Topics

late

AI

Amazon

Image Credits:DrAfter123(opens in a new window)/ Getty Images

Apps

Biotech & Health

Climate

Image Credits:Waveup

Cloud Computing

Commerce

Crypto

Image Credits:Waveup

Enterprise

EVs

Fintech

Image Credits:Waveup

fund raise

Gadgets

gage

Image Credits:Waveup

Government & Policy

Hardware

Image Credits:Waveup

Layoffs

Media & Entertainment

Image Credits:Waveup

Meta

Microsoft

Privacy

Image Credits:Waveup

Robotics

Security

Social

Image Credits:Waveup

Space

Startups

TikTok

shipping

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

adjoin Us

In 2023 , associate and partner at Waveup reviewed over 300 pitch decks , from pre - seed to Series C. In every other deck we ’ve try , one of the most crucial lantern slide — the go - to - market ( GTM ) — has been bollocks up or skipped altogether . As you might guess , these deck do n’t get fund chop-chop .

Your GTM motion is imperative for investors , specially during the other stage . From pre - seed to later stage , investors powerfully handle about three things :

The last one is heavily dependent on an forward-looking , credible go - to - grocery advance . Here , investors require evidence that you know how to set up your Cartesian product and boost your growth fast , ideally with minimum investment . Long move are the times of “ ontogeny at all monetary value ” and “ spray and implore ” selling tactic .

In 2024 , VCs will seek a concrete useable plan and firm evidence of competitive moats in your GTM approach . It ’s going to be a year of no b .

Stop treating your go-to-market plan as a marketing strategy

Your go - to - market ≠ marketing strategy . To some , that might go like an obvious statement . To the bulk , however , it ’s not as unmortgaged . The number of founder using their GTM slide to describe a marketing strategy is downright debatable .

Your GTM is about much more than merchandising . It ’s an arch over plan of attack that should cover element such as the butt market section ( i.e. , ideal customer profile ) and the skill and distribution strategies you ’ll employ to plunge and promote your offer . These elements must be discernible in the GTM section of yourpitch deck , with the degree of point and fullness tailored to your particular stage .

unluckily , GTM slides filled with generic digital selling distribution channel and body process like SEO ( hunting railway locomotive optimisation ) or SMM ( social medium marketing ) — without any explanation of what leverage they cater in this case — are a standard account . Below is a slide from our D2C client that clearly illustrates what NOT to do with your GTM slide .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

What ’s improper with this example :

How to improve it

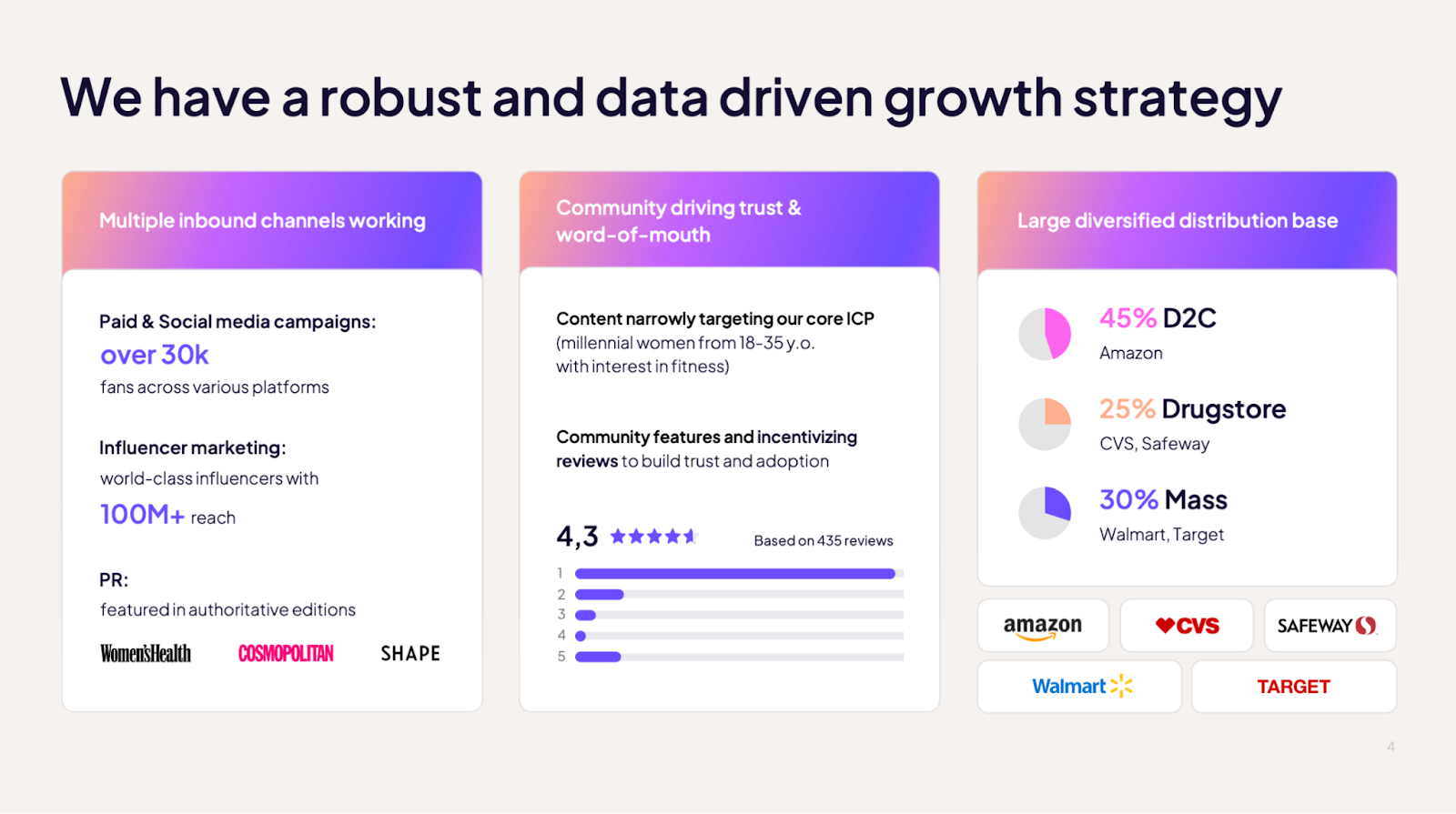

An exercise of how you could make over the slide to broaden the focus from marketing only to the overall GTM approach :

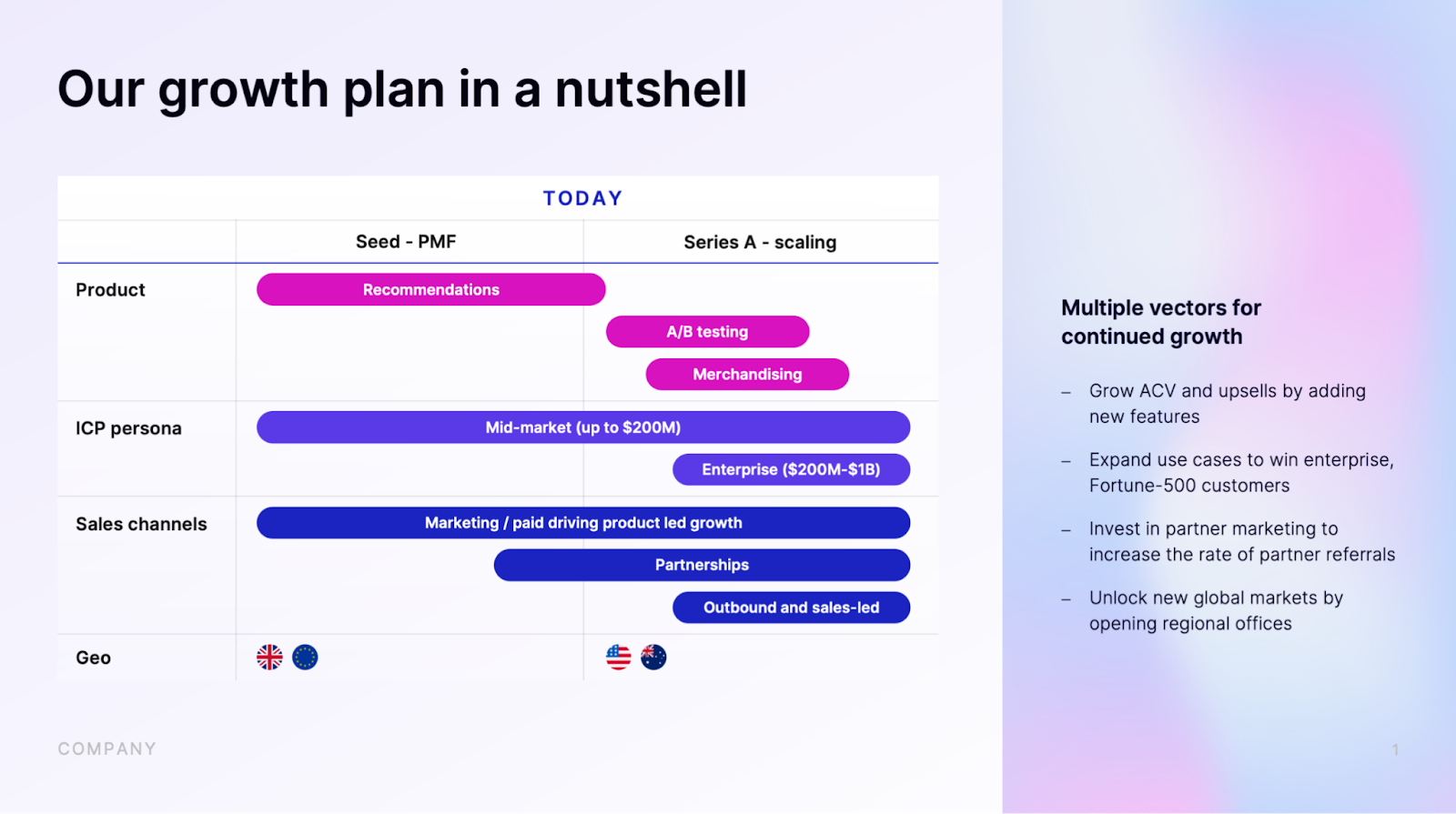

Talk about your ideal customer persona (ICP) now and in 6, 18, 24 months

Even if you ’re selling towels and your target marketplace is “ everyone who shower , ” you ca n’t start by commercialize to every person in every location . In 99 out of 100 cases , you ’ll begin by zero in on a specific market segment , customize your production and approach to appeal to your ICP representing that segment .

This initial engrossment on a undivided securities industry segment is vital . Once you ’ve seize it , you’re able to move upmarket or broaden your geography , adapting your production and acquirement scheme . This approach is known as a foothold grocery store scheme , which is what investors attempt in your GTM plan .

Unfortunately , many startup leap out into pitching without birth a coherent initial ICP and focus . Or they think they have one , but their intro tell a different story .

I ’ve seen many former startups with a “ multifaceted ” GTM scheme assay to target multiple geographies with different mathematical product through various channels . In the pitch deck , this looks like a hodgepodge with no specificity of who you will point , how , and when .

Your go - to - market slide is conjecture to sway investors that you have a solid operating architectural plan for the next 18 + months on win the market and outfox the competition , supported with actionable , concrete milestones and , ideally , early grounds of why this scheme will operate .

A upright scratch line is walking investors through your market place vision and logical system . turn to the decisive motion : Who are your client ? What ’s your GTM motion ? What TV channel do you use — online / offline acquisition , inbound / outbound ? Why did you prefer those channel ?

recollect : Your strategy is dynamic and should evolve with your ICP as you engage more significant markets . Show investors you understand how to do that and show them the timeline .

An example below can be the inspiration , but you’re able to take it one step further and turn it into a proper operational program that also breaks down expected milestones ( number of users , partners , revenue , etc . ) per each stage to try out indisputably to investor that you have a solid capital punishment plan going fore .

Be very intentional with your go-to-market motion

Regarding SaaS startups , specifying your growth movement — why you ’re choose it and what it will be — is paramount at any microscope stage . Your motion type depends on your market place , merchandise , and competitive moat . And here ’s where this connect to the previous point : You ca n’t figure out the proper GTM motility for your product without understanding your ideal customer ’s demand .

The most distinctive go - to - market motions are product- or sale - led ( with the recently workaday new kid on the block — community - led growth ) . Yet , beginner often “ go loanblend ” by bundling together various increment move when their product and interview do n’t call for it ( yet ) . A typical statement might be , “ We will pursue a intersection - led motion supplemented with an go-ahead - led motion , ” all without moult any visible radiation on why this combination would be in effect in their case .

Such an overture is all ripe per se . employ different motions might be warrant when you have already solidified your initial persona with an subsist product and are now poise to expand your market and cut your product consequently .

Just check you do this in a well timed manner because adding a sales - lead motion to sell a reasonably unproblematic , SMB - prised solution with an average contract time value under $ 4,000 will sink your social unit economics and chance to raise chapiter .

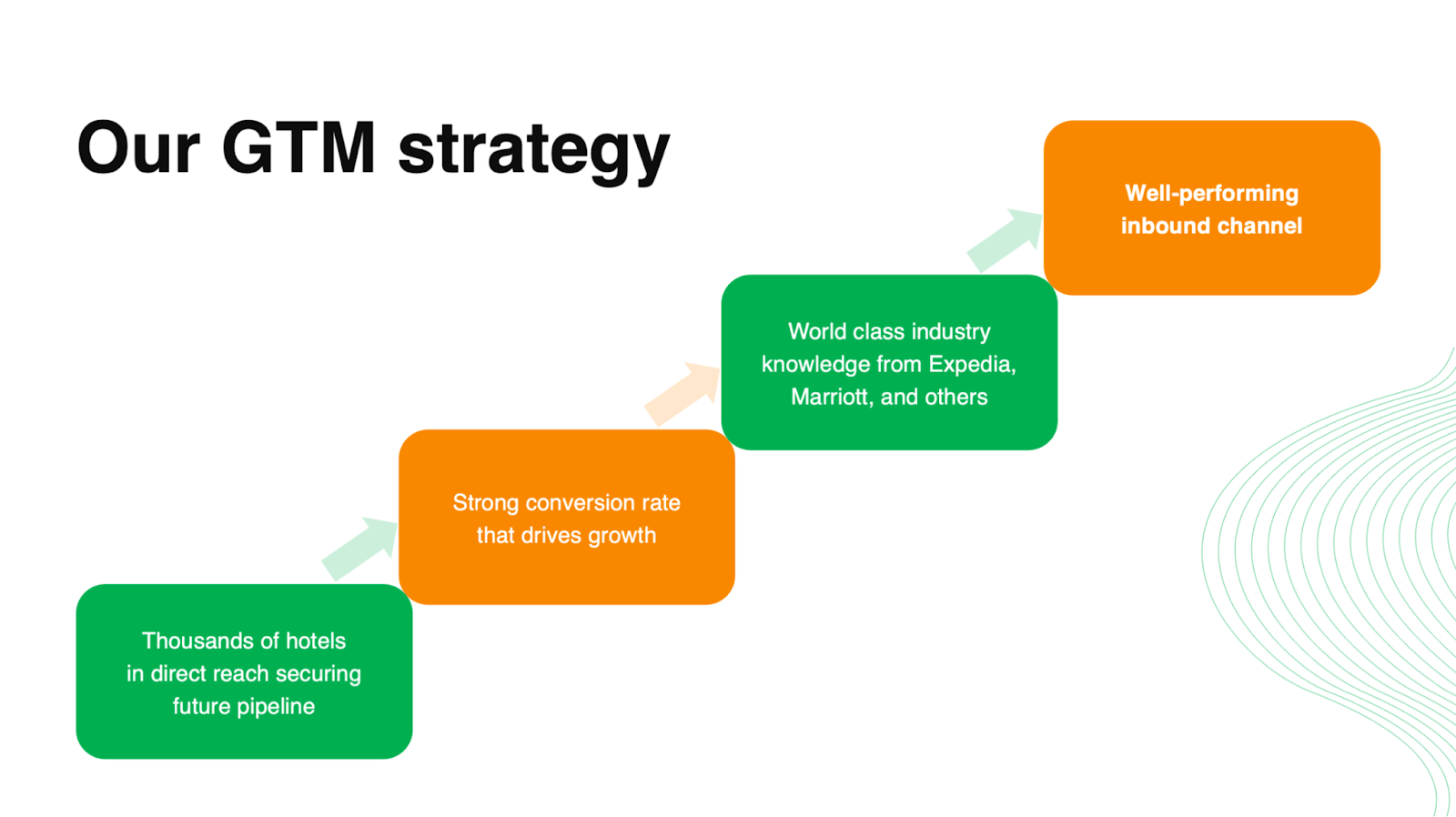

Do think about the competitive moat in your GTM plan

The No . 1 mistake from all the deck we see is generic go - to - market strategies standardized to the balance of the market . you may only sway investors that you will carry out better if you have an underlying advantage in your GTM approaching .

The fixing is easy . Think about your assets or moats that will allow you to surmount quicker or cheap . establish how the strategy chosen links to your experience and try how it will give you an edge over your competition .

For instance :

These facet give you a cutoff to client , and that ’s what investors will be sold on .

For example , here ’s how we rework the slide above to tug more interest from investors :

Show, don’t tell — use numbers to support your claims

The sliding board above is an excellent lesson of how the identification number can totally change the tale and perception of your strategy . Too often , we see GTM slides that are just irksome — not to mention completely unlikely .

This is lazy and flimsy ; avoid go down into this trap . Whenever you ’re trying to force a point abode , nothing does it better than numbers that muse real grip .

Chances are , by the sentence you pitch to investors , you ’ve gained a glimmering of grip in the market . If that ’s the case , do n’t just say it — show metrics that bolster your affirmation .

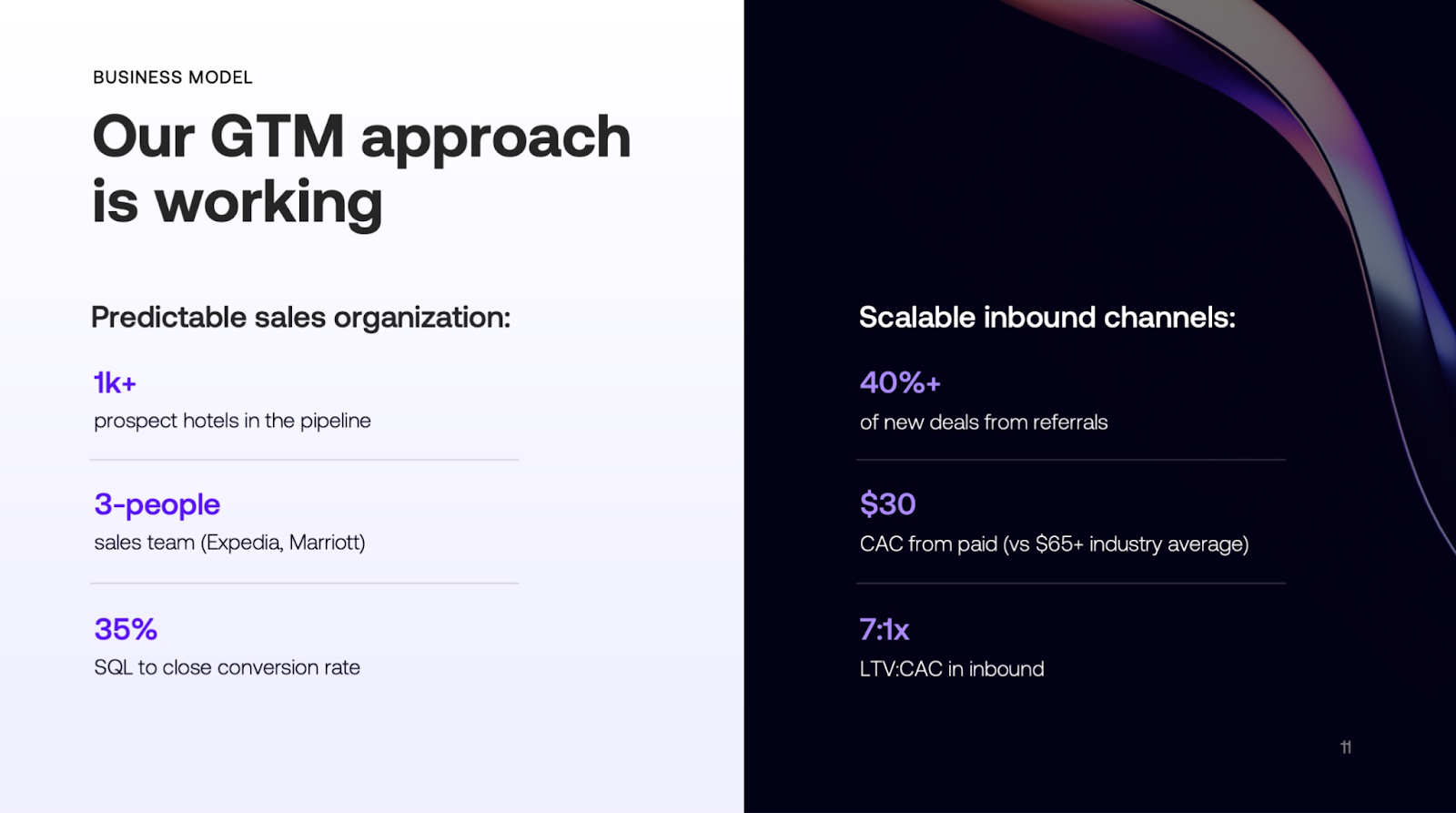

LTV : CAC , vengeance prison term , conversions , organic referral growth : If these metrics stand unfluctuating against diligence benchmarks , pull them up . A great way to draw investor ’ attention is to open up your slide boldly with the statement , “ Our scheme is work , ” and watch up with the metrics that signal growth .

If you still take to start go at full throttle valve and only some canal produce issue , hone in on those carrying into action .

For example :

Here is how we did that for a travel payment platform :

plunge into your current KPIs to unearth grip sign demonstrating that your strategy makes gumption . Find the proof points that will de - risk the investment for the funders . It will always take special piece of work , but doing so will also make you extra points for discernment and chase the key metrics .

Remember , your go - to - market strategy is n’t just a marketing footnote in your rake deck ; it ’s the crux of your growth programme . Do n’t pretermit the mark .