580 billion more ! ) into VC investment firm between 2013 and 2021 ( and increase VC fee income by more than $ 11 billion ) .

This enabled constitute VC firms to raiserecord - break funds ; public “ crosswalk ” funds joined the party ; andover a thousand newer firmsalso raised funds . The industry gained thousands of new investor with fresh checkbooks and limited mentorship or inadvertence , given the rate .

In 2021 , it was a perfect violent storm of well-nigh - zero interest rates and much of the world spend their Clarence Shepard Day Jr. behind screens , more and more reliant on technology for work and life . Due - diligence processes were rushed , orotund size and valuationsbroke record book , and ahugeherd of unicorns was crowned .

Just a sample of formicorns’ struggle in public markets, many spurred by SPACs.Image Credits:Cowboy Ventures

The tide turns

In March 2022 , the Fed raised rates , triggering a multiyear downward effect on public companies ’ revenue multiple and enterprise software system firm ’ budget . Although braggart VC business firm continued to raise great money ( 64 % of speculation capital raised in 2022 went to fundsbigger than $ 1 billion ) , investor mostly freeze down their investments ( around 40 % of VCsstopped dealmakingin 2023 ) . companionship refocused on margins and profitability , cutting costs in several waves . Unicorns startle to diminish via down rounds , public delistings and shutdown .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

But since 2013 , there were 532 ship’s company that join the Unicorn Club . Similar to our original analysis , our 2023 dataset cover U.S.-based , VC - backed tech companies most recently valued at more than $ 1 billion in public or private grocery and launch in 2013 or later .

We apply PitchBook , Crunchbase , People Data Labs , and news article as reservoir but private market datum is challenge . If you spot something inaccurate or we lack , please let us have a go at it at Cowboy Ventures .

To note : Last - rung valuations are an imperfect gauge , and they likely inflate the current ruck sizing and value;Cerebral , ClubhouseandOpenSeamay be in force examples . Using the period - in - meter methodological analysis also leave some companies out . For model , Stripe was found in 2010 , Zoom in 2011 , and Snowflake and Coinbase in 2012 . None of these was a unicorn in 2013 when we did the original analysis , and now they are more than 10 yr quondam , so they ’ve been exclude from this dataset .

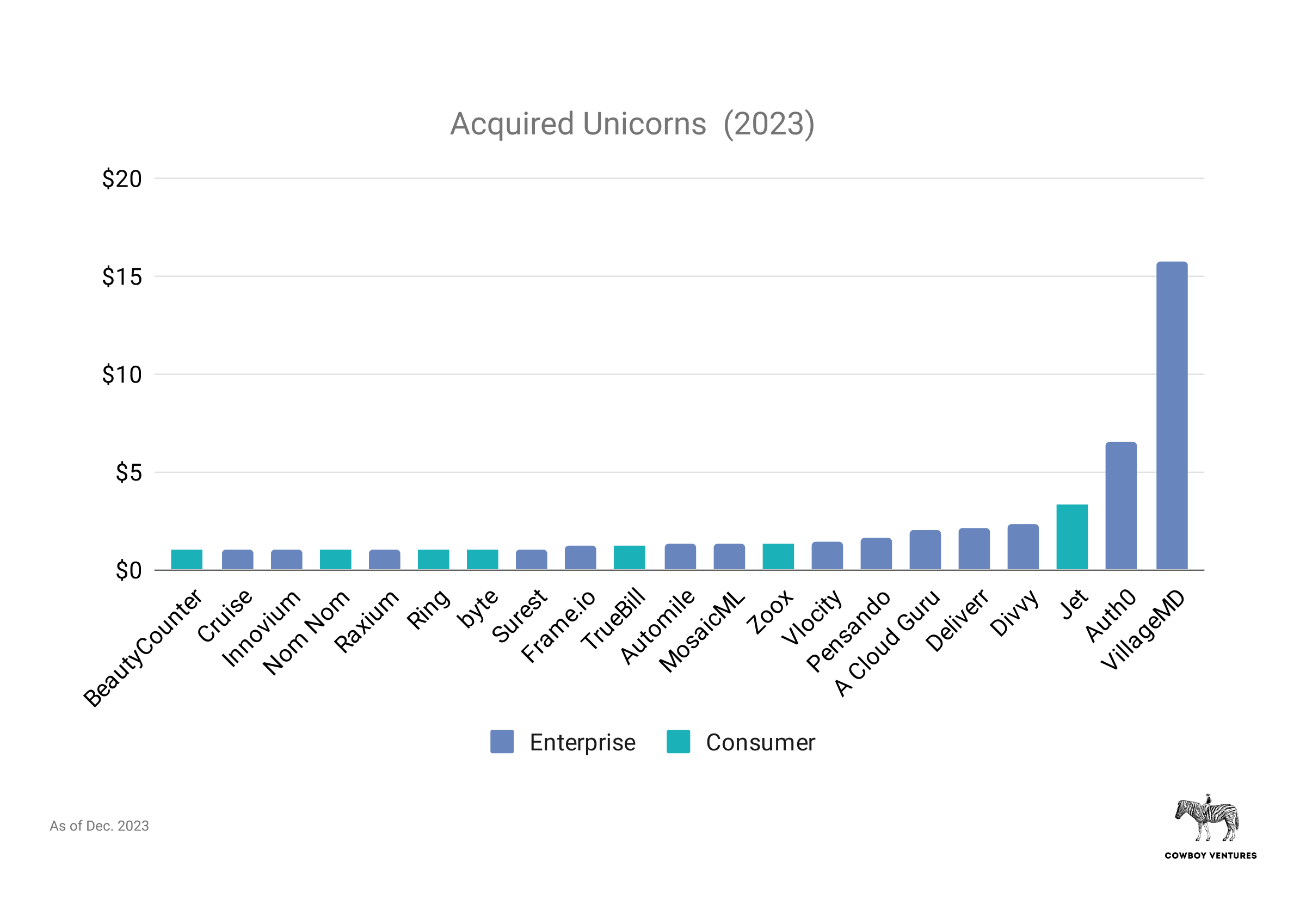

A paltry 4% of 2023 unicorns had an “exit” via acquisition vs. 23% in 2013.Image Credits:Cowboy Ventures

Here ’s a abbreviated look at our takeout about the 532 companies in the 2023 Unicorn Club . Read on for a deeper dive into how thing have changed over the last 10 year :

A deeper dive on where we are today

Unicorns ballooned 14x in the past decade

This ruck is deserving a staggering$1.5 trillionin aggregative time value ( versus $ 260 billion in 2013 ) . But becoming a unicorn is still not easily done : Less than 1 % of VC - endorse startups go on to become worth more than $ 1 billion . An ideal nominee is five time more likely to get into Stanford , Harvard or MIT than to found a unicorn .

unicorn now also traverse a wider array of sector ( we ’re track 19 ! ) . Most of these sectors were n’t on our 2013 list ( social , DoC and general enterprise dominated back then ) . penetrate the gallerybelowto ascertain more about the most worthful companies in each sector .

The most valuable company are in very unlike sectors compare to 2013 .

Capital efficiency plummeted among enterprise unicorns.Image Credits:Cowboy Ventures

The most valuable unicorns in 2023 have innovate across a spacious spectrum that stretches from general AI and health care to food bringing , HR package and stock trading . That marks a grownup difference from the sectors on the 2013 list . As previously take note , last - round valuation is an imperfect gauge : 75 % of the “ unexited ” companies in this top 20 tilt were last valued in 2022 or earlier .

Unlike in our 2013 analysis , there were nobestyears for founding a unicorn : 2020 and 2021 accelerated the “ crowning ” of all age and stage of caller . Today ’s unicorn are seven years old on median , same as a decade ago , which seems like a good thing .

We do n’t canvas fallen unicorns here . But anecdotally , we see being crowned a unicorn too quick could be a curse . Fallen unicorn likeHopinandBirdwere crowned within one year of founding ; machine leaserFairin two years ; andConvoyandKnoteljust three eld after founding .

Shoutouts to highly capital efficient companies (with caveats).Image Credits:Cowboy Ventures

The pendulum swung hard to enterprise

Ten years ago , we found just 15 ( 38 % ) unicorn progress B2B computer software and armed service comprising just $ 55 billion in total value . Workday , ServiceNow , Splunk and Palantir were the most valuable enterprise unicorns at the clock time .

Today , there are 416 endeavor unicorns — making up around 78 % of the list — worth$1.2 trillionand driving 80 % of aggregative value ( versus 20 % in 2013 ) .

Consumer companies today make up 20 % of aggregate value , a with child dividing line to the 80 % they report for back in 2013 . Remember “ SoMoCo ” ? Social ( Facebook , Twitter , Pinterest ) , mobile ( Uber , Square ) and e - commerce ( Groupon , Gilt , Fab ) .

Some 2023 unicorns are currently worth <2x capital raised.Image Credits:Cowboy Ventures

The most valuable consumer startups today operate in areas like last - mile delivery ( DoorDash , Gopuff ) , health ( Devoted , Ro , Cityblock ) , and gaming - drive platform ( Discord , Rec Room ) — ship’s company that drove new habits during COVID .

What have so much cap to flock to enterprisingness companies in the past decade ? The attraction of historical capital efficiency , the predictability of SaaS concern example ( high double-dyed margin and client holding ) , and a maturate number of extremely prize potential acquirer were likely a big tie . Global espousal of swarm made it easier to take in raw software and opened a big window for a whole new ecosystem of app level , substructure , data point and analytics , and security system company .

The cyclical pendulum does swing , so apply the strong shift to enterprise , we hope and require more exciting consumer unicorn will be born in coming long time . For inspiration , many of today ’s leading consumer internet experiences are about two decennary old ( eBay , Expedia , OpenTable , Tripadvisor , StubHub , Yelp ) , possibly fertile district ?

Superunicorns grew superpowers, 2013–2023.Image Credits:Cowboy Ventures

A bloated herd

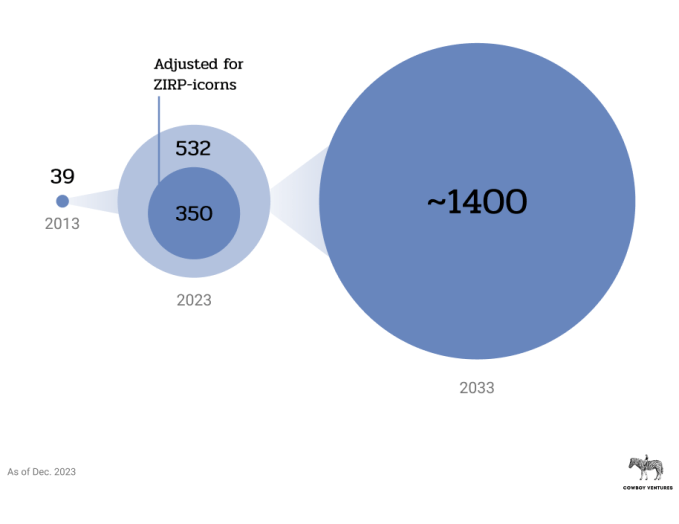

Our 532 fellowship are a wobbly , bloated herd that will slenderize in the come eld to around 350 . That ’s because a whopping 93 % of unicorns are in reality “ papercorns ” : privately prise on paper but not yet “ limpid . ” It ’s a big alteration from just 36 % secret unicorn in 2013 .

Sixty percent of unicorns today are what we call “ ZIRPicorns ” : They were last assess between January 2020 and March 2022 , which visualise peak public multiples and near - zero interest rate .

When money was fall , unprofitable individual companies were often able-bodied to lift enough to fund two to five years of operations . This means that operating runways are getting brusk for many unicorns . Many are working to get profitable on existing immediate payment , which is challenging given the current economy and is even harder when starting with a lower perfect margin business .

COVID effects likely helped spread more unicorns across the country.Image Credits:Cowboy Ventures

Given thechilly current M&A environs , founders ’ opposition to recapitalization , and investor ’ care of “ catching a pass tongue ” by invest in a down circle , we wait more abrupt shutdowns in 2024 ( for instance ,Convoy , Olive Health , Zume ) ( “ unicorpses , ” anyone ? ) .

Coining the condition also seems to have affected the market ( gloomy ! ): 21 % are valued at $ 1 billion ( versus 10 % in 2013 ) , on the leaflet of being a “ unicorn , ” and 46 % at less than $ 2 billion .

Around 40 % are swop below the $ 1 billion valuation mark in petty markets , according to genuine gild data for 290 unicorn on our list fromHiive . It ’s potential more might trade at less than $ 1 billion .

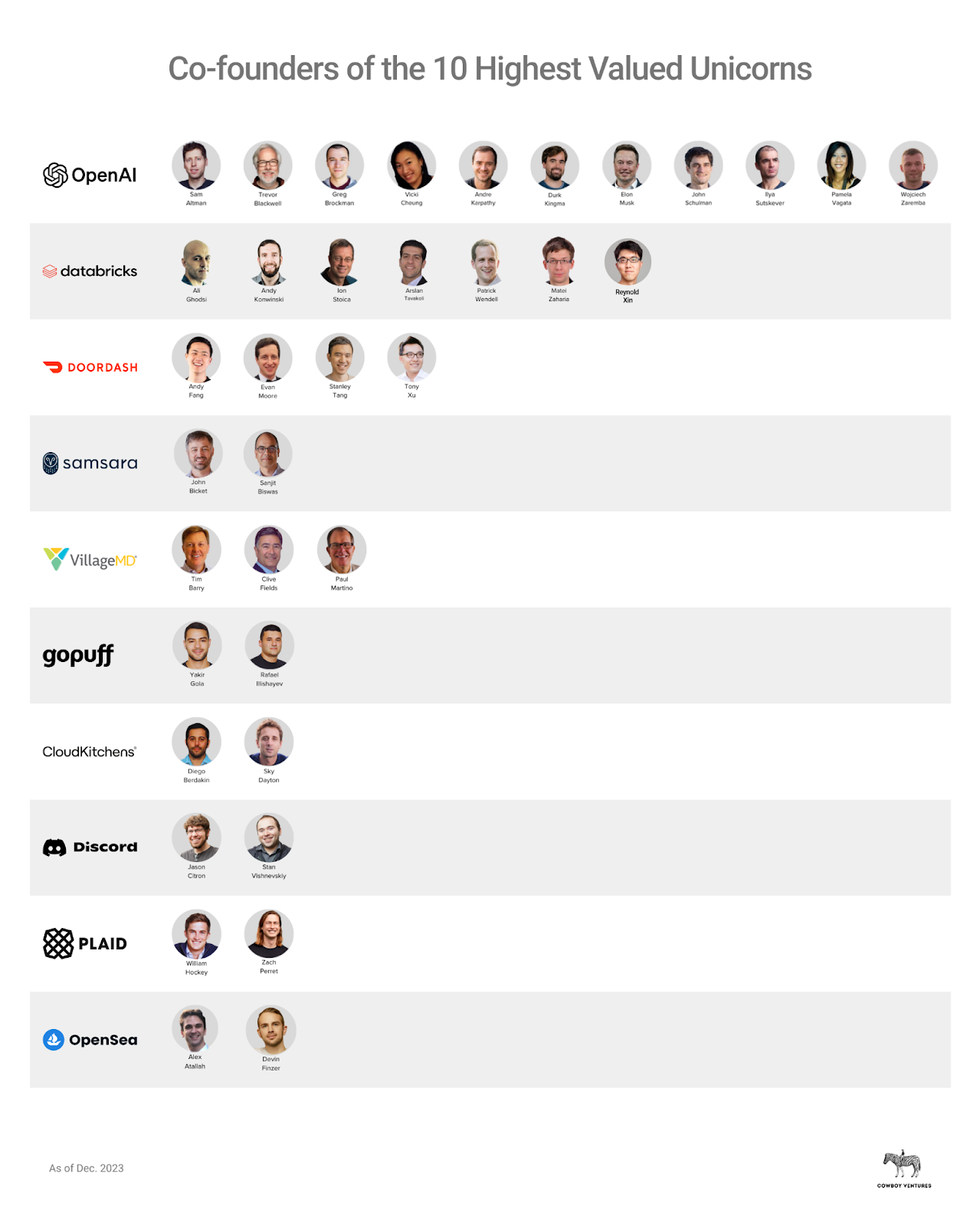

Notice what most of these founders have in common?Image Credits:Cowboy Ventures

On the burnished side , we see approximately 350 healthy businesses of pith in this ruck — almost 10x in a decade ! Many ZIRPicorns and papercorns raised enough cap and are successfully sail the new mood , and will develop into and beyond their current evaluation . Many will become public companies in the coming year , with rock - satisfying financials , tested by the downswing . And a few of these company will grow to become superunicorns .

And , we see evidence of aSoftware Unicorn Power Law .

The number of unicorns increase at an amazing 30 % on average every year in the past tenner , spurred byenterprise software spend , consumer tech acceptation , VC funding and interest rate .

Image Credits:Cowboy Ventures

We see an echo of Moore ’s law here : As compute capacitance , potentiality and usage increase , the identification number of unicorn increases . The current momentum in AI should add fuel to initiation and demand .

Adjusting the current ruck to 350 , succeeding unicorn growth to a less champagne 15 % , and ameliorate current capital efficiency a morsel , we see 4x more , or about 1,400 U.S. unicorn , in 2033 . Counterarguments to this melody of thinking include scarcer speculation uppercase , higher interest rates and software integration . But previous downturns have been fertile for unicorn founding . This will be exciting for the future of instauration , jobs and the technical school economy , despite current shape .

The exclusive “liquid unicorn” club

There have been few loss : only 7 % versus 66 % in the prior decade . Just 35 of 532 unicorns are public or were acquire for over $ 1 billion , a consequence of increased secret capital and a more ambitious regulative and M&A environment . The mean fourth dimension from founding to an IPO or acquisition was a rapid six years , and an impressive 75 % of launch CEOs led their companies from founding through an going .

The public unicorn club is elite , with just 3 % public compare to 41 % going public the decade prior . That ’s a huge change , partially driven by the availableness of so much private capital and investor unforced to invest in richer - than - public valuations in the last tenner .

These company are separate between endeavour and consumer and span a wide array of sectors .

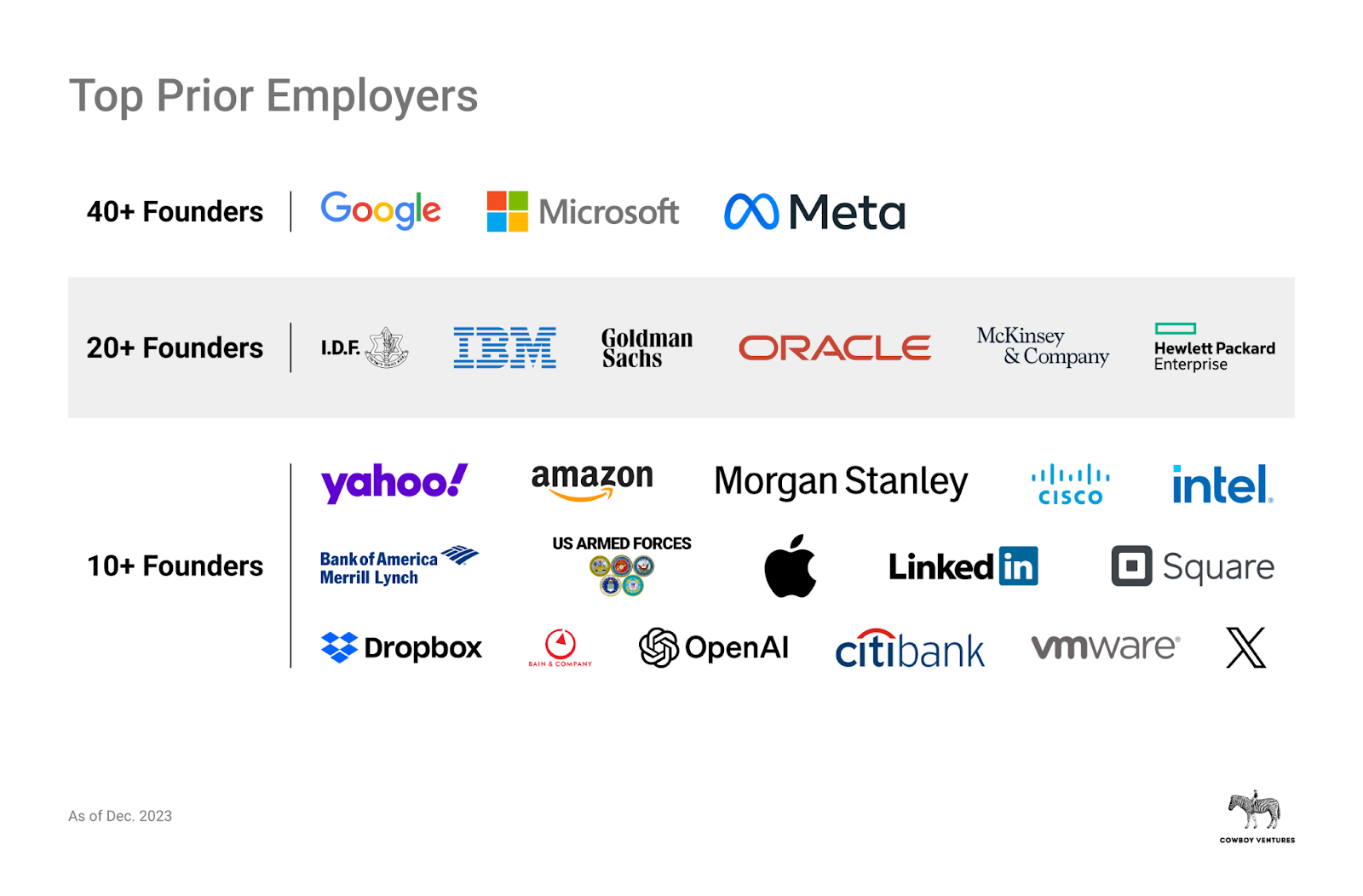

Prior employers include superunicorns, banking, consulting and military.Image Credits:Cowboy Ventures

It ’s also notable that around 70 % of the current public unicorns ’ chief executive officer were the found chief executive officer . So many leaders descale from being a startup founding father and individual contributor to run and deal a multi - billion - dollar public company is impressive !

Reflecting the clip , there are more fallen public unicorns than healthy public unicorn in this ruck . At least 20 unicorns went public in the last decade , then fell below $ 1 billion in economic value ( hello , SPACs ) , versus just 14 current public unicorns . ( These , and company antecedently value at less than $ 1 billion but subsequently acquire or recapitalized at a low valuation , are not included in our analytic thinking . )

Just 21 ship’s company were acquired , traverse a diverse set of sector : Two - thirds were in endeavour and the rest consumer . The average acquisition Leontyne Price was $ 2.4 billion , about 2x that of 2013 . Notably , 33 % of these trade involved ironware companies ( Cruise , Raxium , Ring , Zoox , etc . ) , likely a consequence of low interest rates for both unicorns and acquirers .

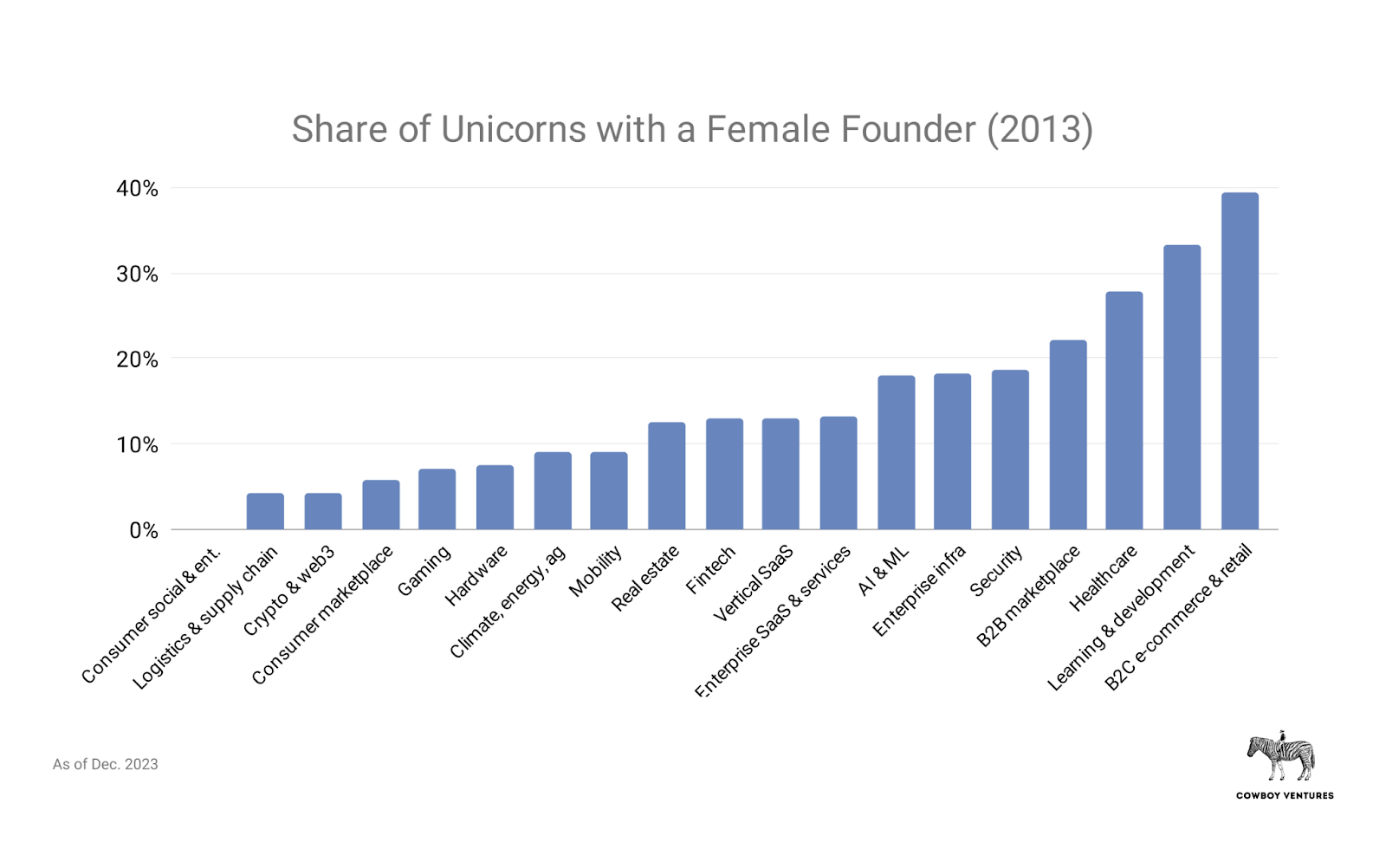

Some sectors have more gender diversity at the top vs. others.Image Credits:Cowboy Ventures

Capital efficiency declined significantly

Unicorn cap efficiency dropped importantly over the last 10 years — sharply for enterprise society . This will be high-risk for issue , venture returns , founding father and employees .

The most successful VC - backed tech companies have historically delivered oversized return . Delivering a 26x tax return within 10 yr is outstanding ( about 40 % IRR ) , but investor ( and natural endowment ) have to risk years of illiquidity versus other plus classes or industry .

In the preceding X , tech has lost its upper-case letter efficiency edge . Enterprise caller ’ formerly impressive capital letter efficiency of 26x plummet to 7x , put it in origin with consumer companies ’ efficiency ( despite typically high margins and client retention ) , which also dropped from 11x to 7x . throw that many unicorn are presently overvalued , even 7x is likely inflate .

In other speech , investors would have been secure off investing in public superunicorns like Salesforce , Amazon , and Microsoft ( up 8x , 9x , and 9x , respectively ) than in many companies in our current unicorn ruck .

Let ’s habituate an example to exemplify cap efficiency as we define it : current valuation divided by private chapiter raised .

interestingness pace again had a bighearted impact here : As rates fall , investor maintained sureness in historical venture returns , while competition grew for allocation in hot lot . This caused many to overlook valuation , business concern model margins , payback periods and burn rates as they seat .

For the startup industry to once again deliver outsized returns , we have to regain capital efficiency correction .

The above chart highlights extremely capital - efficient company , with caveats . The vast majority of these are “ papercorns , ” so this list does not reflect gain capital efficiency . Cruise ’s efficiency is based on its $ 1 billion acquisition by GM in 2016 after being establish in 2014 . The company has raise billion more since as a GM subordinate , which paint a very different icon of its current efficiency .

In our 2013 depth psychology , Workday and ServiceNow were standouts , with capital efficiency of 60x each . Their market caps are also 5x and 19x higher now , respectively .

If you ’re calculate for evidence that companionship bring up too much in the past decade , about 20 % of company on our lean are deserving less than 4x their majuscule put forward . Given how many are likely overvalued , world will in all likelihood be bad than this . The family with the lowest average capital efficiency were climate / energy , real estate , and healthcare .

OpenAI is likely to become the decade’s superunicorn, and AI the megatrend

The previous major undulation of tech innovation have each crowned a superunicorn that grows to be worth more than $ 100 billion over time , like Microsoft , Cisco , Amazon , and Meta . ( Meta is the only one to be crown within the last 10 eld . )

OpenAI is closelipped to being the first AI superunicorn , rumoredto be raising at a valuation of more than $ 100 billion , at just eight years old .

At clock time over the past 10 years , crypto look like it could be the mega - tendency of the decade . Coinbase hit a market cap of $ 76 billion in November 2021 after going public calendar month earlier ; it ’s now worth about $ 32 billion ( because Coinbase was founded in 2012 , it is not included in this dataset ) .

There are now 15 VC - back superunicorns , and they got a mint more valuable over the last decennium . Meta was deserving $ 122 billion in 2013 and is deserving about $ 950 billion , or 8x , today .

Superunicorns have major power that help produce and/or cut off integral categories — like Netflix ( worth more than Comcast , Paramount , and Warner Bros. combined ) and Tesla ( deserving more than the next five big public automakers combine ) .

Of our original dataset , three more became superunicorns in recent eld : ServiceNow , Uber , and Palo Alto Networks . And Airbnb is on the horizon at $ 88 billion . They ’ve grown to be worth more than Hyatt and Marriott combined and have the welfare of internet effects .

Superunicorn power may combine further in the coming years , with software integration and compressed capital restraint for smaller - scale player .

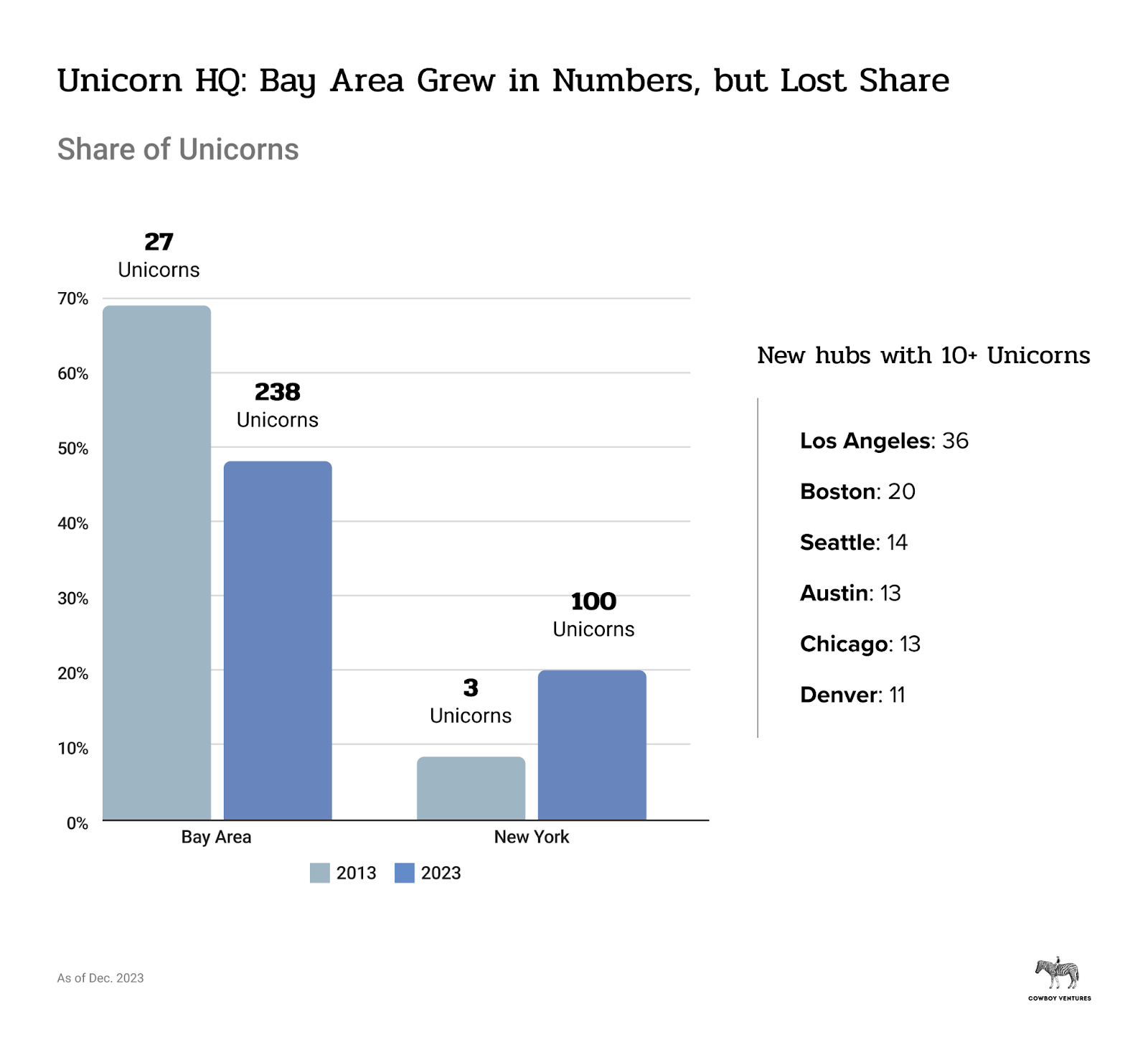

The herd spreads beyond the Bay

The Bay Area gained in numbers but lost ground as the home of unicorns as other hub grow .

The significance of geographics continues to evolve , given COVID - era effects . Many unicorns are now spread across multiple cities and offer a hybrid oeuvre surround to employee . Notably , at least 22 haveno physical HQ office , according to Flex Index data . But there are clear economic and local electronic connection burden to geographical unicorn hub . Many CEOs cite productivity , creative thinking and ethnical gain from in - soul workplace , relevant for promising future unicorn .

The Bay Area is still the largest unicorn pasture , but it fall behind a muckle of priming , from being home to 69 % of unicorn in 2013 to 45 % in 2023 . On the shiny side , it ’s home to 238 unicorn ( including the four most worthful : OpenAI , Databricks , DoorDash , and Samsara ) , 9x more than in 2013 .

It ’s undecipherable whether the Bay Area will regain its height as unicorn telephone exchange . A lot may bet on takings - to - piece of work policy , the grandness and concentration of AI talent , and the timber and price of live on compare to other hubs , as well as the next generation of unicorn .

New York ’s share grew a lot(11 % to 19 % ) as the second - largest hub . The metropolis is now home to 100 unicorns ( about 40 % are crypto / web3 or fintech , including OpenSea and Chainalysis ) .

Many geographics rise from ingest no or few unicorns to becoming HQ to more than 10 : Los Angeles ( CloudKitchens , Blockdaemon ) ; Boston ( Devoted Health , Circle ) ; Seattle ( Auth0 , Outreach ) ; Austin ( Everlywell , Workrise ) ; Chicago ( VillageMD , Tegus ) ; and Denver ( Guild , Crusoe ) .

More unicorns, more founders! But some things didn’t change at all

More unicorns spread across more geographies , and founders now hail from a extensive variety of backgrounds . Using in public available information and data fromPeople Data Labs , our listing grow to more than 1,300 founders versus around 100 in 2013 .

Eighty - three percentof unicorns in the last decade had atomic number 27 - founders ( versus 90 % in 2013 ) . On average , caller had three conscientious objector - founder — same as 10 years ago . The average age at founding was 35 , one year older than 2013 . Twenty - somethings and college dropouts are still outliers .

About 70 % of founder worked previously in technical school , very similar to our 2013 information .

Around 65 % of founders went to shoal or shape together ( a decrease from 90 % in 2013 ) , and 67 % of teams have a atomic number 27 - founder with father experience of some sort ( versus 80 % ) . Prior pursuits ranged from founding a small tutoring biz , to Jet.com and Twitch , to a shine unicorn like WeWork .

But founders ’ educational and work setting are much more diverse today . Only about 20 % of founders croak to a “ top 10 school ” ( as defined by U.S. News & World Report ) compared to two - thirds in 2013 . No school has more than 5 % “ mart share . ” Stanford still head as the alma mater of 5 % , but accounts for much less than the 33 % it did in 2013 .

About 40 % of co - father are “ non - expert ” by education , shoot down the “ father must be technical ” stereotype . Twenty - five pct majored in commercial enterprise and 15 % in the humanities , while 60 % majored in a STEAM field . In 2013 , 90 % of chief operating officer had technical degrees , a large change . According to People Data Labs , just around a third of founders previously held software engineering roles .

A surprisingly eminent 20 % of co - founders previously turn at a superunicorn , in all probability tied to the fact that 70 % of atomic number 27 - father today have worked previously in tech . Google moderate as the top breeding ground for unicorn founders : We find 87 with workplace experience at Google , which is about 6 % of co - founders .

Diversity has lots of room for improvement

As unicorns proliferate , cobalt - founder ’ geographies , education and work backgrounds did , too . This is exciting news for future founders .

Improvement has been dumb when it come to co - founder grammatical gender diversity : Just 14 % of unicorn now have a distaff Colorado - founder ( versus 5 % in 2013 ) , and 5 % have a female introduction CEO ( compared to none in 2013 ) .

These numbers are still quite pathetic : There are more founders mention Michael , David and Andrew than there are women CEOs of unicorn . At this rate , we wo n’t reach equal grammatical gender representation until 2063 .

It ’s challenging to pass over other facial expression of personal identity like airstream or whether the person is a phallus of the LGBTQ+ community . Myriad studiesshow divers teams deliver better results , including indownturns , so improving multifariousness given the tougher times seems like a no - brainer .

showcase in point : The elect public unicorn club has higher gender diversity at the top : 14 % have female chief operating officer ( two ) and 21 % have distaff co - founders ( three ) .

Looking ahead: The next 10 years

If the past is a prologue , anticipate variety in front for this herd of unicorn and a very different , much larger list in 2033 . routine , sectors , and father backgrounds changedso muchthis past decade .

Our original 39 had assorted fortune . About half are presently public companies and around 80 % are worth more today . Three more became superunicorns ( ServiceNow , Palo Alto Networks and Uber ) , and net event companies ( we love net effects ! ) also grew stronger ( Uber + Airbnb + LinkedIn = value of whole original listing ) .

endeavour companies fared more reliably , increase 6x in value since 2013 . All but one ( Rocket Fuel ) sustain unicorn position through the second decade . So consumer companies had bumpier journey . Thirty - three per centum are small-scale today ( Lending Club , Yelp ) , and some have had fire sales or shut down ( Tumblr , Zulily ) .

The sizing , exfoliation and issue of VC house will also alter in the add up age . In 2013 , there were about 850 active venture funds . Today there are about 2,500 . As unicorns come down out of the dataset , we bear morechange in VC firms . Some VCs will turn in , some will raise smaller funds ( right-hand - sized for good riposte ) , downsize teams , or fold up . Given the likelihood of lower return from many papercorns in this herd , change seems inevitable . We ’ve seen “ VC melodious chairs ” in former cycles , and it ’s happening again .

As notice in ouroriginal post , multi - billion - buck VC fund want multi - billion - dollar outcomes to deliver satisfactory return . As store make bigger , their incentive changed and repulse round sizes and valuations higher , with some negative consequences . We do n’t carry VC firms to go back to 2013 in staff or AUM . But the deterrent example here should give father , VCs and LPs luck of caution about too much money , too other and too fast — and from whom .

That said , despite the sin of the past decade , applied science continues to change our world . Founders have access to more inspiration , role model , working capital and talent than ever . Unicorns are still comparatively few and lowly versus the telephone number of much great , slower - travel companies with outdated engineering . We see land mile of green field for more unicorns in class to fare .

What does this all mean?

The march of technology has create so many more unicorns , wait on a much wider array of sector . cranch the turn , you ca n’t help but reflect on the enormous societal and fiscal impact VC - back tech has had and get activated for more history to unfold .

It feels like we ’re living during a new Industrial Revolution , powered by software , that is starting to circularize to more and more sectors of society . Less than 10%of today ’s Fortune 500 companies are technical school companies . In the next 10 year , we expect the share to climb — and many to be from the 2023 ruck .

We ’ve also learned unerasable lesson . That macroeconomic factors and cycles weigh . The massive inflow of secret upper-case letter make a proliferation of companies but a declivity in capital efficiency discipline , which will degrade fiscal outcomes for years , given how many are still papercorns .

The bicycle is far from over . The venture ecosystem will feel the wallop of the retiring ten in years to occur via more shutdowns , down bout and marred founders , employee and investors .

evaluation is also clearly a convenient but imperfect , impermanent measure of success . Becoming a unicorn at a new age might even be a curse ! Founders today can see how chasing vanity valuations with weak underlying fundamentals can lead to unintended poor outcomes .

There were time in the ten when many believe building a unicorn was easy and mutual . Elder unicorn know that it ’s not . It requires the sustained conjuration of product and velocity , client love , business model economic science , capital efficiency , relentless execution and more , over many years .

We tip our hats once again to the hundreds of companies ( no longer tens ! ) that accomplish and maintained unicorn milestones . Building and sustaining more than $ 1 billion in time value in the retiring 10 years was statistically improbable and a major , extra squad effort .

For more like this ( although we promise other posts are forgetful ) , give us a follow onLinkedIn , Medium , and X ( @CowboyVC,@aileenlee,@allegra_v2 ) .

Correction : This story was updated to reflect that 20 % of unicorns on the tilt are on the cusp , rather than 201 % .