Topics

recent

AI

Amazon

Image Credits:Cleva

Apps

Biotech & Health

Climate

Image Credits:Cleva

Cloud Computing

Department of Commerce

Crypto

Image Credits:Cleva

Enterprise

EVs

Fintech

fundraise

Gadgets

bet on

Government & Policy

Hardware

layoff

Media & Entertainment

Meta

Microsoft

seclusion

Robotics

Security

Social

Space

startup

TikTok

Transportation

Venture

More from TechCrunch

event

Startup Battlefield

StrictlyVC

newssheet

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

get through Us

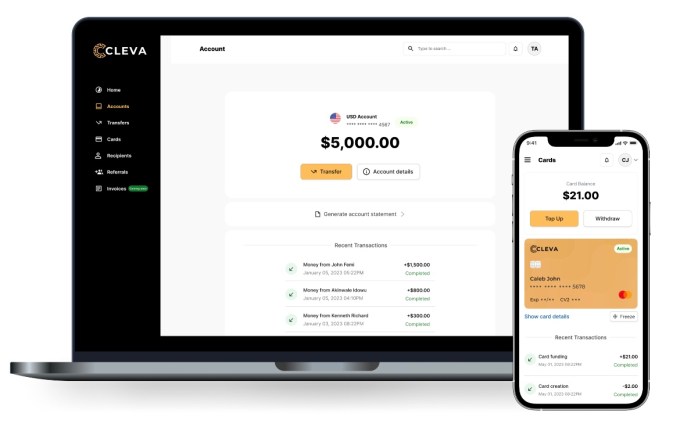

Nigerien fintechCleva , concenter on make a banking platform for African person and businesses to receive international payments by opening USD chronicle , has raised $ 1.5 million in pre - seed funding .

The round was led by 1984 Ventures , an other - level venture chapiter house establish in San Francisco . Other participant in the round include The Raba Partnership , Byld Ventures , FirstCheck Africa and several holy person investor .

Aaron Michel , a partner at 1984 Ventures , expressed support for Cleva ’s founding father , Tolu AlabiandPhilip Abel , observe that their intersection provides a means for Africans to navigate hyperinflation challenge , which he depict as a monolithic opportunity . “The team is unambiguously qualified to address this given their experience building banking merchandise at Stripe and rich platforms at AWS . The telling other development is a testament to the team ’s unparalleled capacity to execute across Africa and the U.S. , ” he append .

Y Combinator also participated in Cleva ’s pre - seed round as the fintech start its involvement in the accelerator ’s wintertime 2024 batch this month . The famed gas pedal has antecedently back African startups avail freelancers and remote actor on the continent open U.S. banking company accounts for receiving payments , savings and currency exchange , such asGrey FinanceandElevate(formerly Bloom ) .

CEO Alabi , in an interview with TechCrunch , explain the principle behind launching the platform in August despite a competitive landscape painting with other political program like Techstars - backed Geegpay andPayday .

First , she underscored the tenacious challenges Africans still confront in obtain international payments for their skills and product , a pain point both founders identified through secondhand experience and extensive inquiry . They estimate the grocery store for facilitating defrayment for remote actor and freelancers in Africa to be an $ 18 billion chance .

Another important factor is founder - market fit . Both founder share a strong connexion with the African market . Born and raised in Nigeria , they moved to the U.S. on college scholarships , where Abel go to MIT while Alabi afterwards run short to patronage school at Stanford . Notably , they lend valuable proficient and product experience from their roles at major technical school companies , including Amazon , Stripe , AWS and Twilio .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

“ Then there ’s the marketplace opportunity , ” notice Alabi in the audience . “ The trouble that we ’re endeavor to clear , which is enabling masses to receive international defrayment , is not a Nigerian problem nor an African one . It ’s a global problem ; people in Latin America , Asia and even Canada need to have buck for their work and service . We ’re starting with Nigeria because we know the mart and it ’s also a big grocery store . But we feel like because of our backgrounds , we ’re very well positioned to solve this trouble at a global plate . ”

Cleva has initially launched its services to Nigerians , allow users to spread USD accounts , with onboarding requiring a Bank Verification Number ( BVN ) and a government - issued ID . ( It ’s deserving highlighting that while Cleva exclusively provide USD chronicle , other players offer GBP and EUR accounts . ) In the four calendar month since its launch , the Delaware- and Lagos - based fintech has facilitated the opening of U.S.-based account for “ one thousand ” of Nigerians , work over $ 1 million in monthly requital while experiencing calendar month - on - calendar month receipts growing of 100 % , according to the CEO .

As Alabi highlights , the fintech tell itself from the competition in two key areas : client experience and business model . “We trust in going above and beyond for our customer to have a great experience . This is the feedback we ’ve get from client . They know that when they email us or reach out to our customer support , it wo n’t take one hebdomad or two weeks , ” she remark .

Meanwhile , the YC - backed inauguration , which give revenue when users swap and exchange their funds ( in USD accounts ) for the local currency ( in naira for now ) , also saddle a 0.9 % fee on deposits into customer ’ USD accounts . Notably , Cleva cap fees at $ 20 , distinguishing itself from competitors that often use an uncapped 1 % fee no matter of the amount welcome .

search onwards , Cleva has several upcoming products in its pipeline to diversify revenue current , including USD cards and savings in U.S. asset , CTO Abel said in the interview . Also , Cleva , which has had to surmount through the common challenge for fintechs in its category , such as finding the right banking mate and talent , will soon target Africans in the diaspora . To that final stage , other upcoming product , per its internet site , admit allowing users to create professional invoices and send USD globally , entering a competitive remittance category where platforms like Flutterwave ’s Send , Chipper immediate payment , Lemfi and Afriex are active .

The full addressable market for fintechs focusing on freelancers and Africans in the diaspora is poised for free burning development . This drift is fuel by a globalizing world , where more young Africans upskill and export their talent to encounter the increase need for skilled individuals . “Long full term , we are undefended to Cleva evolving from just being a ware - only service to being a platform issue APIs to do a clustering of other things that aid us distribute services across other African countries or around the human beings , ” Abel articulate , supply more detail on Cleva ’s future roadmap .