Topics

Latest

AI

Amazon

Image Credits:Tek Image Science Photo Library(opens in a new window)/ Getty Images

Apps

Biotech & Health

mood

Image Credits:Tek Image Science Photo Library(opens in a new window)/ Getty Images

Cloud Computing

Commerce

Crypto

Image Credits:YL Ventures

go-ahead

EVs

Fintech

Image Credits:YL Ventures

Fundraising

Gadgets

punt

Image Credits:YL Ventures

Government & Policy

ironware

Image Credits:YL Ventures

layoff

Media & Entertainment

Image Credits:YL Ventures

Meta

Microsoft

Privacy

Image Credits:YL Ventures

Robotics

Security

societal

Image Credits:YL Ventures

Space

startup

TikTok

transport

Venture

More from TechCrunch

Events

Startup Battlefield

StrictlyVC

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

Contact Us

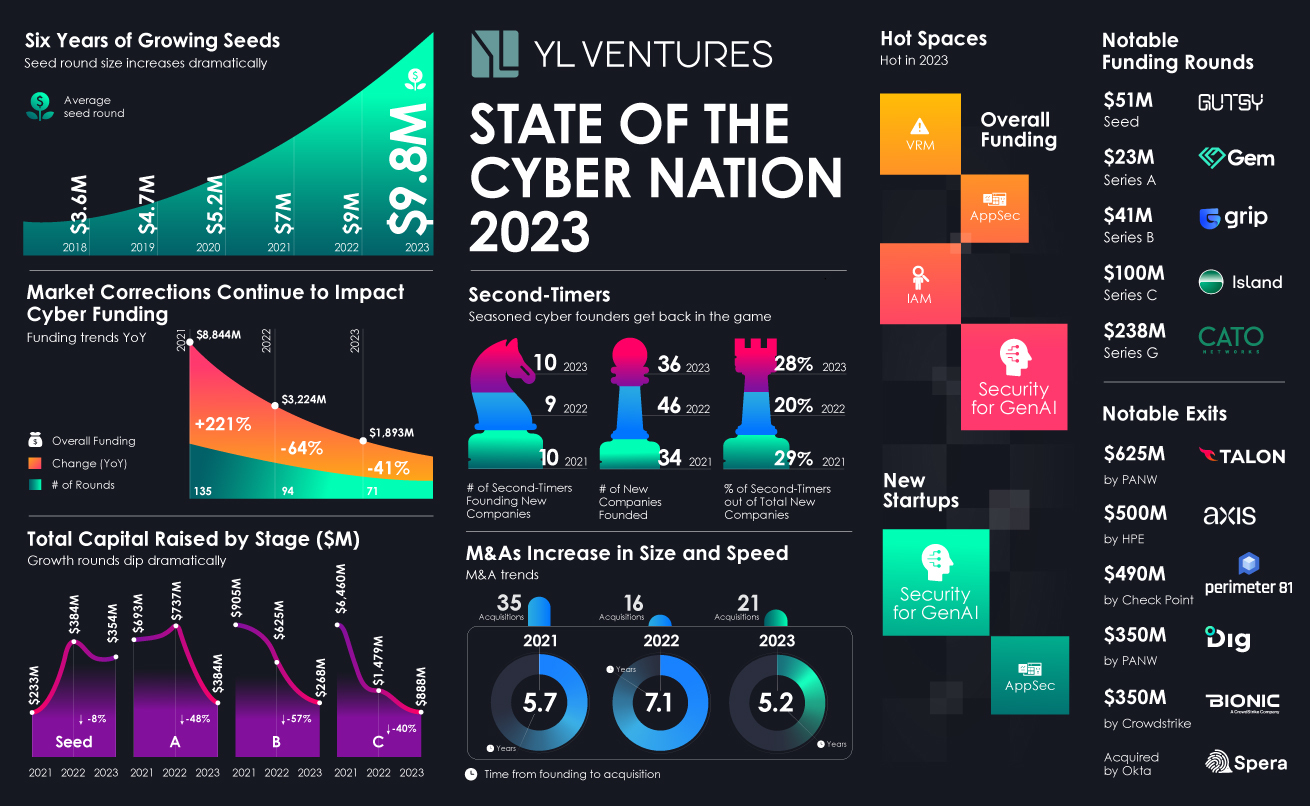

The Israeli cybersecurity industry , much like the global one , has been undergoing an evolution that seemed to top out in 2021 with soaring financing stave , overwhelming valuation , and multiple newly coin unicorns , only to cool down dramatically amid the market slowdown of 2022 with outrageous declines and frozen growth rounds . The breakneck speed of these fluctuations led to ramifications that reverberated across the industry throughout 2023 , as Israeli cybersecurity inauguration had to adapt and find their footing in this Modern post - bonanza funding reality .

Each year , YL Venturesmonitors , analyzes , and bring out data on funding and acquisition in the Israeli cybersecurity grocery store , with insights from manufacture luminaries to clear up the tendency and shifts in this fiercely militant and relentlessly trailblazing industry . In 2023 , despite diminution in fundraising overall , we can identify trend indicating a positive flight for the diligence , including an increase in exits . These tendency are observable in continued investment in bright cybersecurity startups and in the decision of skilled , get enterpriser to find and cover the most acute and urgent security problems ailing the business concern globe today .

Beyond the general macro aspect , specifically in the cyber domain , the prevailing account for this downward trajectory is a lengthiness of food market corrections come the needlelike increases of 2021 . Toward the end of 2023 , Israel was faced with national , economical , and geopolitical challenges . The ongoing war between Israel and Hamas has touch on the Israeli technical school sphere much like the rest of Israeli high society , but its resiliency and determination mold the groundwork for increase growth , stability , and seniority despite unprecedented challenge . There were several impressive backing cycle and acquisitions of Israeli cybersecurity startup in the terminal quarter of 2023 , despite the circumstances , and the effects of these upshot will most belike be manifest only in the first half of 2024 .

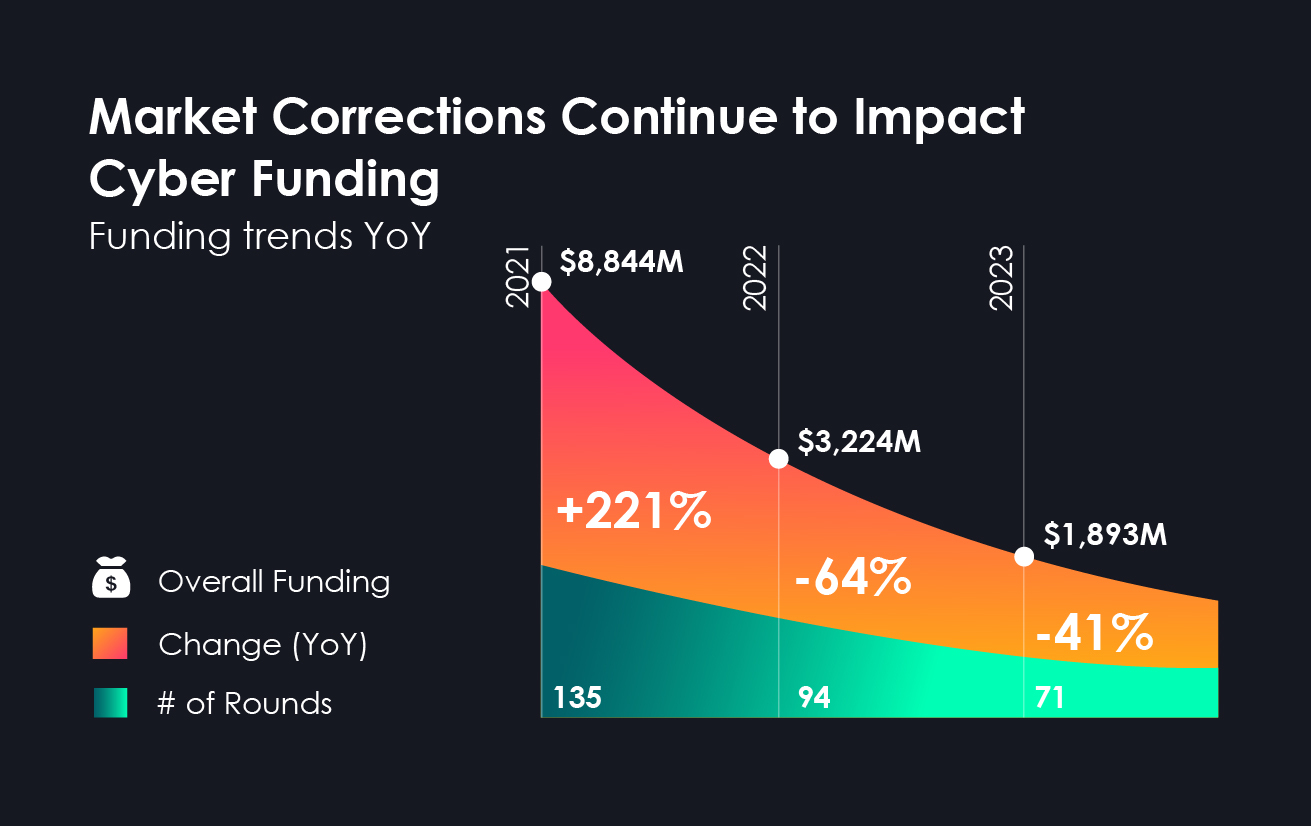

Overall funding in 2023

In 2023 , the overall declination in technical school investment continued , with total funding of Israeli cybersecurity startups progress to only $ 1.89 billion across 71 funding rounds , down 41 % from 2022 ’s total — $ 3.22 billion across 94 financing rounds . “ In 2021 , the irrational exuberance in the fiscal markets led to high-sounding evaluation across the startup landscape painting , admit cyber , ” remarksErica Brescia , managing director at Redpoint Ventures . “ What we ’re witness now is not a lag , but rather a return to pre - pandemic sanity — a market correction that pave the manner for healthier inauguration . ”

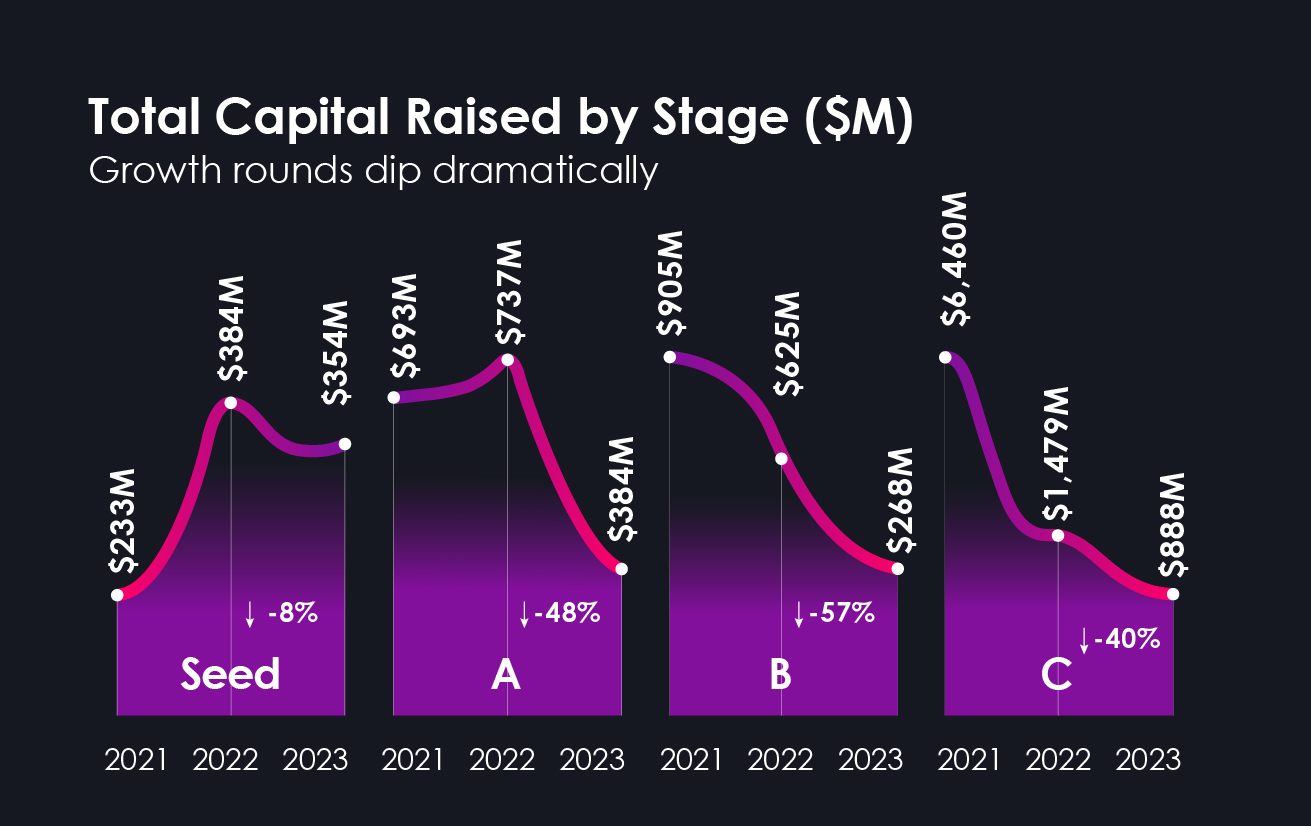

Early-stage funding

Unlike overall funding vogue , there was a significant addition in the medium cum daily round for the sixth consecutive twelvemonth , from $ 9 million in 2022 to a record $ 9.8 million in 2023 . This can be attributed to the constant and arise pauperization for groundbreaking surety solutions to adjudicate unrelenting surety issues and sustained investor appetite for supporting innovative founding teams able to do so . While the average seeded player amount grew , the issue of seed rounds in 2023 was only 36 , down from 46 in 2022 .

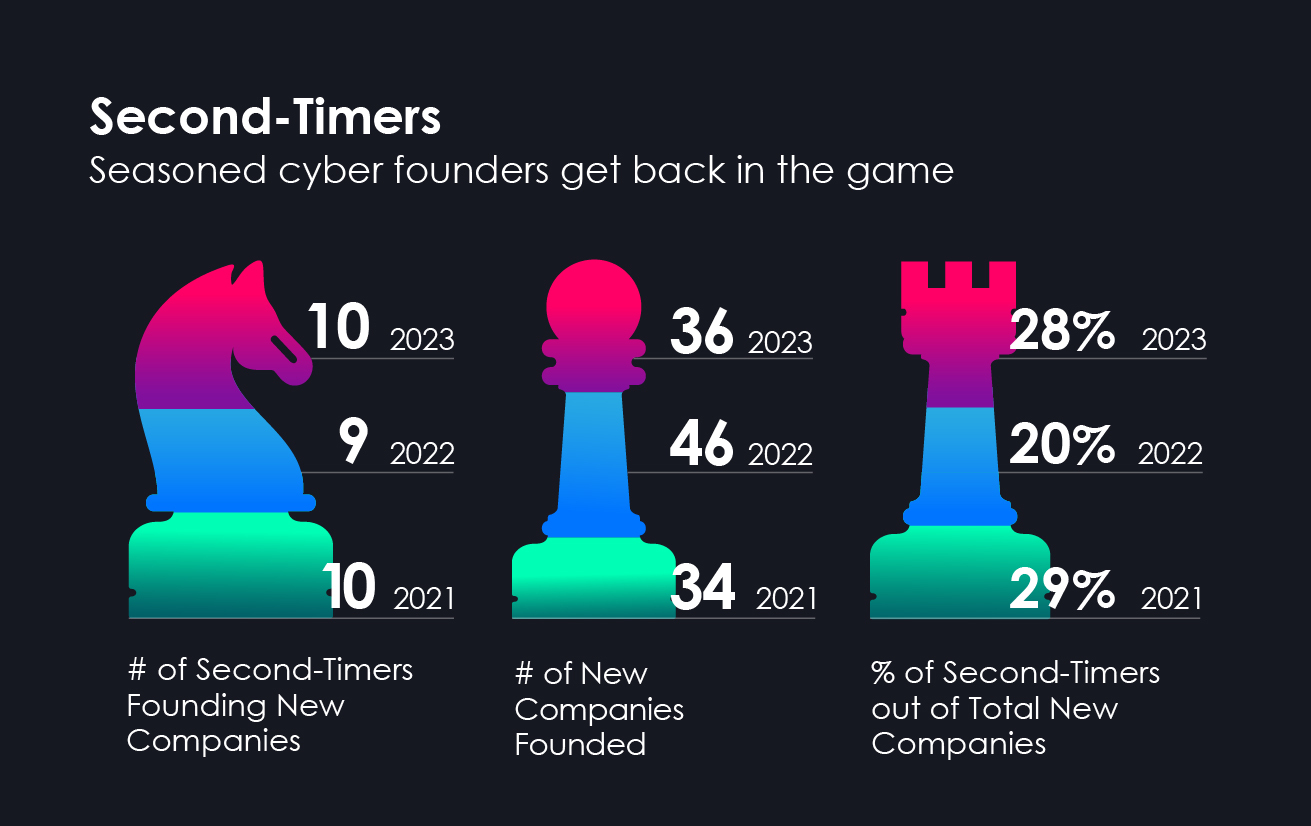

The dissonance between the step-up in the average seed bout and the decline in the phone number of round can be ascribe to several monumental rounds raised by serial entrepreneurs that pushed the norm up considerably . The acquire number of startup found in 2023 by veteran cybersecurity entrepreneur who have one or more exit under their belt take priceless experience , a path record of success , and the ability to depend at existing markets , detect underlying problems , and invent new category . Cyber investor trust that this experience is significant for building category - lead companies in a competitive and crowded market , and they , therefore , apportion big resource to support these entrepreneur in bring their vision for category leadership to realization . The assumption is that they will succeed in overcome substantial challenges , such as efficiently scaling and building a global go - to - marketplace ( GTM ) strategy , give way their successful past experience in doing so . In a competitive and active category like the cyber domain , the power to accomplish and move quickly holds great importance for investors due to the spirit level of risk involved .

We detect this bud trend in 2022 when nine cybersecurity startups were plant with 2d - time founders at the helm . In 2023 , the number of successive enterpriser who raised seed rounds increased back to 10 , after a flimsy pickpocket in 2022 , most still in stealth mode . This twelvemonth , however , these veteran entrepreneurs had a larger share of the ejaculate pool than in 2022 .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

“ History has shown that times of economic turbulence and market uncertainty are often close succeed by a resurgence of innovation . Veteran cybersecurity entrepreneurs who have witnessed this hertz in the past are eager to get in the game early and can not refuse the challenge of find the next cybersecurity find , ” saysBen Bernstein , co - founder and CEO of YL Ventures portfolio companyGutsy * , which previously built , scaled and sold swarm - native security pioneer Twistlock to Palo Alto Networks in 2019 . Gutsy raise $ 51 million in 2023 , one of the largest seed daily round in cybersecurity story , to pioneer data point - driven security department governance using process mining . “ There are still unbelievably exciting opportunity in cybersecurity , and in building our 2nd startup , Gutsy , we endeavor to master the field of honor for a longer run than our late success at Twistlock , which makes a huge remainder in our approaching this time . I think we ’ll see a growing number of veteran founders build new company in 2024 and gap up new and unexplored spaces in cybersecurity that are ripe for disruption . ”

The repercussions of 2021 ’s mega - rounds and hyped - up rating were find most in 2023 in all follow - on funding rounds , from Series A onward . “ The Browning automatic rifle for fundraising for each troll will continue to go up into 2024 , forcing founders to be optical maser - focused on drive strong growth with wakeless underlie basics , ” tell Erica Brescia . “ While 2024 will be a thought-provoking year for fundraising , there is wad of capital available for those who deliver best - in - class growth , and cyber will be no exception . ”

Total upper-case letter raise in Series A , B , and C rounds spend across the board in 2023 when compared to 2022 ’s numbers : Series A — from $ 737 million in 2022 to $ 384 million in 2023 ; Series B — from $ 625 million in 2022 to $ 268 million in 2023 ; and Series C and onward — from $ 1.48 billion in 2022 to $ 888 million in 2023 , a 40 % decrease in full capital at this stage . Notable rounds in 2023 includeGem Security‘s $ 23 million Series A bout led by GGV Capital;Grip Security‘s * $ 41 million Series B round extend by Third Point Ventures;Island‘s $ 100 million Series C cycle led by Prysm Capital;Wiz‘s $ 300 million Series D round led by Greenoaks , Index Ventures and Lightspeed Venture Partners ; andCato Networks ‘ $ 238 million Series G circle led by Lightspeed Venture Partners . While investors remained affirmative about new spaces and startups in the earliest stages , they were more hesitant to vest in company that raised uppercase at insalubrious valuations in 2021 and needed a important influx of majuscule in 2023 to extend their runway .

We guardedly anticipate that in 2024 , follow - on rounds will increase in turn and size . party that bring up financial backing cycle in 2021 and 2022 will constantly be impel to conjure up capital in the next 18 months , be acquire , or reach profitableness — which is extremely hard to reach , as most high - growth cybersecurity startups lean to be ineffective . rather of essay acquisition , these companies may raise support rounds at less attractive terms to avoid culmination workshop in all . reckon further in front to anticipate next trend , development rounds will bounce back to their antecedently dominant status once the 2021 crop of startups is acquired or continues to grow more sustainably . Startups that raised semen rounds in 2023 will in all likelihood be able to raise intelligent , substantial follow - on rounds in 2025 , block off any external factors that may affect this trend .

Hot spaces in 2023

Last year was undoubtedly the year of generative AI technology , lure users and early adopters with its transformative capableness for occupation productiveness and personal use . weigh at first to be just another trend , GenAI quickly filter enterprises , products , and services , becoming an unavoidable element that is everywhere . As with any raw technical school buzz , the security department implications and opportunity were not far , just a little . As enterprises struggle to delimitate fresh security guideline and internal policies to govern the use of GenAI technology , the employment of GenAI in third - company applications , homegrown product , and among employee grew exponentially .

It is barely surprising , therefore , that within the Israeli cybersecurity ecosystem , seven Modern startup raised seed rounds in 2023 in a new category that did n’t be in 2022 — security for GenAI . In the next few age , we look to that most enterprises will use GenAI across all of their environs , including production and employee use . As use develop , so does the GenAI onset surface , and security for GenAI will more and more draw investor interest .

AppSec is among the most prevailing cybersecurity spaces for budding entrepreneurs for the third straight year . There were 11 new AppSec companies founded in 2022 and only six in 2023 , indicating this space ’s saturation level . While it remains a large and interesting family , in 2023 , we fancy consolidation begin as companies were acquired , includingEnso security system * ( acquired bySnyk ) andBionic(acquired byCrowdStrike ) . This may indicate a dry piece regarding creation in this space , limiting the number of novel support rounds we ’ll see here .

Identity and access direction was at the top of the listing in 2022 and continue an more and more popular infinite with six new startups in 2023 . identicalness has been called the “ young security perimeter , ” a top - of - mind problem for security practitioners and C - suite executives . Today , it is one of the fastest - growing cybersecurity sector due to the prevalence of identity - based plan of attack , as malicious actors find it easy to wangle machine or human user and overly permissive identity operator . We envision that while it will continue to be an attractive distance for investors in 2024 , it will soon become a crowded market if new , innovative , and large - enough subcategories are not created . Okta’sacquisitionof identity security stance management startupSpera Security * late in 2023 instance the interest group in this space and its attraction for turgid enterprise .

exposure and risk management has also been among the top three blistering cybersecurity spaces in the past , with five new caller in 2023 . It continue to attract investor involvement due to the recent rise in essential to report cybersecurity incident and reveal information on the processes and methodology used to secure against them . SEC regulations from August 2023 levy stringent transparence and reporting demands on publicly switch companies . copulate with the May 2023 sentencing of ex - Uber CISO Joe Sullivan , following Uber ’s 2016 conclusion not to report a rift to the Federal Trade Commission , there is now a clear incentive for companies to invest more in vulnerability and risk management solutions that proactively assess a caller ’s security governance and power to measure and report on its security posture .

As CISOs pack their security wads with many discovery tools that bomb them with alerts , they require these risk management platforms to analyze , prioritize , and deduce them . These processes are crucial to ensure developer fix what matter and quash watchful fatigue and growing foiling within developer teams . The manufacture is shifting toward holistic , simplified management rather than add more tool to govern these processes , solutions , and stakeholder . Gutsy , for object lesson , zero in in on this needlelike problem space to show security professionals how their existing tools and unconscious process work together and how they can meliorate and streamline what they already have . We bode sustained sake in this sphere in 2024 as the industry matures .

M&A activity

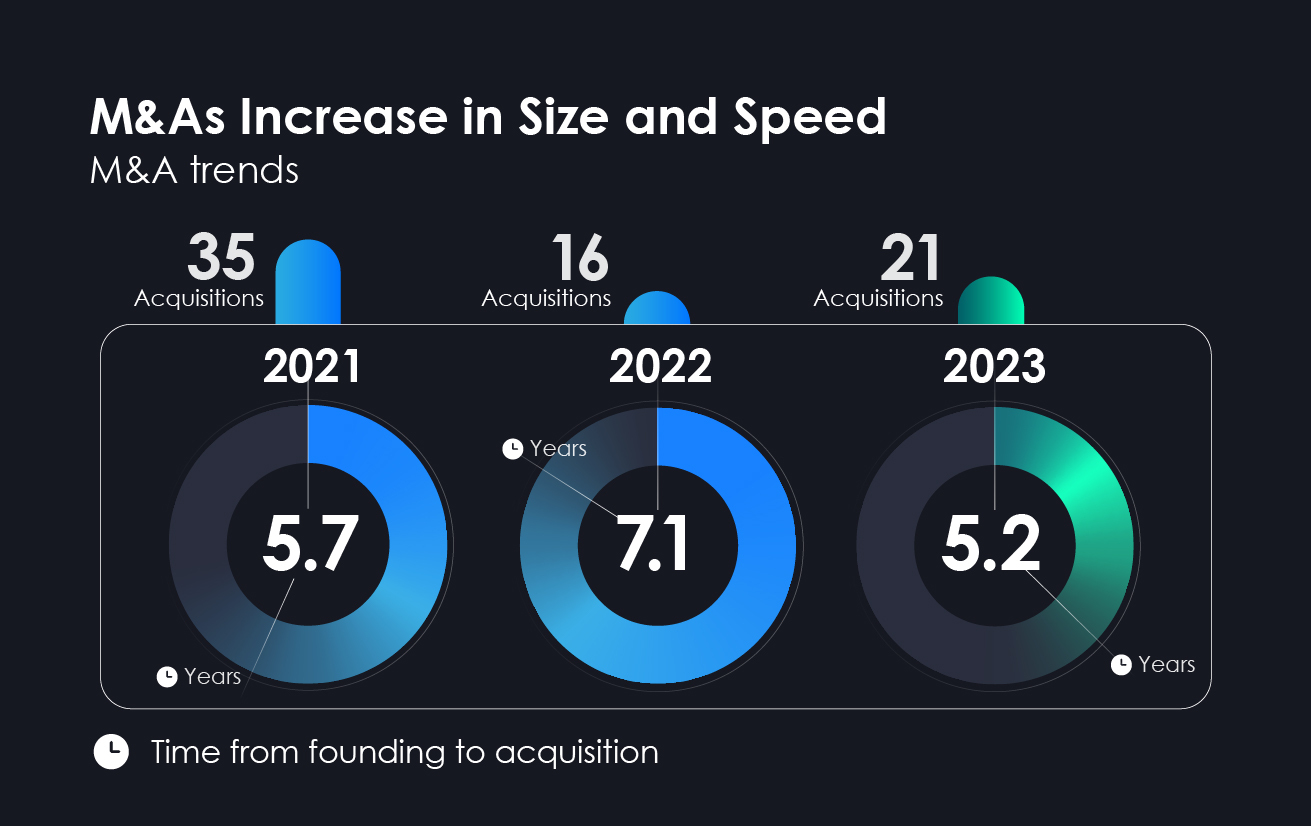

A confident course that we predicted in last year ’s written report and that indicates free burning sake in the Israeli cybersecurity ecosystem is an increase in the number of Israeli cybersecurity startups acquired in 2023 . The number of acquirement reached 21 last year , surpassing the 16 deals in 2022 . “ Reflecting on the retiring twelvemonth and heading into 2024 , the uncouth motif in security is consolidation , ” saysOfer Ben - Noon , veteran soldier cybersecurity enterpriser , co - father , and CEO of Talon Cyber Security ( recentlyacquired by Palo Alto Networksfor $ 625 million ) and former co - founder and CEO of Argus Cyber Security , acquired in 2018 by Continental . “ customer only desire to enthrone in solution that can address various economic consumption cases and challenges while being wide-eyed to do . The day of using dozens of security peter are cursorily coming to an end . From an M&A perspective , I await companies to go after integration with result that satisfy meaningful holes in their platform , to expand the problems they can solve , and give customers protract protection without needing to contribute young vendors to their tech stacks . ”

The combination of this shift toward consolidation and the realization that acquirement is the only pick for several inauguration lead to an interesting decline in the average number of years it took to achieve an exit . In 2022 , it took startups an norm of 7.1 class from founding to acquisition , while in 2023 , the average dropped to only 5.2 years , even lower than 2021 ’s norm of 5.7 year .

Another interesting M&A trend is the rise in acquisitions led by companies that are not purely cybersecurity focused , doubling in size from five in 2022 to 10 in 2023 . underlie this dramatic increment is their growing interestingness in augmenting their offering with cybersecurity potentiality and talent . From a business perspective , legacy industries can better their positioning and electronic messaging ( thereby increase their value ) if they add these capableness . case includeHewlett Packard Enterprise ’s acquisitionof Axis Security ( for $ 500 million),Thales ’ acquisitionof Imperva ( for $ 3.6 billion ) andRubrik ’s acquisitionof data security company Laminar ( for $ 250 million ) . Other notable issue in 2023 admit Palo Alto Networks ’ acquisition ofDig Security for $ 350 millionand CrowdStrike ’s acquisition ofBionic for $ 350 million . Leading security vendors today are increasingly involved in the early - stage “ scene ” and actively scout the youngest and most innovative cybersecurity startups . Their centering on the early stages straight touch their power to key out attractive accomplishment targets , build strong connection and present accomplishment proposals quickly , as they recognize the electric potential within young teams and know how to leverage the challenging backing landscape painting to their vantage .

An unexpected turn of events

The cybersecurity sector has traditionally been the uncontested leader of Israeli high - tech , attract interest and deal flow even when global mart made investment in other sectors unconvincing . The resiliency of the Israeli cybersecurity industry was tested in 2023 with an extra , unexpected , and catastrophic geopolitical force that greatly affected the entire nation and its thriftiness in the fourth quartern of 2023 — the Israel - Hamas war . As the saving rally to ensure Israel ’s stability during this agitation , cybersecurity has an even more critical role as a beacon of excellence in the face of hard knocks and strife .

While many startup founder and employee divide their time between the post and the front lines of this battle in active military reserve duty and civilian financial aid efforts , occupation continuity remain a top antecedence . The ramifications of these events on the Israeli cybersecurity industry are as yet unknown . What has already been made clean is that the Israeli gamey - tech industry , with cybersecurity at its helm , will continue to redeem top - tier service , products , and innovation , no matter what .

- Gutsy , Spera , Grip and Enso are part of the YL Ventures portfolio .