Topics

Latest

AI

Amazon

Image Credits:Zūm Rails

Apps

Biotech & Health

clime

Image Credits:Zūm Rails

Cloud Computing

Commerce

Crypto

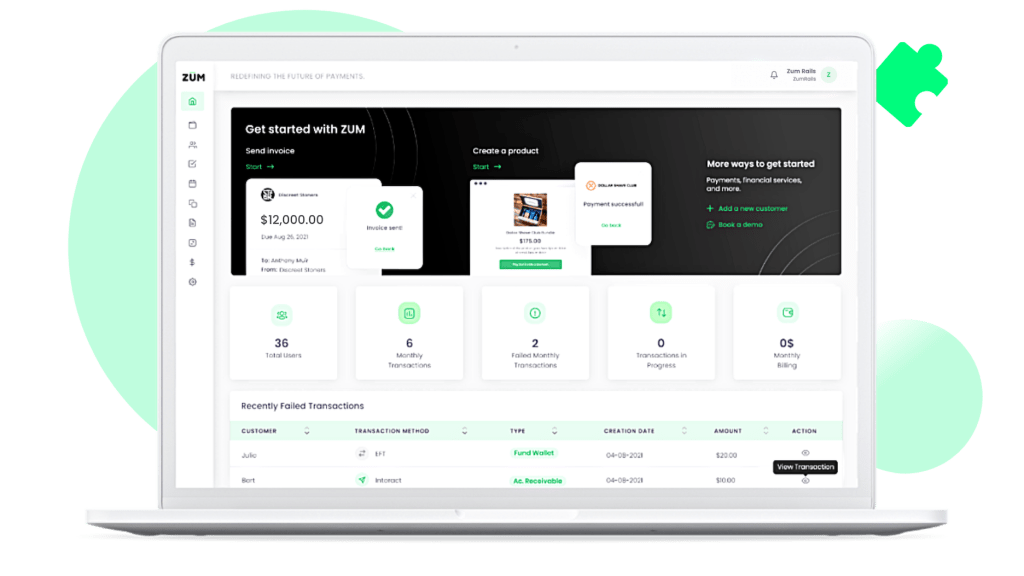

Zūm Rails’ technology leverages “omni rails” for payments, whether it is traditional credit, debit or electronic funds transfer options.Image Credits:Zūm Rails

Enterprise

EVs

Fintech

fundraise

Gadgets

Gaming

Government & Policy

Hardware

Layoffs

Media & Entertainment

Meta

Microsoft

privateness

Robotics

surety

Social

Space

startup

TikTok

shipping

Venture

More from TechCrunch

consequence

Startup Battlefield

StrictlyVC

newssheet

Podcasts

Videos

Partner Content

TechCrunch Brand Studio

Crunchboard

touch Us

The espousal of open banking and blink of an eye payments is move easy in the United States compare to other markets around the world , for example , Brazil . That said , the raw programFedNowwent survive in July 2023 , and data - sharing regulations are coming , so more potential is on the skyline .

Until then , the co - founder ofZūm Railssay the experience consumers have with paymentscontinues to be fragmented , entail companies have to create a tech stack to provide a wide compass of services to their customers . The Montreal - ground society is taking the plan of attack of providing an all - in - one payments gateway that combine open banking with instant payments .

Marc Milewski and Miles Schwartz started the caller in 2019 . Milewski ’s background is in treasury payments and he was an early employee at accounts receivable automation software company Versapay . While there , he worked on what at last became Canada ’s first webhook - enabled EFT gateway .

“ You learn about all the problems everyone has moving money , ” Milewski told TechCrunch . “ undefendable banking was discussed , but I thought it was more about requital . Miles and I sing about build up a whole new gateway that unite these experiences . Companies do n’t want to be payment expert — that ’s our job . ”

Decentralized finance may be the response to banking ’s payment rails problem

They started build package to simplify the complexity of moving money via different payment rail so companies can use whichever approach makes sentience for their patronage . Their engineering science leverage “ omni rails ” for requital , whether it is traditional credit , debit entry or electronic funds transfer options . It also provides for real - time selection through pardner , including Visa Direct , Mastercard , MX and Canada ’s Interac internet .

Join us at TechCrunch Sessions: AI

Exhibit at TechCrunch Sessions: AI

Zūm Rails manage the period of money , including the decrease of faker and miscarry transactions , by verifying a client ’s identity , linking flat with bank account and facilitating requital via the method acting of the customer ’s choosing .

The company now processes more than $ 1 billion in defrayal through its political platform each month for over 500 companies , include Questrade , Coinsquare and Desjardins , which is a large confederacy of credit unions in North America . In the past year , the company acquire over 200 % and launched in the U.S. at the terminal of 2023 .

Milewski and Schwartz bootstrapped Zūm Rails , building it up to a team of 30 the great unwashed . Last twelvemonth , the duo decided to raise venture Washington .

“ We reached the point where we realize that bootstrapping is no longer healthy for our business , ” Schwartz told TechCrunch . “ We have some big initiatives we want to work on and grow on . Now it makes sense to do it all at once , and it ’s sizeable for the line of work to now go all - in and use the fuel . ”

They close on a $ 10.5 million Series A financial backing round , lead by Arthur Ventures , and signify to clothe in growing in the U.S. and flourish its defrayment offer that will admit the introduction of new banking - as - a - Robert William Service features for merchants . In addition , Zūm Rails is work on a FedNow offer in the U.S. that will enable businesses to send and have FDIC - control payments within s .

Zūm Rails ’ carrying out to appointment “ is really impressive , ” Jake Olson , vice president at Arthur Ventures , recount TechCrunch . He visit the company “ a with child fit ” for its investment dissertation , which is in high spirits - outgrowth and capital - effective B2B software package companies .

“ Achieving profitableness without any outside capital is telling , ” Olson say . “ Their Cartesian product positioning is also really compelling . Rather than weaving together unlike systems , Zūm Rails can supply organizations with a comprehensive solution that powers the entire dealings journeying and enable them to have a unlined experience for their end users . Any organization that reckon the streamline digital financial fundamental interaction mate with the instant defrayment capability as a competitive reward will be a great conniption for Zūm Rails . ”

FedNow ’s effectual footing stop a secret plan record changer for digital wallets and payment apps