Topics

Latest

AI

Amazon

Image Credits:Buena Vista Images(opens in a new window)/ Getty Images

Apps

Biotech & Health

Climate

Image Credits:Buena Vista Images(opens in a new window)/ Getty Images

Cloud Computing

mercantilism

Crypto

Enterprise

EVs

Fintech

fund raise

Gadgets

punt

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

seclusion

Robotics

Security

societal

blank

startup

TikTok

Transportation

Venture

More from TechCrunch

outcome

Startup Battlefield

StrictlyVC

Podcasts

television

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

If you look at venture Washington investing trend in the cybersecurity market , you ’d be excused for thinking that the sector was struggling .

Crunchbasedata indicatesthat cybersecurity startup raised $ 1.9 billion in the third poop , across 153 deals . The amount was better than the $ 1.7 billion startups in the sphere raised in Q2 2023 , but deal enumeration decline from 181 deals .

The Exchange explores startups , market place and money .

But Crunchbase go on to note that with third - quarter cybersecurity speculation funding down 30 % compared to the year - ago period , investment in the family could fall to its lowest level since 2019 . Other author arealso tracking a declinein cyber venture investment this year .

That ’s not a huge surprise since venture capital investment haslargely been in hideaway in 2023compared to the past several old age , but given public cybersecurity companies ’ execution these days , we ’re a little fleck puzzled at just how half-hearted venture investment in this space is .

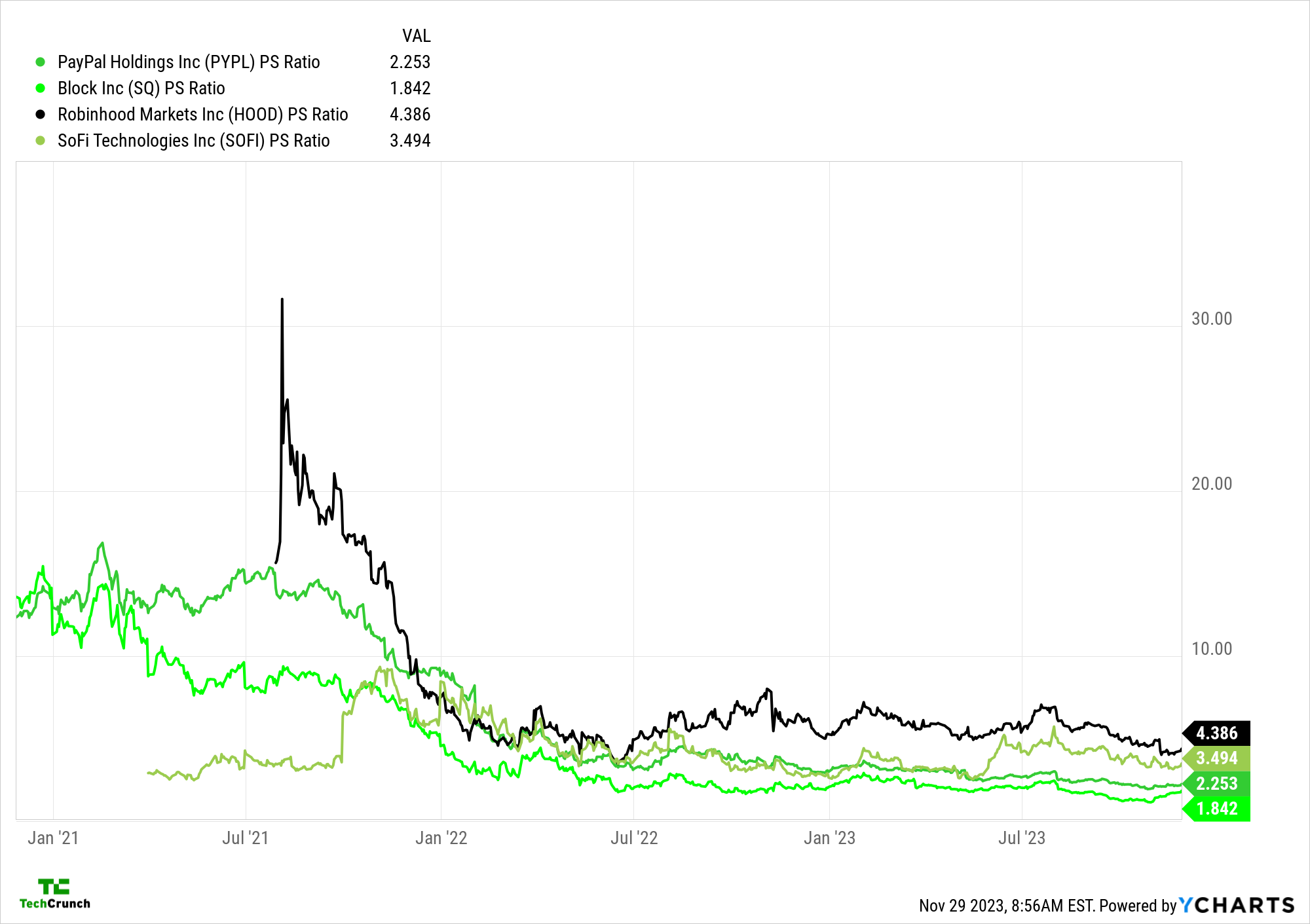

It make sentiency that fintech as a sectoris suffering , since those companies ’ growth rate have get down , and the startups that benefited from pandemic - driven tailwind have since run across their valuations slashed .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

PayPal ’s revenue , for example , arise 8 % in the third quarter , and the caller ’s monetary value / sales multiple has collapsed in late days ( price / sales is the grown - up version of a startup tax income multiple ) . Observe :

startup building fintech product will contend to earn a threefold - digit revenue multiple when they go public . Less speculation capital bodily process makes sense here , because you simply do n’t get as much future market cap for each clam of revenue that fintech startups yield .

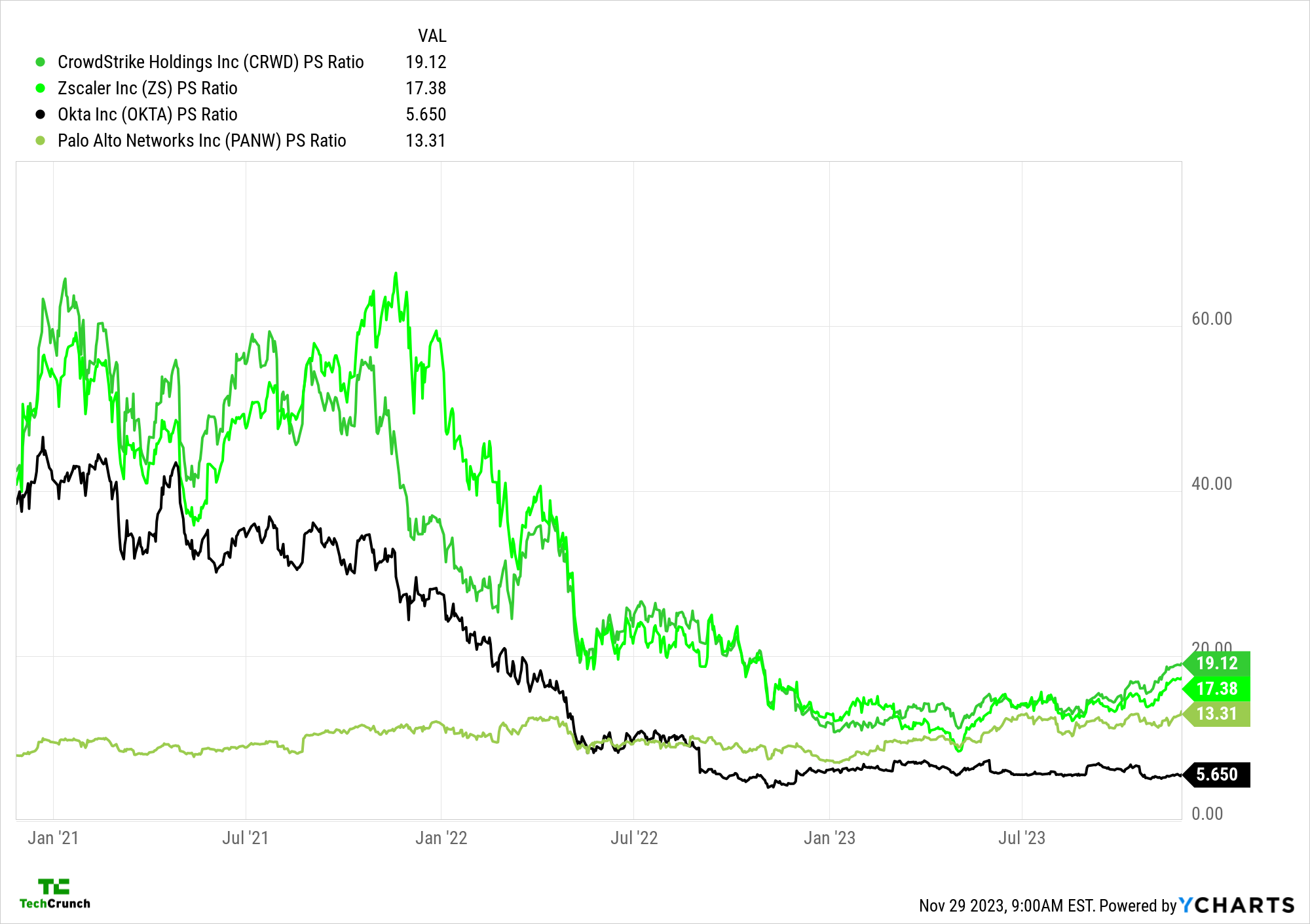

Observe a interchangeable chart , but featuring cybersecurity companies :

Here , we see a interchangeable compaction of toll - sales multiple , but theendingratios are different . Apart from Okta , whose shares are presently being hammered due toa security breach , leading cybersecurity companies are trading at double - digit multiples today . That ’s far more attractive than what fintech can manage .

Hence our confusion : If cybersecurity party are worth so much more per dollar of revenue , why are n’t venture investor rush to invest in the sphere ? After all , so far this year , Palo Alto Networks ’ share Leontyne Price has almost repeat , Zscaler is savour a 76 % gain this year , and CrowdStrike is up about 106 % . That ’s one infernal region of a recovery .

To see if we are missing something critical , The Exchange comprehend into Zscaler ’s and CrowdStrike ’s quarterly results this week , and compared what we found with Microsoft and Palo Alto Networks ’ answer .

TL;DR : Cybersecurity looks live as heck , and companies in the space are growing like skunk compare to other parts of technical school .

Here ’s what we ’re seeing :

Lots of gross increase across the board ? Yep . firm earnings multiples compared to other technical school sector ? agree . And yet , cybersecurity speculation capital investiture remains lustreless .

Perhaps venture working capital investment charge per unit lag market performance more than we thought ? Or has late - stage investing declined so much that no technology subsector can really mail impressive investment funds number ? I ’m not sure , but I would play that next yr , we ’ll see cybersecurity venture investiture post a solid recovery .