Topics

Latest

AI

Amazon

Image Credits:Bryce Durbin / TechCrunch

Apps

Biotech & Health

Climate

Image Credits:Bryce Durbin / TechCrunch

Cloud Computing

mercantilism

Crypto

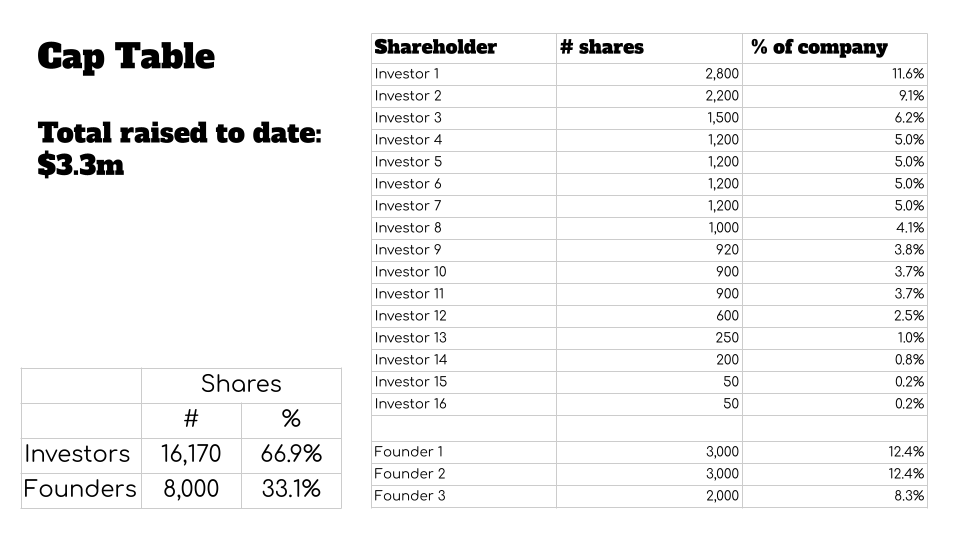

This cap table is a reproduced, accurate illustration of the cap table that was in the deck. It’s been simplified and redacted to remove the names of the investors.Image Credits:Haje Kamps/TechCrunch

Enterprise

EVs

Fintech

Fundraising

widget

back

Government & Policy

computer hardware

layoff

Media & Entertainment

Meta

Microsoft

Privacy

Robotics

Security

societal

Space

Startups

TikTok

Transportation

speculation

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

adjoin Us

This Norwegian hardware startup may be in for a nasty surprise when it starts raising funding

The CEO of a Norse ironware startup apportion a slant pack of cards with me that had an unusual slide : It included the society ’s capitalization table — the equipment failure of who have what part of the company . Typically , cap table are portion out in the diligence phase of investing .

assume a closer look at the table , something is significantly amiss :

The problem here is that the company has afford up more than two - thirds of its equity to stir $ 3.3 million . With the party starting a $ 5 million fundraising round , that represents a serious hurdle .

TechCrunch talk to a number of Silicon Valley investor , posing the conjectural of whether they would invest in a founding father who presented a jacket crown table with similar dynamics as the one show above . What we learn is that the ceiling table as it abide today essentially take a crap the company uninvestable , but that there is still hope .

Why is this such a big problem?

In less advanced startup ecosystem , investors can be tempted to make forgetful - sighted determination , such as trying to take as much as30 % of a company ’s equityin a relatively small financial support round . If you ’re not familiar with how startups exploit in the farseeing test , that can seem like a sensitive goal : Is n’t it an investor ’s job to get as much as they can for the money they invested ? Perhaps , yes , but blot out within that moral force is a de facto toxicant contraceptive pill that can limit how large a inauguration can maybe get . At some point , a caller ’s founders have so small fairness left , that the cost / benefit psychoanalysis of the grueling death - borderland that is consort a startup starts shifting against them go along to give it their all .

“ This cap table has one elephantine red pin : The investor root owns doubly as much as the three father immix do , ” said Leslie Feinzaig , worldwide spouse atGraham & Walker . “ I need founders to have a lot of pelt in the plot . The good founders have a very mellow earning potential — I want it to be unquestionably worth their meter to keep give-up the ghost for many yr after my investiture in them … I want the motivator to be completely align from the get go . ”

Feinzaig say that this company , as it stands , is “ essentially uninvestable , ” unless a newfangled tether comes in and fixes the cap table . Of of course , that , in itself , is a mellow - risk move that is going to take a lot of time , energy , money and lawyers .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

“ Fixing the cap mesa would mean cramming down existing investors and returning possession to the founders , ” Feinzaig say . “ That is an aggressive move , and not many new investor are going to be willing to go to those length . If this is the next OpenAI , they have a bonny shot at feel a leading who will serve clean this up . But at the seed leg , it is brutally hard to remain firm out so clearly , let alone in the current VC market . ”

With unmotivated beginner , the company would potentially exit sooner than it might have otherwise . For those of us who live and breatheventure capital line of work models , that ’s a bad sign : It conduce to mediocre result for startup founders , which limits the amount of angel investing they will be able to do , taking the first appearance - level financial support out of the startup ecosystem .

Such an other exit would also circumscribe potential upsides for the VCs . A company that exits later at a far higher valuation increases the chance of a huge , 100x fund - returning event from a single investment . That , in turn , entail that the limited partners ( i.e. the common people who clothe in VC business firm ) see decreased returns . Over time , the LPs will get bored of that ; the whole point of VC as an plus division is incredibly high risk , for the potentiality of ludicrously good recurrence . When the LPs go elsewhere for their high - risk of infection investiture , the intact startup ecosystem collapse due to lack of funds .

There is a potential solution

“ We by all odds desire to try and keep ejaculate and Series A capital tables see ‘ normal , ’ ” Hunter Walk , general married person atHomebrew , assure TechCrunch . “ Typically investor own a nonage of the company in sum , the father still have healthy ownership , which they ’re vest into , and the company / team / pool has the respite of the plebeian [ stock ] . ”

I asked the chief operating officer and father of the hardware company in inquiry how the company mother itself into this mess . He asked to remain anon. so as not to endanger the company or leave his investors in a bad spot . He explains that the team had a bunch of large - company experience but lack experience in the startup world . That means they did n’t know how much work it would take to get the product to grocery . Internally , he said that the company accept the full term “ just for this round , ” and will engage a high valuation for the next turn . Of course , as the company kept running into delays and issues , the investors ran a hard bargain , and facing the choice of run out of money or taking a spoilt deal , the company decide to take the bad business deal .

The CEO say the company is building a solution for a trouble get by 1.7 billion citizenry , and that the society has a novel , patent of invention - pending Cartesian product that it has been successfully testing for six months . On the face of it , it looks like a companionship with multibillion - buck potential difference .

The current design is for the ship’s company to elevate the current $ 5 million beat , and then make an attempt at correcting its ceiling mesa later . That ’s a unspoiled idea in theory , but the startup has ambitions of raising from international investor who are going to have some opinions on the jacket table itself . And that may raise interrogative sentence about the founders themselves .

Cleaning up a cap table

“ Situations like these which deserve ‘ clean up ’ certainly are n’t automatic ‘ bye ’ but they require the company and cap table to be comfortable with some restructuring in guild to gear up the bonus bodily structure alongside the funding , ” Walk say . “ If we feel like it ’s go to be near unimaginable to reconcile ( even if we play the ‘ spoiled guy ’ on behalf of the founders ) , we ’ll often rede the chief operating officer to work out it before raising more capital . ”

Mary Grove from Bread & Butter Ventures agrees that it ’s a red flagstone if founder own so little of their company at the seed stage — and in finicky that the investors own the other 66 % , rather than some of the equity having gone to key hire .

“ We ’d require to understand the reasons behind why the company has taken such dilution this too soon . Is it because they are ground in a geographics with limited accession to chapiter and some early investor — either not have with VC or bad actors — aim advantage ? , ” Grove told TechCrunch . “ Or is there an rudimentary reason with the business that made it really backbreaking to conjure capital ( take a looking through taxation increment / churn , did the company make a major pivot that made it essentially commence from scratch , was there some litigation or other challenge ) ? reckon on the reason , we could get behind happen a path forward if the business and team met our filter for investment and we conceive it is the right partnership . ”

Grove said that Bread & Butter Ventures wish to see the founder own a combined 50 - 75 % at this phase of the company — the opposite of what we see in our above replication — abduce that this ensures alignment of interest and that founders are given recognition and incentive to build for the length ahead for a venture - backed company . She indicate that her house might have a terminal figure sheet that includes disciplinary measures .

“ We would quest that the laminitis receive extra choice grants to convey their possession up to the combined 50 - 75 % prior to us leading or investing in the new round , ” Grove says , but she points out the challenge in this : “ This does intend survive investor on the cap table would also share in the overall dilution to make this reset chance , so if everyone is onboard with the plan , we ’d go for to be all align on the path forward to support the father and ensure they have possession to carry through their big vision and to take the company through to a great exit . ”

in the end , the overall jeopardy word picture depends on the specific of the fellowship , and reckon on how Washington - intensive the patronage will be in the hereafter . If one more ascent could get the troupe to hard cash - rate of flow neutral , with healthy organic increment from there , that ’s one thing . If this is a type of business that will continue to be cap - intensive and will ask multiple round of significant funding , that changes the risk of exposure profile further .

Rewinding the choices

The chief operating officer told me that the ship’s company ’s first investor was a Norse corporate , which sometimes spins out its own companies based on technology creation it has make grow . In the case of this companionship , however , it made an external investment at what the founder now describes as “ below - market term . ” The CEO also mentioned that existing investors on its board suggested raising money at small valuations . Today , he harbors regrets , see that the choices might put the caller ’s long - term winner in risk . He articulate he suspected that VCs would n’t mean his company was investable , and making indisputable that this issue was front and center for succeeding investor is why he put the cap table as a slide in the slide deck in the first place .

The problem may not be isolate to this one father . In many developing startup ecosystem — such as Norway ’s — honorable advice can be hard to come by , and the “ average ” are sometimes determine by people who do n’t always infer how the venture model looks elsewhere .

“ I do n’t require to alienate my investors ; they do a great deal of good thing as well , ” the CEO said .

Walk say that bad doer are , regrettably , not as rarified as he ’d like , and that Homebrew often come across situation where an incubator or gun owns 10 % or more on “ exploitive terms , ” or where greater than 50 % of the ship’s company already sold to investors , or where a large part of the shares are allocate to fully vest founding father who might no longer be with the company .

The upshot could be if non - local investor want to invest in early - degree companies in developing ecosystems , they have an incredible opportunity : By offering more sensible terms to call early - stage startups than the local investors are willing to give , they can pick the good investment and leave the local investors to oppose over the scraps . But the obvious downside is that this would represent a tremendous fiscal drain from the ecosystem : or else of keep the money in the country , the riches ( and , potentially , the endowment ) goes overseas , which is just the sort of affair the local ecosystem is stress to avoid .

If you have intelligence tips or information for Haje , you could share it with himover emailorSignal .